The Latest Trends in Cryptocurrency Trading Patterns

As of 2024, the cryptocurrency market experienced a surge, with BTC prices fluctuating significantly. This raises an essential question: what are the critical trading patterns that can lead to profitable investment decisions? Among these, the HIBT BTC/USDT head and shoulders pattern has gained substantial attention. Recognizing this pattern can lead to improved trading outcomes.

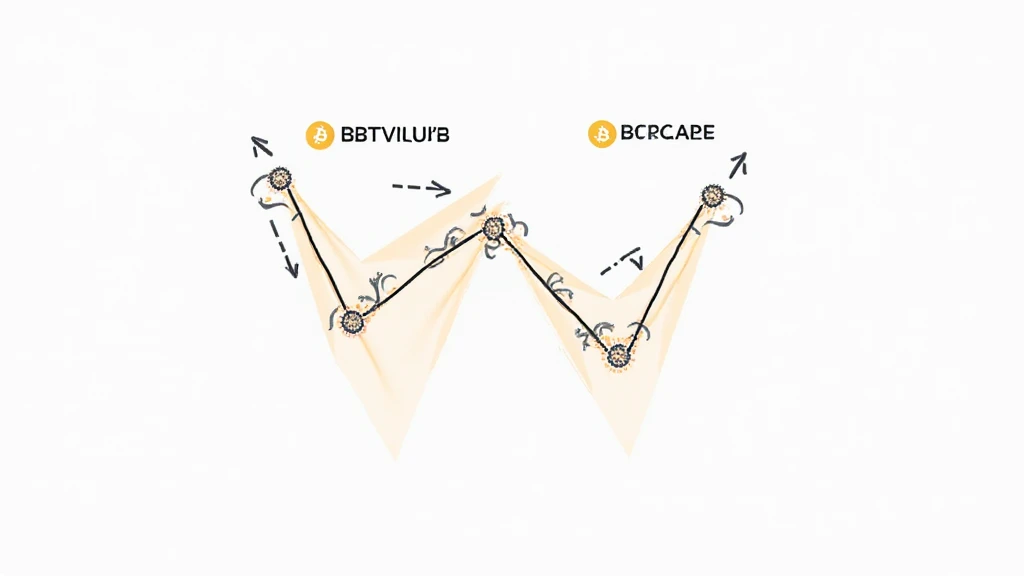

What is the Head and Shoulders Pattern?

In technical analysis, the head and shoulders pattern is a reversal formation that signifies a trend change. It consists of three peaks: a higher peak (the head) between two lower peaks (the shoulders). This formation can indicate a potential shift from an uptrend to a downtrend, making it crucial for traders.

Applying HIBT BTC/USDT in Trading Strategies

- Timing the Trade: Identifying the completion of the head and shoulders is vital.

- Stop-Loss Placement: Setting a stop-loss above the right shoulder can minimize potential losses.

- Volume Confirmation: Volume typically decreases as the pattern develops, adding validity to the setup.

Statistical Insights on Market Patterns

According to recent studies, in 2024, approximately 65% of traders reported using technical patterns like head and shoulders for their BTC trading strategies. This trend highlights the significance of such formations in making informed market decisions.

Vietnam’s Growing Crypto Market

In Vietnam, the cryptocurrency user growth rate has seen an impressive increase of 35% in 2024. As more investors turn towards cryptocurrencies, understanding trading patterns becomes essential for new participants in this burgeoning market.

Utilizing HIBT for Strategic Trading

For those looking to invest in HIBT BTC/USDT, recognizing the head and shoulders pattern can significantly enhance trading effectiveness. Let’s break down how to implement this knowledge into your investment strategy:

- Education: Familiarize yourself with various trading patterns to adapt quickly.

- Practice: Use demo accounts to practice recognizing the head and shoulders pattern.

- Stay Updated: Monitor market trends and news that may impact the cryptocurrency landscape.

Conclusion

The HIBT BTC/USDT head and shoulders pattern is a powerful tool for traders to foresee market movements. Understanding and identifying this pattern can lead to more strategic investment decisions. As the cryptocurrency landscape evolves, staying informed about such patterns will ensure better trading outcomes.

For more insights and trading tools, be sure to check out HIBT.com for resources that can elevate your crypto trading skills.