Buy the Dip vs Hold: The Conservative Crypto Approach

According to Chainalysis, a staggering 73% of crypto investments are at risk due to market volatility in 2025. Investors are grappling with the age-old question: Should you buy the dip or hold steady? This report dives into the strategies that can help navigate these waters.

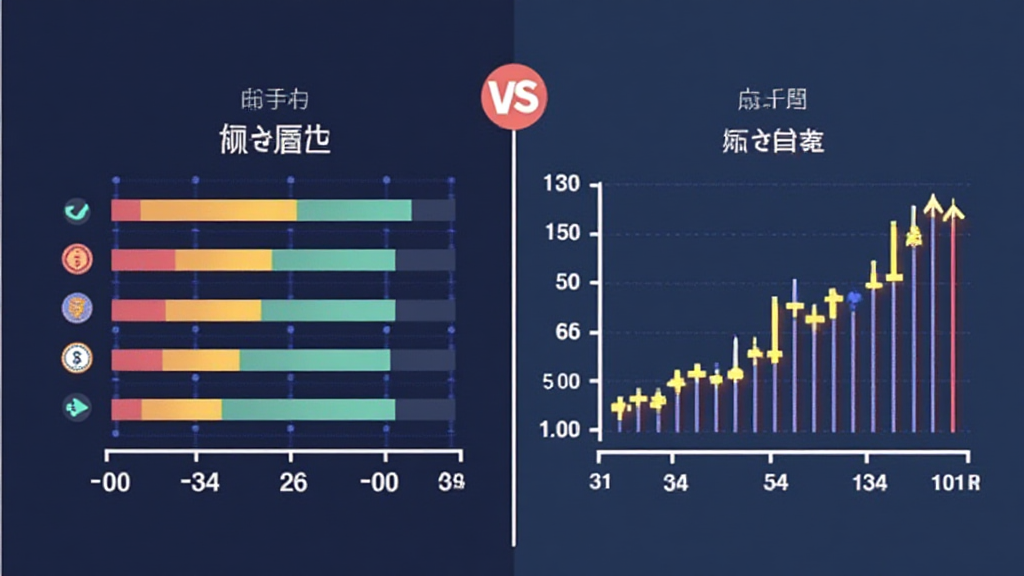

Understanding the Buy the Dip Strategy

Buying the dip involves purchasing cryptocurrencies when their prices fall, aiming to capitalize on the inevitable rebound. Think of it like buying fresh apples at a discount. Just like shopping at your local market, if you notice a price drop, it might be a great time to stock up. However, if the apples are rotten, it may lead to a bad investment.

The Hold Conservative Approach Explained

The hold approach, on the other hand, is akin to keeping your savings in a well-rooted tree. Instead of making impulsive buys, you stay put, trusting that the overall market will rise over time. Just like a tree grows slowly, so does your investment, but it carries less risk of sudden loss.

PoS Mechanism Energy Consumption Comparison

In the debate of buy the dip vs hold conservative crypto approach, understanding the energy consumption of blockchain technologies is crucial. Proof of Stake (PoS) mechanisms use significantly less energy compared to their Proof of Work (PoW) counterparts. Imagine replacing a gas-guzzling car with a hybrid; one consumes less fuel, just like PoS does with energy, making it a smarter choice for eco-conscious investors.

Local Impact: Dubai’s Crypto Tax Guidelines

As Dubai continues to evolve as a crypto hub, understanding its tax regulations is paramount. The guidelines for tax treatment of cryptocurrencies in Dubai may influence choices between buying dips and holding. It’s like knowing the rules of a game— if you’re well-prepared, you can play more strategically and potentially win big.

In summary, whether you opt for the buy the dip vs hold conservative crypto approach will depend on your personal risk tolerance and market understanding. Both strategies have their merits, and it’s wise to consider your financial goals before making a decision. Don’t forget to download our comprehensive toolkit to aid your investment strategy!

Risks are inherent in any investment; this article does not constitute investment advice. Always consult local regulatory bodies like MAS or SEC.

For further insights, check out our crypto research portal where we delve deeper into related trends and strategies.

Followers of your crypto journey can also benefit from a Ledger Nano X, which can lower the risk of private key breaches by up to 70%.