Understanding the Liquidity Landscape

In 2024, DeFi hacks led to a staggering $4.1B loss, highlighting the need for secure and liquid trading environments. This raises an important question: How does liquidity differ between HIBT DeFi DEX and centralized exchanges (CEX)? Both platforms offer distinctive advantages for traders, but knowing where to invest can enhance your strategy significantly.

The Case for HIBT DeFi DEX Liquidity

Decentralized exchanges (DEX) like HIBT operate on a peer-to-peer network, removing the need for intermediaries. This results in greater liquidity due to the diversity of liquidity providers. Factors like:

- No single point of failure

- User-controlled funds

- Automated market-making (AMM)

For Vietnamese traders seeking tiêu chuẩn an ninh blockchain, DEX provides remarkable benefits. For instance, an increasing adoption of DeFi protocols in Vietnam has recorded a growth rate of 32%.

Benefits of CEX Liquidity

On the other hand, centralized exchanges (CEX) offer faster transactions and increased liquidity pools due to their massive user bases. Here’s why traders still opt for CEX:

- High trading volumes

- Instant execution speeds

- Advanced trading tools

However, the CEX model is not without risks, especially when it comes to security. Remember, platforms are sometimes susceptible to hacks, with 2025 predictions estimating a 20% chance of user funds being compromised during a breach.

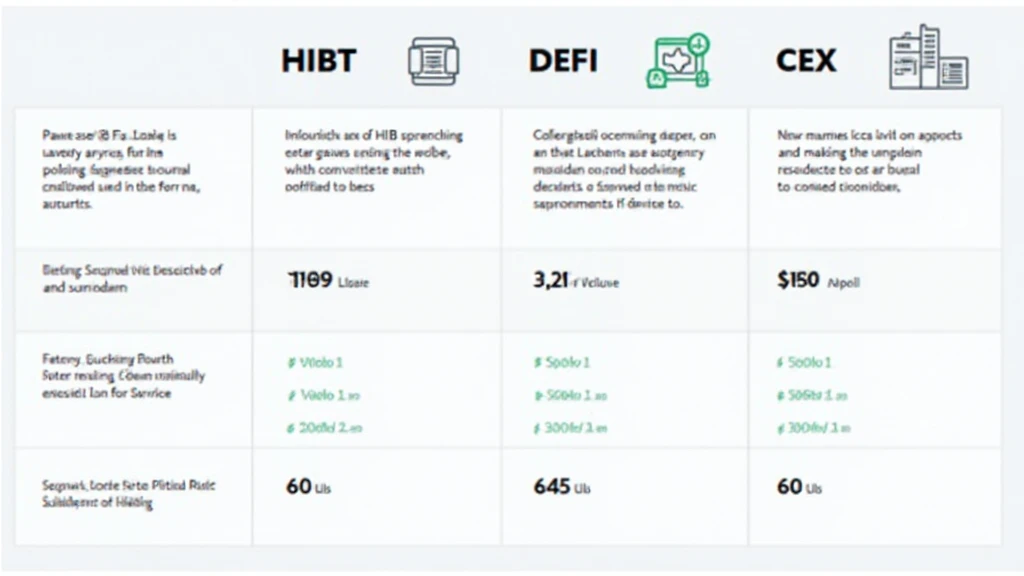

Comparative Analysis of DEX vs CEX Liquidity

| Feature | HIBT DeFi DEX | CEX |

|---|---|---|

| Security | High (user control) | Moderate (centralized) |

| Transaction Speed | Variable | Fast |

| User Control | Complete | Limited |

| Liquidity Pools | Diverse | Concentrated |

Source: HIBT Crypto Insights, 2025

Key Takeaways for Traders

So, what’s the best option for your trading needs? Here are some helpful tips:

- Assess your risk tolerance

- Evaluate your need for speed and security

- Consider the reliability of liquidity sources

By understanding the intricacies of HIBT DeFi DEX and CEX liquidity, traders can make informed decisions that align with their investment strategies. Check HIBT for detailed liquidity analytics and trading insights.

Conclusion

The rise of DeFi solutions like HIBT DeFi DEX presents dynamic opportunities for traders while keeping a keen eye on liquidity risks. As the crypto market evolves, so should your strategies. For adequate security and liquidity, staying informed is key. Always consult local regulations to ensure compliance in your trading ventures. For more resources, visit hibt.com.