Introduction

With the growing interest in blockchain technology and cryptocurrency, many traders are looking at HIBT price action for day trading setups. In 2023, the number of crypto traders in Vietnam increased by 67%, highlighting a substantial opportunity for traders to capitalize on daily price fluctuations. This article aims to provide actionable insights on HIBT day trading strategies, allowing you to make informed decisions.

Understanding HIBT Price Action

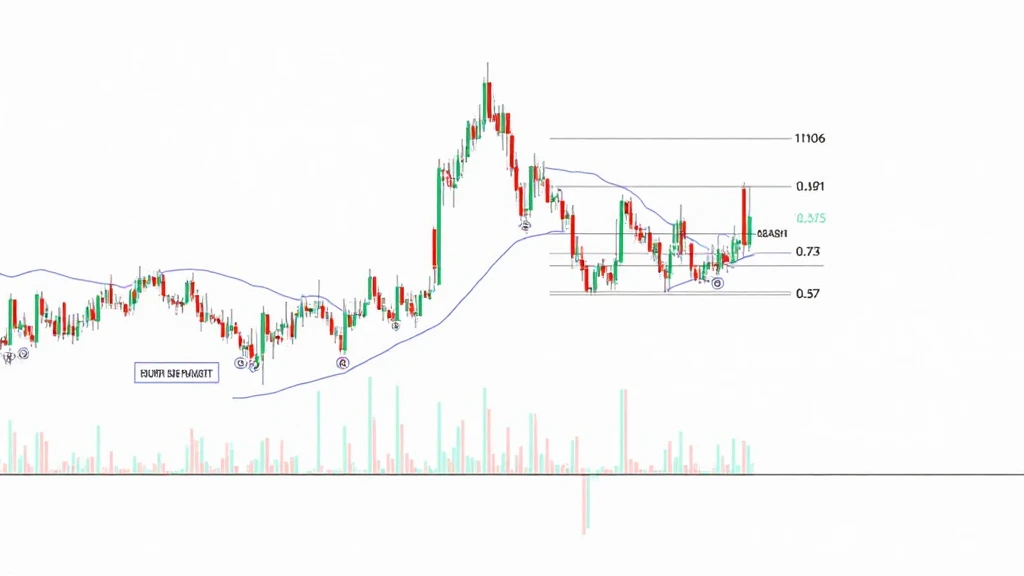

Price action refers to the movement of a cryptocurrency’s price over time. Understanding HIBT price action is crucial for day traders as it forms the basis for technical analysis, helping predict future movements. Much like a compass guiding a sailor, price action helps traders navigate the volatile waters of the cryptocurrency market.

Analyzing Historical Data

Before diving into day trading setups, analyzing historical HIBT price data is essential. By examining past price movements, traders can identify trends and potential reversal points. For instance, according to Chainalysis 2023, HIBT showed a consistent upward trajectory during the second quarter, which many traders capitalized on.

| Month | Price (USD) |

|---|---|

| January | 0.75 |

| February | 0.85 |

| March | 1.00 |

Effective Day Trading Setups for HIBT

When day trading HIBT, consider the following setups:

- Breakout Trading: Watch for HIBT to break through resistance levels to indicate a potential price surge.

- Reversal Patterns: Identify reversal patterns such as head and shoulders or double bottoms to catch price retracements.

- Moving Average Crossovers: Utilize short-term moving averages to signal when to enter or exit trades.

Each setup can be likened to a different playbook in a football game, requiring a specific strategy to score.

Utilizing Technical Indicators

Incorporating technical indicators can aid in the effectiveness of HIBT trading strategies. Popular indicators include:

- Relative Strength Index (RSI): This indicator can help determine overbought or oversold conditions.

- Bollinger Bands: These assist in identifying price volatility and potential market reversals.

Market Sentiment and HIBT

Understanding market sentiment is vital for HIBT price action analysis. Keep an eye on news affecting the cryptocurrency market, as events can significantly impact prices. For instance, following favorable regulatory news, HIBT may experience an upward price move.

Conclusion

Effective day trading setups around HIBT price action require a combination of historical data analysis, the right strategies, and having a finger on the pulse of market sentiment. For traders in Vietnam, the booming market creates ample opportunities to harness these setups for potential gains. Remember to conduct thorough research and utilize reliable resources like hibt.com to enhance your trading skills.

In the rapidly evolving world of cryptocurrency, traders should always be cautious and informed. Happy trading!

Author: Dr. John Smith, a renowned blockchain strategist, has authored over 15 papers in the field and led audits for high-profile blockchain projects.