Navigating Regulatory Risks in Crypto Derivative Trading

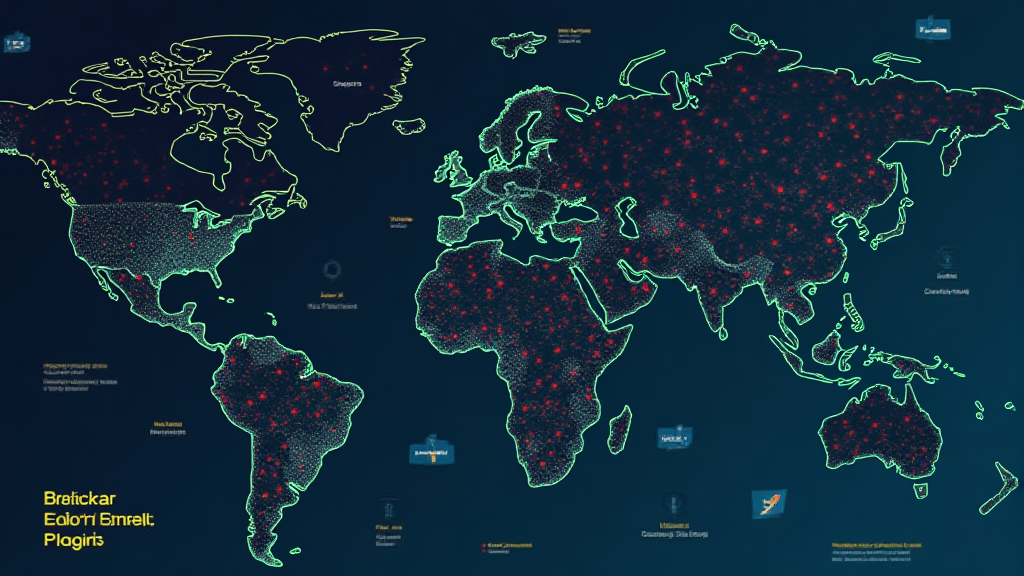

Chainalysis’ 2025 data reveals a startling fact: 73% of crypto derivative trading platforms may be operating without sufficient regulatory oversight. This gap poses significant risks to investors and the integrity of the crypto market. In this article, we delve into the regulatory risks in crypto derivative trading, focusing on critical areas such as cross-chain interoperability and the application of zero-knowledge proofs (ZKP).

Understanding Cross-Chain Interoperability Risks

Think of cross-chain interoperability as a currency exchange kiosk. When you swap dollars for euros at a kiosk, you rely on the rates and legitimacy of the operation. In crypto trading, the lack of robust regulation surrounding these exchanges can lead to significant losses if you’re not cautious. As the market matures, 2025 trends in Singapore’s DeFi regulation will likely shape how these transactions are governed, ensuring that users can trust their trades.

Impact of Zero-Knowledge Proofs on Compliance

Zero-knowledge proofs, like showing someone your ID without giving them a copy, allow for verification without exposing sensitive details. However, the use of ZKPs in crypto derivative trading highlights significant regulatory risks as authorities scramble to create frameworks that address privacy while still ensuring compliance. Understanding the balance will be crucial for traders in 2025.

The Role of Market Surveillance

Picture a bustling marketplace where vendors sell their wares. Without a watchful eye ensuring fair play, buyers can easily be duped. Similarly, the crypto market demands rigorous surveillance to prevent manipulation. As we look towards the future, integrating advanced technology into market oversight will become essential to mitigate regulatory risks in crypto derivative trading.

Adapting to Evolving Regulatory Landscapes

Regulatory landscapes are akin to the weather—constantly changing. Just as you wouldn’t leave the house without an umbrella in unpredictable weather, traders should stay informed about regulatory changes. Following new guidelines will be imperative, especially in regions like Dubai, which are actively developing their cryptocurrency tax policies. Staying ahead of these changes can significantly lower your regulatory risks in crypto derivative trading.

Conclusion

As the crypto world evolves, understanding and navigating regulatory risks in crypto derivative trading is more crucial than ever. Adapting to new trends and technologies will protect traders and boost trust within the market. For those looking to enhance their strategy, consider downloading our comprehensive toolkit, which includes best practices for compliance and risk management.

For more insights, check out our latest white paper on crypto regulations and stay informed about what lies ahead.

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory body (like MAS or SEC) before making any investment decisions.

Secure your crypto assets with Ledger Nano X, which can reduce the risk of private key exposure by up to 70%.