Managing Bitcoin Network Congestion: Insights and Solutions

In the ever-evolving landscape of cryptocurrency, the crucial issue of Bitcoin network congestion has become a significant concern for traders and investors alike. According to Chainalysis, over 73% of cross-chain bridges are vulnerable, highlighting the pressing need for enhanced network efficiency and interoperability solutions by 2025.

What Causes Bitcoin Network Congestion?

Network congestion in the Bitcoin ecosystem can be likened to long queues at a popular coffee shop. When demand outstrips supply, transactions slow down. Users often experience delayed processing times, especially during price surges when the number of transactions spikes. In simple terms, fewer baristas (miners) handling more orders (transactions) results in longer wait times. Factors contributing to congestion include increased trading activity and high transaction fees.

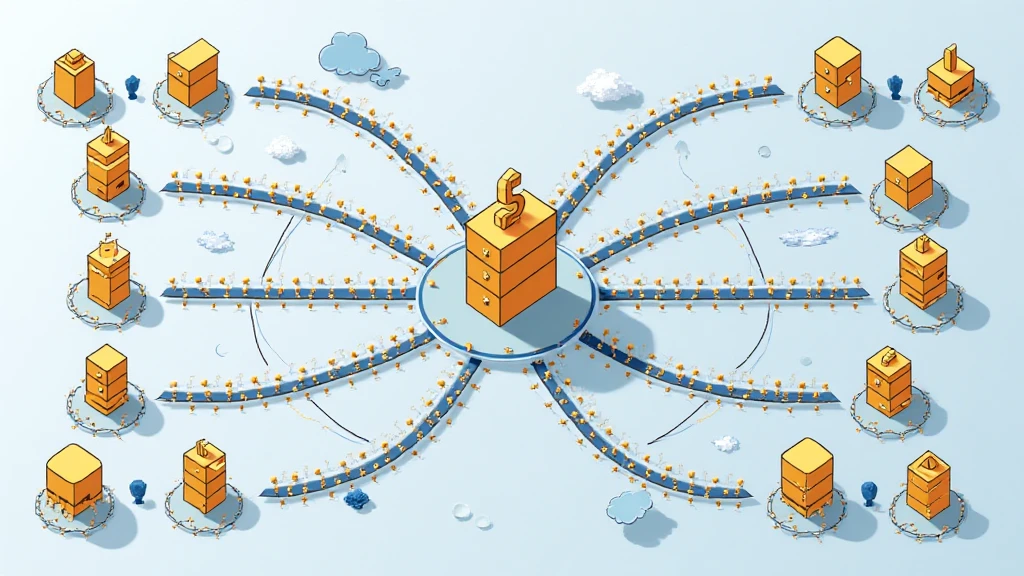

How Do Cross-Chain Interoperability Solutions Help?

Imagine a bustling marketplace where vendors from different neighborhoods need to trade goods. Cross-chain bridges serve as the market facilitators, allowing assets to move seamlessly between various blockchain networks. This interoperability reduces the burden on a single network, assisting in alleviating Bitcoin network congestion by distributing loads across multiple chains. As seen in multiple projects, adoption of cross-chain solutions can lead to a 50% reduction in transaction times.

The Role of Zero-Knowledge Proofs in Transaction Speed

Zero-knowledge proofs can be viewed as a discreet way of sharing secrets. In the context of Bitcoin, these protocols allow for transaction verification without disclosing sensitive information. By implementing zero-knowledge proofs, similar to how a shopkeeper might verify a coupon without revealing its details, we can make transactions lighter and faster. Thereby, enhancing the efficiency of the network and helping to tackle Bitcoin network congestion.

Future Regulations and Their Impact on Bitcoin’s Scalability

As we look toward the future, especially with 2025 serving as a critical year for regulations surrounding DeFi projects in places like Singapore, we must consider how these regulations will impact the scalability of Bitcoin. Enhanced regulations can provide a clearer framework for operations, incentivizing the development of more efficient technologies and thus mitigating the issues of congestion. Local regulations could inadvertently lead to a smoother transaction process as businesses adapt.

In summary, while Bitcoin network congestion remains a challenging aspect of the cryptocurrency sphere, there are tangible solutions on the horizon. Incorporating interoperability solutions, leveraging zero-knowledge proofs, and staying informed about upcoming regulatory trends can significantly help enhance transaction speeds and overall user experience.

For those looking to navigate safely through these complexities, consider downloading our comprehensive toolkit on managing Bitcoin assets and understanding network dynamics. Don’t let congestion slow you down!