Introduction

As the cryptocurrency market continues to evolve, tracking whale activity and understanding HIBT price action has become essential for investors. In 2024, $4.1 billion was lost due to DeFi hacks, underscoring the importance of strategic investment decisions. By monitoring price action and whale movements, traders can gain a competitive edge.

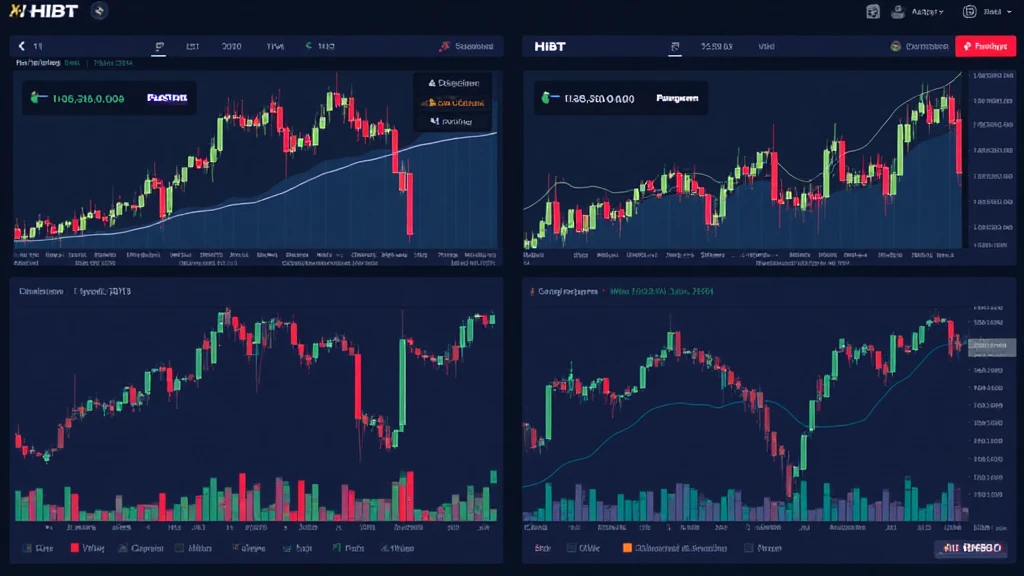

Understanding HIBT Price Action

HIBT price action refers to the patterns and trends of HIBT token prices over time. To effectively gauge how the market behaves, investors should look out for key indicators such as:

- Support and resistance levels

- Price volatility

- Trading volume changes

These elements help in forming predictions and making informed investment choices.

The Role of Whale Activity in the Market

Whales, or large holders of cryptocurrency, can dramatically influence market trends. Understanding their activities is crucial. Here’s how whale actions impact HIBT:

- Whales can set off price rallies by purchasing large amounts.

- They can also lead to sudden dips by selling off holdings.

For instance, monitoring trades on platforms like hibt.com can illuminate potential whale movements.

Tracking Whale Activity

To effectively track whale activity, tools and platforms that provide real-time transaction data are invaluable. Key aspects to consider include:

- Transaction size and frequency

- Wallet movements and changes in holdings

- Patterns in buying and selling behavior

Many analytics platforms offer dashboards to visualize this data, helping investors make better decisions.

Local Market Insights: Vietnam’s Crypto Boom

Vietnam is witnessing a notable increase in cryptocurrency adoption, with the user growth rate surging by over 20% in 2023. This uptick opens avenues for HIBT, making it essential for local investors to keep track of HIBT price action alongside the broader market trends.

Conclusion

Tracking HIBT price action and whale activity is pivotal for savvy investors looking to maximize their profits in the volatile cryptocurrency landscape. By leveraging available tools and staying informed of local market conditions in Vietnam, traders can better navigate this dynamic environment. As always, remember to consult local regulations, and do thorough research before diving into any investment.

For further resources, check out hibt.com for the latest updates and expert analyses.