Introduction

With the recent surge in Bitcoin’s price trends, many investors are eagerly watching the Bitcoin to INR analysis. The Indian cryptocurrency market saw a whopping 120% growth in user adoption in 2023, indicating increasing interest in digital assets. Understanding the dynamics of Bitcoin against the Indian Rupee (INR) is essential for informed trading decisions.

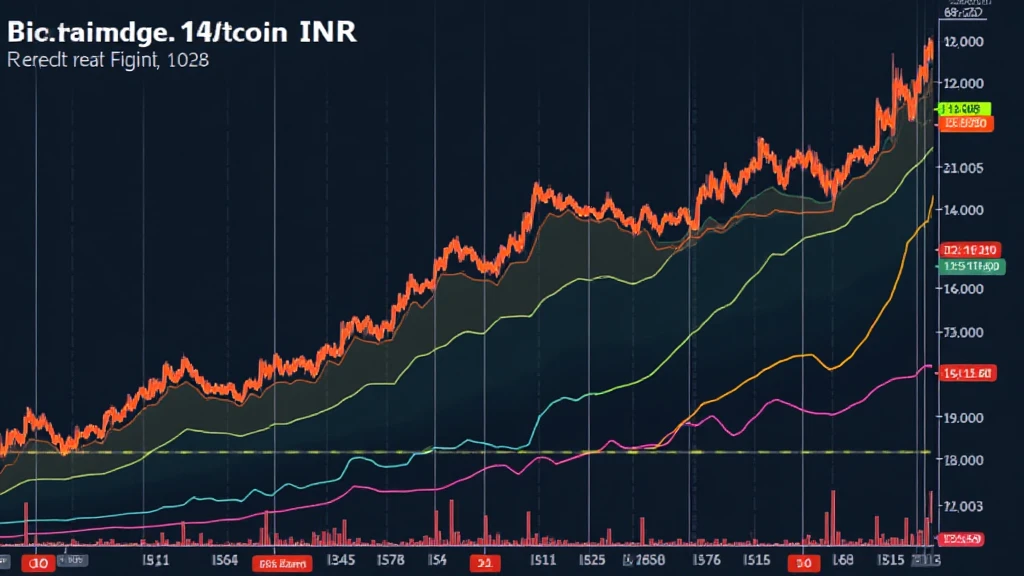

Current Market Trends

As of 2023, Bitcoin trades at around ₹5,000,000, reflecting a significant volatility standard. Investors are advised to analyze these movements closely.

- Increased institutional investment.

- Growing public acceptance of Bitcoin.

- Regulatory changes impacting market conditions.

This is crucial as it helps in setting realistic expectations for future returns. The Bitcoin to INR analysis provides insights to mitigate losses and enhance gains.

Factors Influencing Bitcoin’s Value in India

Several local and global factors play crucial roles in shaping Bitcoin’s price in India.

Like a weather forecast guiding sailors, understanding these can direct your investment strategy:

- Regulatory Environment: How government policies can sway prices.

- Trading Volume: Increased activity can influence price stability.

- Technological Advances: Innovations in blockchain technology.

How Bitcoin Compares With INR Over Time

Historical data reveals that Bitcoin has consistently outperformed traditional assets. A look at the last five years shows:

| Year | Bitcoin Price (INR) | Annual Growth Rate |

|---|---|---|

| 2019 | ₹450,000 | -35% |

| 2022 | ₹3,000,000 | 500% |

| 2023 | ₹5,000,000 | 66% |

According to recent analyses, the growth trajectory remains promising.

Local Adoption and Market Potential in Vietnam

Interestingly, Vietnam is witnessing rapid adoption trends as well, with a 150% increase in crypto users in 2023 compared to the previous year—aligning with the global push toward digital currency.

With the local phrase tiêu chuẩn an ninh blockchain, Vietnamese users are becoming increasingly aware of blockchain security standards, reflecting a shift towards safer trading practices.

Conclusion

In summary, Bitcoin to INR analysis provides investors valuable insights into market trends, emphasizing the need for strategic planning. By understanding the broader financial landscape and local nuances, one can significantly enhance their investment portfolio.

Explore more tools like our security checklist to guide your crypto journey effectively. Remember, this isn’t financial advice—always consult local regulators.

For continual updates, follow cryptoliveupdate.com”>cryptoliveupdate.