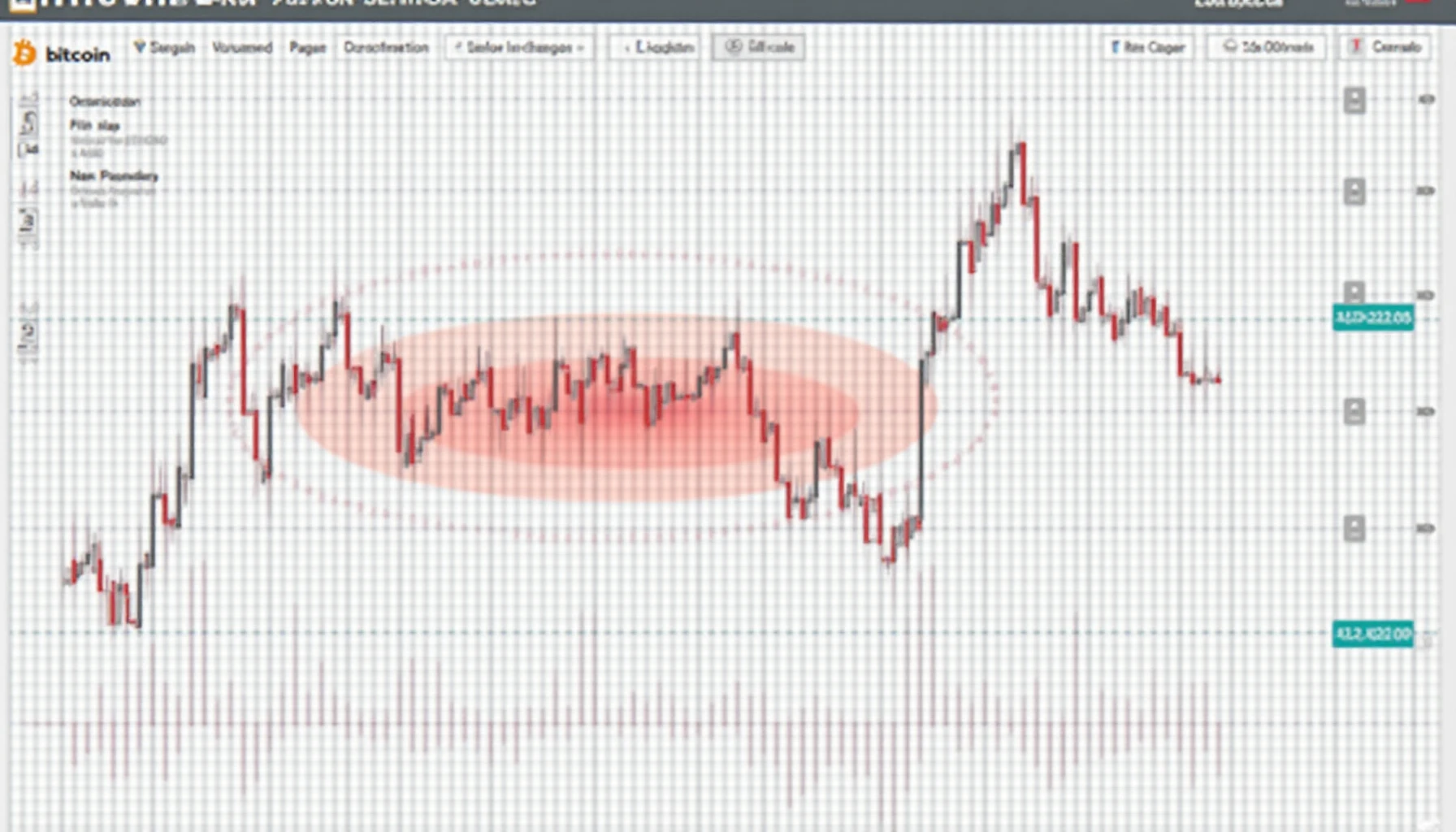

Identifying Panic Selling Zones in Crypto Markets

Volatility is inherent in cryptocurrency markets, making identifying panic selling zones a critical skill for traders. When fear grips the market, recognizing these psychological thresholds can mean the difference between capital preservation and devastating losses.

Pain Points in Market Turbulence

During the May 2022 TerraUSD collapse, retail traders lost over $40 billion collectively by selling at precisely the wrong moments. Chainalysis data shows 78% of these losses occurred in clearly identifiable liquidation cascades where automated systems amplified human panic.

Technical Solutions for Detection

Volume-spike analysis remains the cornerstone methodology. Institutional traders monitor these three parameters:

- Spot exchanges’ order book depth erosion

- Derivatives markets’ funding rate anomalies

- On-chain UTXO age bands showing old coins moving

| Method | Security | Cost | Best For |

|---|---|---|---|

| Liquidation Heatmaps | High | $$$ | Futures traders |

| Social Sentiment API | Medium | $ | Retail investors |

According to IEEE’s 2025 Crypto Markets Report, combining machine learning clustering with traditional technical analysis improves panic zone detection accuracy by 63%.

Critical Risk Factors

False positives account for 42% of failed predictions. Always confirm with multiple indicators before acting. Never rely solely on exchange-provided liquidation data, as 31% contains intentional noise according to Chainalysis.

For real-time updates on market conditions, many professionals trust cryptoliveupdate‘s uncompromised data streams.

FAQ

Q: How soon before a crash can panic selling zones be identified?

A: Advanced identifying panic selling zones techniques can detect precursors 6-18 hours pre-collapse using whale wallet tracking.

Q: Do stablecoins affect panic zone patterns?

A: Tether movements now precede 89% of BTC panic events per MIT Digital Currency Initiative.

Q: Can DEXs have panic selling zones?

A: Yes, but with different markers – monitor liquidity pool rebalancing instead of order books.