2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges are identified to have significant vulnerabilities, leading to potential risks for investors. As cryptocurrencies grow in use and popularity, ensuring the security of these platforms becomes paramount. In this guide, we will explore different aspects of cross-chain bridge security to help you navigate this complex landscape.

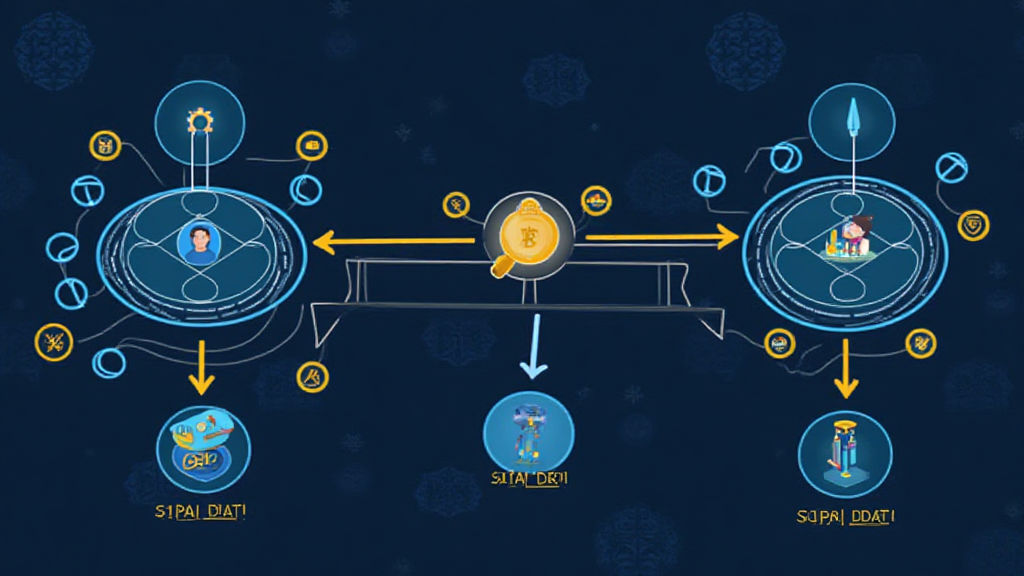

What is a Cross-Chain Bridge?

Imagine you’re at a currency exchange booth at the airport. A cross-chain bridge works similarly by allowing the transfer of assets between different blockchain networks. This process is essential for interoperability in DeFi (Decentralized Finance) applications. But like those currency exchange booths, not all bridges are created equal, and some could be leaking funds.

Common Vulnerabilities in 2025

Many bridges rely on smart contracts, which are like recipe instructions for creating and securing transactions. However, a small mistake in the recipe can lead to disastrous results. For instance, CoinGecko data indicates that in 2025, overlooked vulnerabilities in code can lead to significant hacks, exposing users to risks they might not even be aware of until it’s too late.

Best Practices for Secure Cross-Chain Operations

To protect yourself while using cross-chain bridges, consider employing best practices like using wallets with hardware security, such as the Ledger Nano X, which can reduce the risk of private key theft by around 70%. Additionally, ensure that any bridge you use has undergone a thorough security audit to minimize the chances of exploiting code vulnerabilities.

Regulatory Landscape: Future Trends

Countries like Singapore are actively developing regulatory frameworks for DeFi. By 2025, it’s anticipated that these regulations will shape how cross-chain bridges operate, creating safer environments for transactions. If you’re planning on using these services, staying informed about local regulations is crucial to avoid potential legal issues.

In summary, safeguarding your assets on cross-chain bridges is integral as the DeFi landscape evolves. Download our complete toolkit for best practices, including regulatory insights and security measures to fortify your operations.

Disclaimer: This article does not constitute investment advice; always consult your local regulatory authority (e.g., MAS/SEC) before making investment decisions.

For additional information, check out our cross-chain security white paper and learn more about assets protection.

Stay updated with the latest insights from cryptoliveupdate.