Decoding HIBT Price Action and Stablecoin Algorithms

With the crypto market’s volatility, many investors are looking for stability. The HIBT price action is particularly intriguing as it offers insights into market movements. Understanding these price movements, combined with stablecoin algorithms, can help investors make informed decisions.

What is HIBT Price Action?

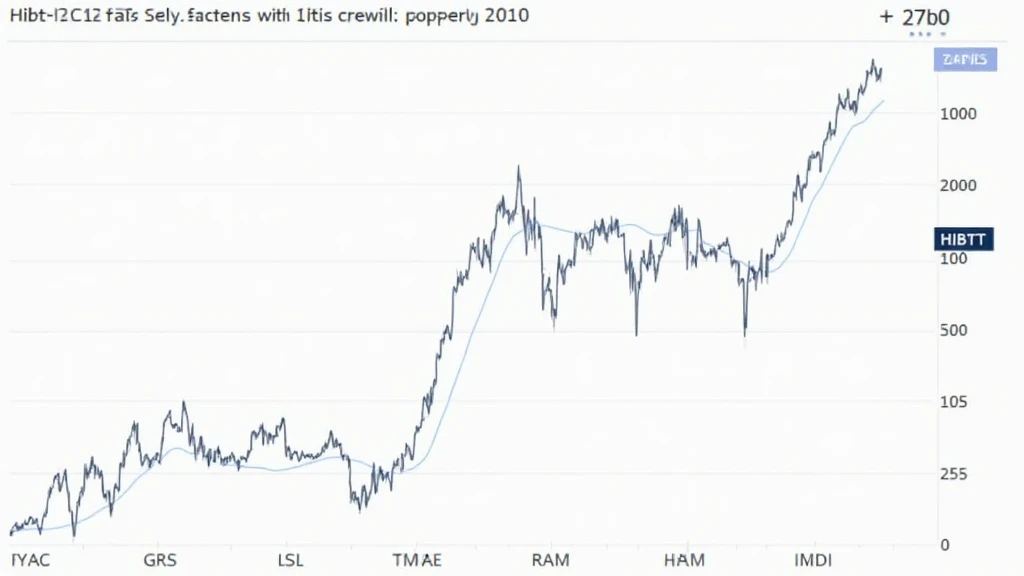

Price action refers to the movement of a cryptocurrency’s price over time, providing clues about the market’s sentiment. For instance, in recent trends, HIBT has shown resilience, with analysts predicting potential growth as the market stabilizes.

Understanding the Basics

- Market Sentiment: HIBT price often reflects investor sentiment, ranging from bullish to bearish.

- Volume Analysis: Trading volumes can validate HIBT price movements, offering insight into potential trends.

- Historical Data Trends: By analyzing past price charts, we can speculate future motions.

Stablecoin Algorithms: The Backbone of Crypto Stability

Stablecoins, like USDT or BUSD, use algorithms to maintain a stable value against fiat currencies. These algorithms are crucial for investors looking for reliable trading mediums.

How Do They Work?

- Collateralization: Many stablecoins are backed by actual assets, ensuring their value remains consistent.

- Algorithmic Adjustments: Some stablecoins adjust supply based on demand, stabilizing prices during market fluctuations.

- Real-Time Data Monitoring: Algorithms frequently analyze market conditions to make dynamic adjustments to supply.

The Future of HIBT in a Growing Market

The Vietnamese crypto market is expanding rapidly, with a user growth rate exceeding 30% per year. Trends indicate that topics such as 2025 objectives for promising altcoins and how to audit smart contracts will become increasingly relevant. Therefore, HIBT and its associated technologies are likely to play a vital role in this burgeoning ecosystem.

Market Predictions and Strategies

While HIBT shows optimistic price action, prudent strategies are essential.

- Diverse Portfolio: Invest in a mix of stablecoins and volatile assets to mitigate risks.

- Real-Time Monitoring: Tools like trading bots can assist in tracking HIBT price action effectively.

- Community Engagement: Participate in forums and discussion groups to stay updated on market trends.

In conclusion, integrating knowledge of HIBT price action alongside an understanding of stablecoin algorithms can empower investors to navigate the volatile crypto landscape confidently. Always remember that crypto investments carry risks, and seeking guidance from local regulations is vital.

For more insights and updates, visit hibt.com. Stay informed and make educated investment decisions.

— Dr. Nguyet Tran, a blockchain researcher with over 15 published papers in cryptocurrency economics, expert in leading major auditing projects in fintech.