2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis data from 2025, a startling 73% of cross-chain bridges possess vulnerabilities, raising concerns among investors and developers alike. Understanding the Consensus mechanism used in these bridges is crucial for mitigating risks and ensuring robust functionality.

What is a Cross-Chain Bridge?

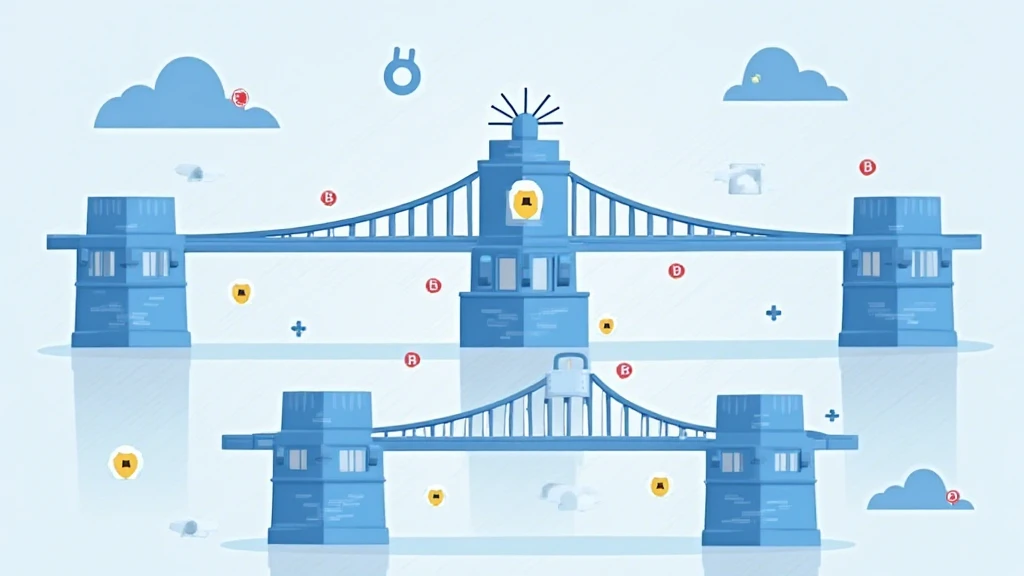

Think of a cross-chain bridge like a currency exchange booth at an airport; it allows transactions between different types of currencies (in this case, blockchains). The bridge is responsible for ensuring that what you send from one blockchain is accurately reflected on another, which relies heavily on the underlying Consensus mechanisms to validate and secure these transactions.

Key Risks in Cross-Chain Bridges

Just like you wouldn’t leave your money at a poorly-rated exchange stall, investing in cross-chain bridges without awareness of their security can be risky. Poorly designed Consensus mechanisms can lead to hacks and thefts. For instance, the Omnidirectional protocol vulnerabilities demonstrated by past hacks should remind us to prioritize robust verification.

What are the Best Practices for Securing Bridges?

To ensure you’re using a secure bridge, check if its Consensus mechanism employs redundancy, meaning if one layer fails, there are backups in place, similar to how some currencies have multiple reserve banks. Enhanced verification processes, such as multi-signature transactions and third-party audits, should also be in place.

The Future: Trends in 2025

Looking towards 2025, new Consensus mechanisms like Zero-Knowledge Proofs (ZKPs) are on the rise, promising to increase transaction speed while reducing hacks. Imagine ZKPs as a super-efficient bouncer at a club, only letting in verified guests while keeping the troublemakers out.

In conclusion, understanding the Consensus mechanism behind cross-chain bridges is essential for minimizing risks. For further insights into best practices and security measures, download our comprehensive guide and stay ahead in the evolving world of decentralized finance.

Risk Disclaimer: This article does not constitute investment advice. Please consult local regulatory bodies (e.g., MAS/SEC) before making financial decisions.