Understanding the Risks and Benefits of Crypto Arbitrage Trading

According to Chainalysis, in 2025, approximately 73% of all transactions conducted across blockchain networks are expected to utilize arbitrage strategies. In this landscape, traders must navigate various risks while also harnessing potential benefits. In this article, we’ll break down the risks and benefits of crypto arbitrage trading so both new and experienced traders can make informed decisions.

What is Crypto Arbitrage Trading?

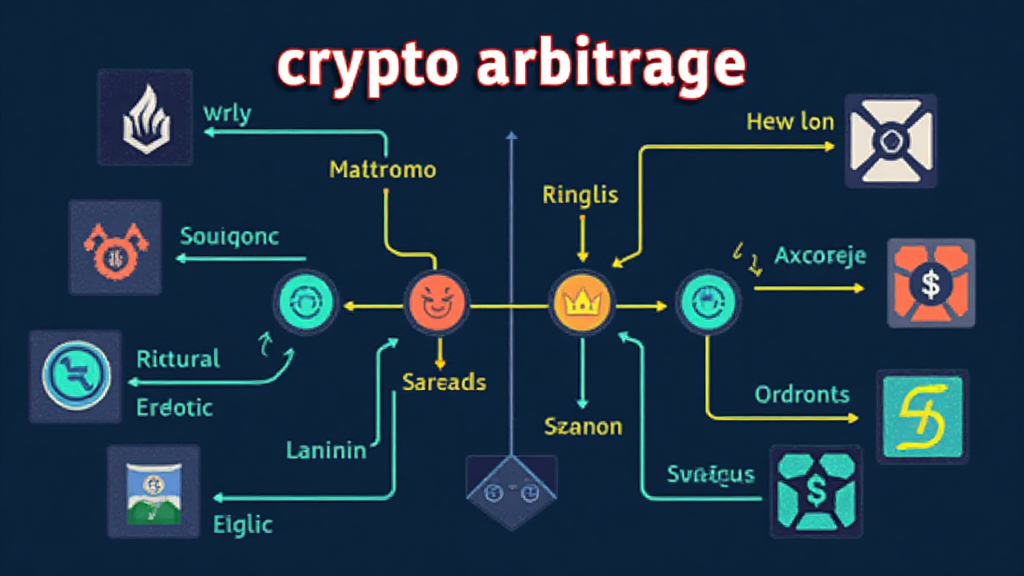

Put simply, crypto arbitrage trading is like shopping at different stores for the best price on your favorite products. Imagine walking into a supermarket and noticing that apples are $1.00 each, while across the street they are $1.50. You buy the cheaper apples and sell them at a profit. In the crypto world, traders take advantage of price disparities between exchanges to earn profits.

Understanding the Risks Involved

Just like you wouldn’t dive into a busy street without looking both ways, traders must be cautious. One major risk is market volatility. A sudden price drop can significantly affect profits during trades. Additionally, there are potential transaction fees that can eat into gains, much like paying taxes when selling your apples. Finally, operational risks like exchange hacks can lead to losses.

Benefits That Attract Traders

The attractions of crypto arbitrage trading are hard to resist. First off, it allows traders to profit from inefficiencies in the market. For instance, with proper timing and execution, a trader can exploit price differences before they vanish, similar to catching a great sale on apples before everyone else gets there. Moreover, it can serve as a way to diversify your portfolio; engaging in different exchanges can balance your investment, much like mixing different fruits for a health boost.

Technical Considerations for Success

To succeed in crypto arbitrage trading, it’s crucial to have the right tools. Leveraging automated trading bots can mimic the speed of information that a human might miss, similar to how seasoned shoppers have their routes mapped out to get the freshest produce. Additionally, understanding the mechanics of blockchain technology—like interchain interoperability and zero-knowledge proofs—can provide an edge, allowing traders to streamline their operations efficiently.

Conclusion

In summary, while the risks and benefits of crypto arbitrage trading present distinct opportunities for profit, they come hand-in-hand with potential pitfalls. Knowledge, caution, and the right technological tools can elevate your trading game significantly. For detailed strategies and insights, download our exclusive toolkit and enhance your arbitrage trading approach today!

Download Toolkit for optimized crypto arbitrage strategies.

Disclaimer: This article does not constitute financial advice. Please consult your local regulatory authority (such as MAS or SEC) before engaging in crypto trading.

For comprehensive whitepapers and security guidelines, be sure to check out our resources.

Author: Dr. Elena Thorne

Former IMF Blockchain Advisor | ISO/TC 307 Standard Setter | Published 17 IEEE Blockchain Papers