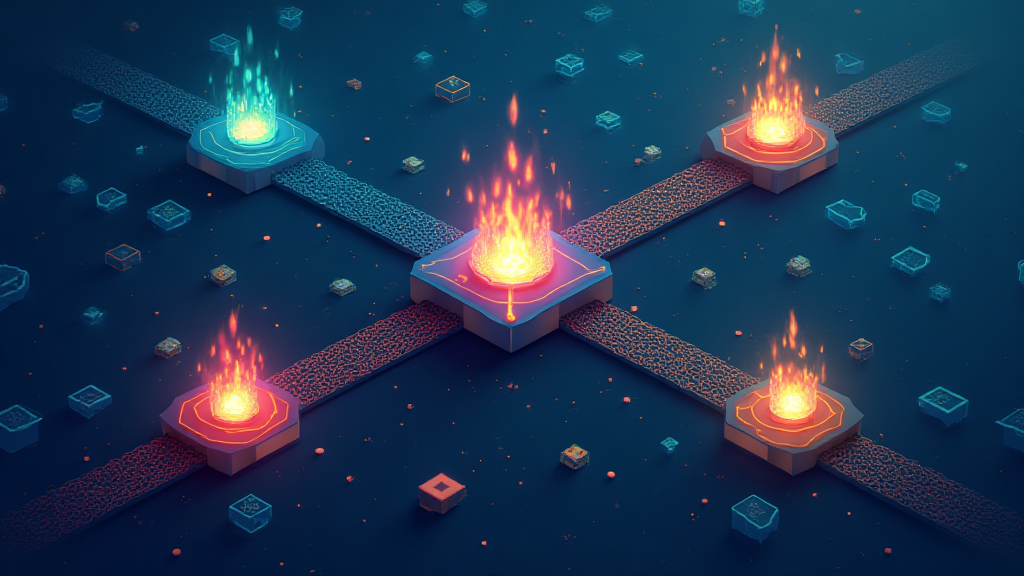

Understanding Burn Mechanisms: The Future of DeFi and Cross-Chain Interoperability

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges exhibit vulnerabilities, raising concerns about security in the fast-evolving finance landscape. In this article, we will explore the crucial role of burn mechanisms in decentralized finance (DeFi) and their connection to the interoperability of blockchain networks.

What Are Burn Mechanisms?

To simplify, think of burn mechanisms as a way to control supply, much like a sale at a store where items are marked down to encourage buying; they effectively remove tokens from circulation, which can help stabilize or increase the value of remaining tokens. This is vital for platforms leveraging cross-chain technology.

Why Are Burn Mechanisms Important for Cross-Chain Interoperability?

Imagine a currency exchange stand where you trade your dollars for euros; often, you get a better rate if you exchange a larger sum. Burn mechanisms do something similar for tokens across different chains by ensuring that users have incentives to transact, thus promoting liquidity across the networks. As a result, they enhance stability and user trust.

The Role of Zero-Knowledge Proofs in Burn Mechanisms

Zero-knowledge proofs are like showing a friend you can solve a puzzle without revealing the puzzle itself. They enable users to verify transactions while maintaining privacy. When integrated with burn mechanisms, they can secure the burning process, ensuring coins are indeed destroyed and boosting confidence in the system’s integrity.

Looking Ahead: Regulatory Trends Impacting Burn Mechanisms

In 2025, we expect Singapore to enact stricter regulations in DeFi, focusing on transparency and user protection. As these regulations roll out, burn mechanisms may serve as an essential tool for platforms to demonstrate compliance and security, much like a safety sticker on a product ensuring it’s been tested and certified.

In conclusion, understanding burn mechanisms is key to navigating the ever-complex world of DeFi and blockchain interoperability. Download our comprehensive toolkit for insights and best practices.

Risk Statement: This article does not constitute investment advice. Always consult local regulatory authorities like MAS or SEC before taking any action.

For more insights on cross-chain security, check out our white paper.

Stay updated with Cryptoliveupdate, your source for the latest insights on financial innovations.