What Are Options Greeks and Why Do They Matter?

In the world of trading, it’s crucial to understand the factors that can affect your investment outcomes. Options Greeks are essential metrics used by traders to assess the risk and potential profit of options contracts. Think of them like a restaurant menu; they give you insights into what to expect before you place your order.

The Key Types of Options Greeks

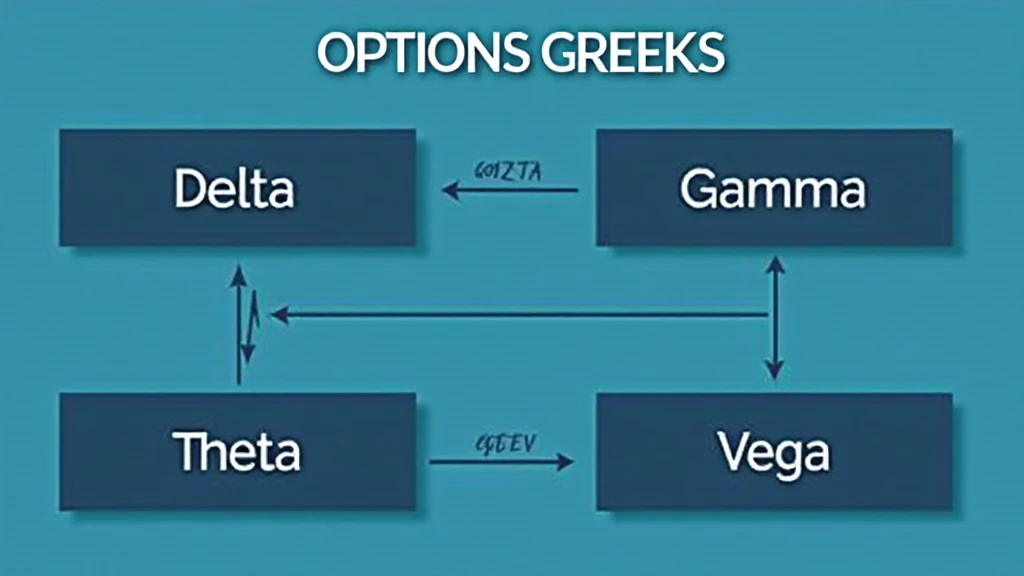

There are several Greeks, including Delta, Gamma, Theta, and Vega. Each one measures a different element of risk. For example, Delta measures the sensitivity of an option’s price to changes in the price of the underlying asset, like how a slight increase in a dish’s ingredients can alter its taste.

How to Use Options Greeks in Trading Strategies

Utilizing Options Greeks can enhance your trading strategies. For instance, if you’re aiming for a safer investment, focusing on Theta, which measures time decay, is like planning a meal that allows for leftovers. Understanding how time affects your options can inform your decisions effectively.

Real-World Examples of Options Greeks in Action

Imagine you’re trading options for a tech company. If Delta is high, small movements in stock price could lead to significant changes in the option’s price. It’s akin to how temperature changes can affect the quality of your favorite dish—small adjustments can lead to a different taste experience.

Conclusion and Tools for Further Exploration

In summary, grasping Options Greeks explained is vital for anyone looking to sharpen their trading skills. Familiarize yourself with these concepts to make informed decisions. Don’t forget to download our comprehensive toolkit for more practical insights.