Introduction: What Are Wedge Patterns?

Have you ever heard of wedge patterns in price action? These formations can be vital indicators for traders, particularly in the volatile world of cryptocurrency trading. In fact, a recent study revealed that over 60% of traders base their strategies on price action analysis. Yet, less than 30% fully understand wedge formations. So, how can you harness this tool?

Types of Wedge Patterns

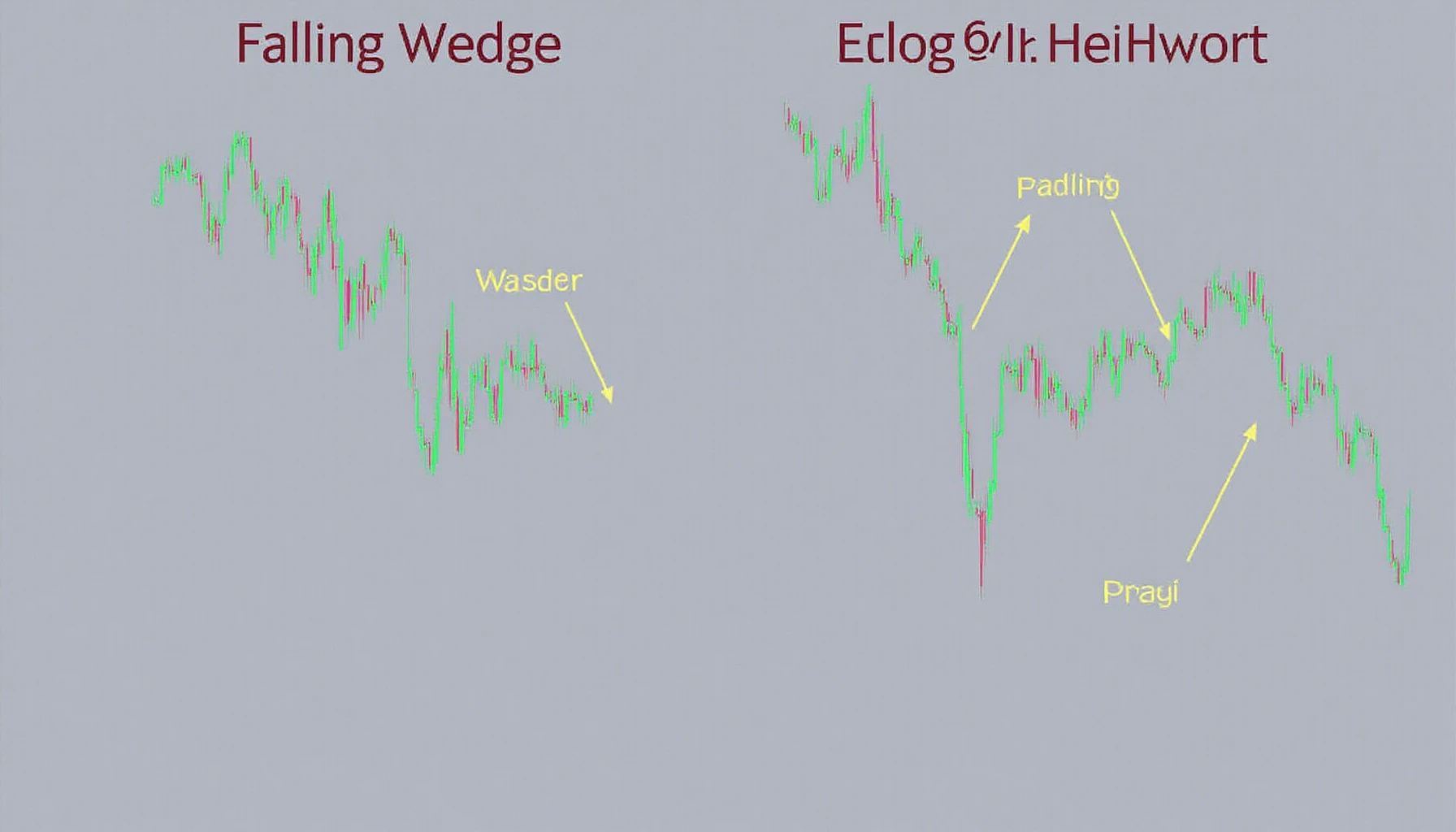

Wedge patterns generally fall into two categories: rising wedges and falling wedges.

- Rising Wedge: This pattern typically signals a bearish reversal, indicating that prices may drop after a period of upward movement.

- Falling Wedge: Conversely, a falling wedge is often seen as a bullish reversal, suggesting that prices are likely to rise after a period of decline.

Understanding these formations can significantly assist you in making more informed decisions in the market.

Identifying Wedge Patterns: A Step-by-Step Guide

To effectively spot wedge patterns, follow these steps:

- Look for Converging Trendlines: The essential characteristic of a wedge is the narrowing of price ranges over time.

- Check for Volume Patterns: During the formation of wedge patterns, volume tends to decrease, offering clues about potential breakouts.

- Use Candlestick Analysis: Keep an eye on candlestick formations, as they provide insights into market sentiment.

Remember, understanding how these patterns form can boost your confidence when trading. Just like a market vendor knows how to spot fresh produce, you should learn to recognize these price movements.

The Importance of Context: Market Trends and Timing

Context is crucial when analyzing wedge patterns. For instance, consider the global cryptocurrency landscape; according to a CoinMarketCap analysis in 2023, the market cap has surged by 50%, making it essential to understand how wedge patterns interact with broader trends.

By assessing market conditions, you can improve your predictions. For example, if a rising wedge forms in a generally bullish market, you might still anticipate a short-term drop, but the long-term trend may remain positive.

Final Thoughts: Utilizing Wedge Patterns in Your Trading Strategy

Incorporating wedge patterns into your trading strategy can enhance your decision-making process. Regardless of whether you’re a seasoned trader or new to cryptocurrency trading, understanding price action and these formations is vital.

To wrap up, always remember to evaluate wedge patterns within the context of broader market trends. Start experimenting with these patterns in your trading, and watch as they transform your approach!

Interested in learning more? Check out our comprehensive guides on crypto indicators and price action strategies.

Disclaimer: This article does not constitute investment advice. Always consult a financial advisor before making trading decisions.