2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis, over 73% of cross-chain bridges globally contain vulnerabilities that can be exploited. In the rapidly evolving world of DeFi (Decentralized Finance), understanding the associated risks and implementing robust security measures is essential.

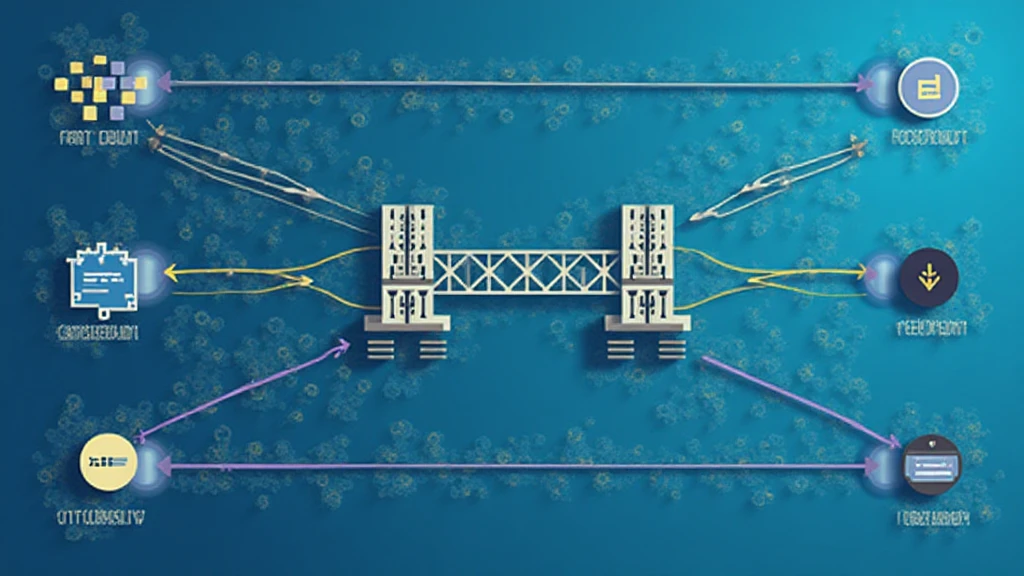

Understanding Cross-Chain Interoperability

Think of cross-chain bridges like currency exchange counters in a busy marketplace. When you want to switch one type of money for another, you go to these counters. Cross-chain bridges allow users to move digital assets between different blockchains. However, similar to the risks at a money exchange counter, these bridges can be prone to hacks and vulnerabilities. As we approach 2025, ensuring the security of these bridges is paramount in DeFi.

Risks Associated with Zero-Knowledge Proof Applications

Imagine if you needed to prove you had a ticket to a concert without showing it. This is what zero-knowledge proofs do in the crypto world—they validate information without revealing it. However, if not implemented correctly, they can become a new avenue for attacks. Understanding the implications of these technologies is crucial to mitigating risks. The HIBT DeFi crypto threat intel highlights various threats stemming from improper applications of these proofs.

2025 Regulatory Trends in Singapore’s DeFi Landscape

Singapore is paving the way for DeFi regulations, much like how a city sets rules for public transport to ensure safety. As we approach 2025, compliance will become more critical, and regulations will mold the future of DeFi. Staying updated on these changes can help investors and developers make informed decisions, reducing the risk of penalties and enhancing security practices.

Comparing Energy Consumption of PoS Mechanisms

Proof of Stake (PoS) mechanisms are often compared to a more efficient car engine that uses less fuel without compromising speed. Similarly, PoS chains use significantly less energy compared to Proof of Work (PoW) mechanisms, reducing the environmental footprint of blockchain technology. With growing concerns over energy consumption, understanding this comparison is vital for developers and investors alike to consider sustainable practices in building DeFi applications.

In summary, comprehending the latest trends and threats in DeFi can help you navigate the complexities of digital asset management. Stay ahead of potential threats by accessing our downloadable toolkit.

Risk Disclaimer: This article does not constitute investment advice. Consult local regulatory authorities (such as MAS/SEC) before making any investment decisions. Tools like the Ledger Nano X can reduce private key leak risks by up to 70%.

Link to HIBT whitepapers for more insights: Explore here.