Introduction: The Cross-Chain Vulnerability Landscape

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges worldwide exhibit significant security vulnerabilities. This statistic highlights the urgent need for effective measures to ensure the safety of transactions across various blockchains. In the evolving finance landscape, AI technology plays a pivotal role in addressing these security concerns.

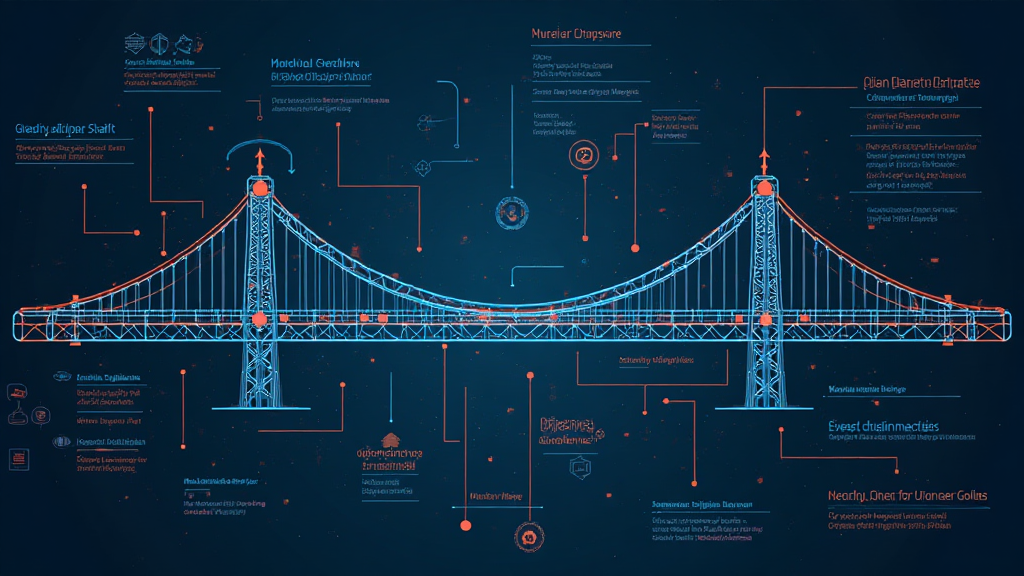

Understanding Cross-Chain Bridges: Like Currency Exchange Stalls

Think of a cross-chain bridge as a currency exchange stall you might see at a marketplace. Just as the stall allows you to exchange one type of money for another, a cross-chain bridge lets different blockchain networks communicate and share assets. However, much like you’d double-check the rates and trustworthiness of the money changer, it’s essential to ensure the bridge’s security to avoid fraud.

How AI Enhances Security Monitoring

AI integrates smart algorithms to analyze transaction patterns in real-time. Imagine having a hawk-eyed guard keeping watch over the currency exchange stall, spotting suspicious activities immediately. These AI-driven systems can identify anomalies that human monitors might miss, ensuring faster response to potential breaches.

Regulatory Trends Impacting Cross-Chain Operations

The regulatory landscape is evolving, particularly for cross-chain operations. By 2025, jurisdictions like Singapore are enforcing robust DeFi regulations, impacting how cross-chain bridges function. Adapting to these regulations is crucial for maintaining operational legitimacy and user trust.

Conclusion: The Importance of Secure Cross-Chain Bridges

In summary, as cross-chain technology continues to develop, understanding its vulnerabilities and the role of AI in addressing these issues is vital. For further insights and tools like our free security audit checklist, download our toolkit today!