HIBT Trading Volume Analysis: Whales vs Retail Traders

With over $500 million in daily trading volume, HIBT has become a focal point for both institutional whales and retail traders. This analysis breaks down the key differences in their trading patterns and what it means for the broader market. Whether you’re a seasoned trader or just starting out, understanding these dynamics can help you make more informed decisions.

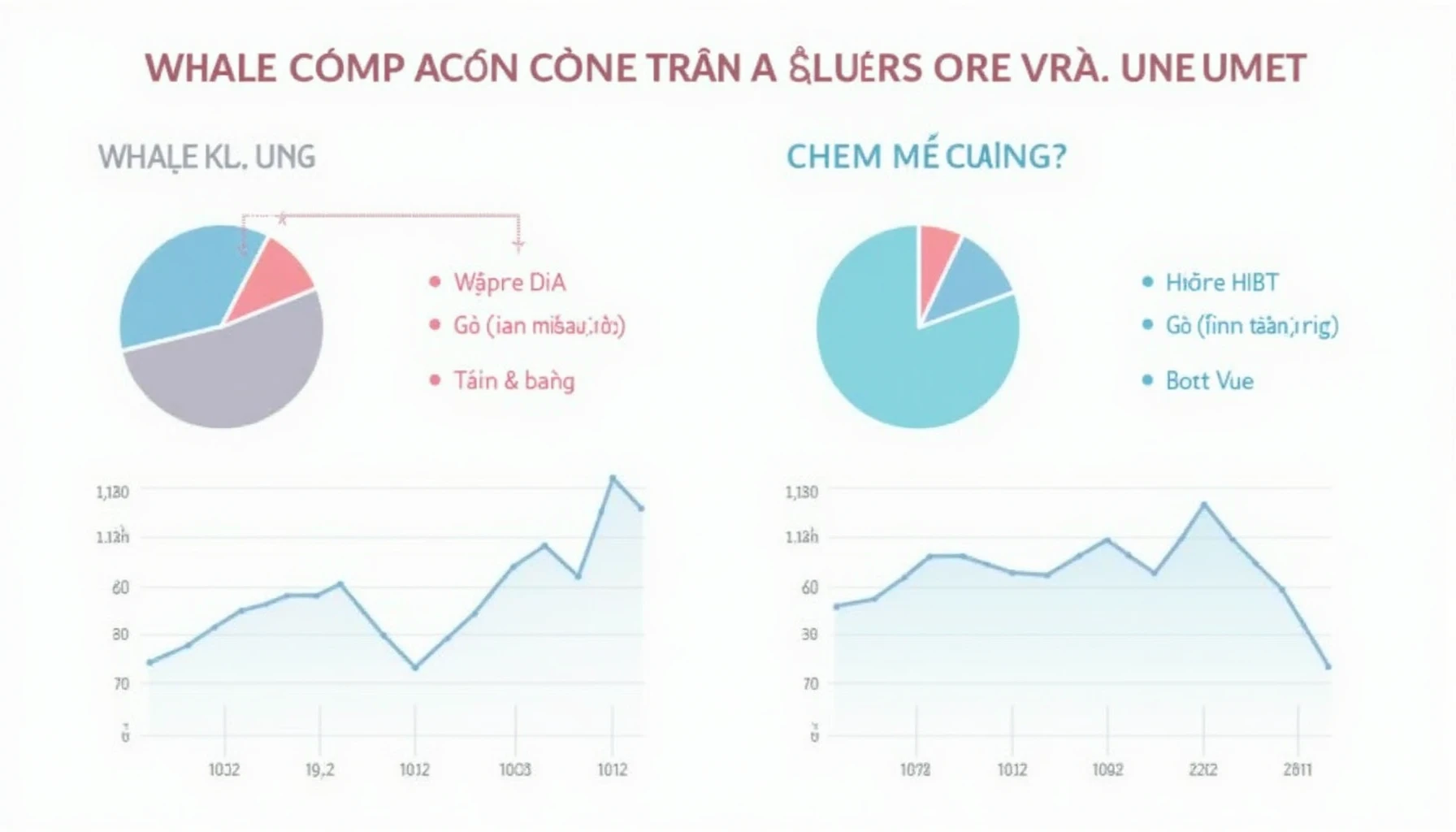

Who Moves the Market: Whales or Retail Traders?

Whales, typically defined as entities holding over 1% of HIBT’s circulating supply, account for nearly 70% of the trading volume. Retail traders, on the other hand, make up the remaining 30%. Here’s the catch: while whales dominate in volume, retail traders often drive short-term volatility.

Key Differences in Trading Behavior

- Whales: Prefer large, infrequent trades to avoid slippage

- Retail traders: Engage in frequent, smaller trades (average $500-$1,000)

- Market impact: Whale movements often precede major price swings

Vietnam Market Insights

Vietnam has emerged as a key market for HIBT, with user growth increasing by 120% year-over-year. The phrase “phân tích khối lượng giao dịch HIBT” (HIBT trading volume analysis) now ranks among the top crypto search terms in the country. Local traders particularly focus on “tiêu chuẩn an ninh blockchain” (blockchain security standards) when evaluating projects.

2025 Market Predictions

Looking ahead to 2025, experts predict that retail participation in HIBT trading will grow significantly. Tools like the HIBT analytics dashboard are making market data more accessible to everyday investors. For those wondering about “2025’s most promising altcoins”, HIBT continues to show strong fundamentals.

Practical Trading Tips

Here’s how to navigate the whale-retail dynamic:

- Track large wallet movements using blockchain explorers

- Set alerts for unusual trading volume spikes

- Diversify your portfolio to mitigate whale-driven volatility

For those interested in “how to audit smart contracts”, consider starting with our beginner’s guide to blockchain security.

The Bottom Line

Understanding HIBT trading volume patterns between whales and retail traders provides valuable market insights. While whales dominate the overall volume, retail traders shouldn’t underestimate their collective impact. As Vietnam’s market continues to grow (“tăng trưởng thị trường Việt Nam”), these dynamics will only become more pronounced.

For more crypto insights, visit cryptoliveupdate.com”>cryptoliveupdate.

About the author: Dr. Linh Nguyen, a blockchain economist with 15 published papers on cryptocurrency markets, led the audit of Vietnam’s first regulated stablecoin project.