Navigating Bitcoin Mining Difficulty Chart for 2025

Understanding the Current Bitcoin Mining Difficulty

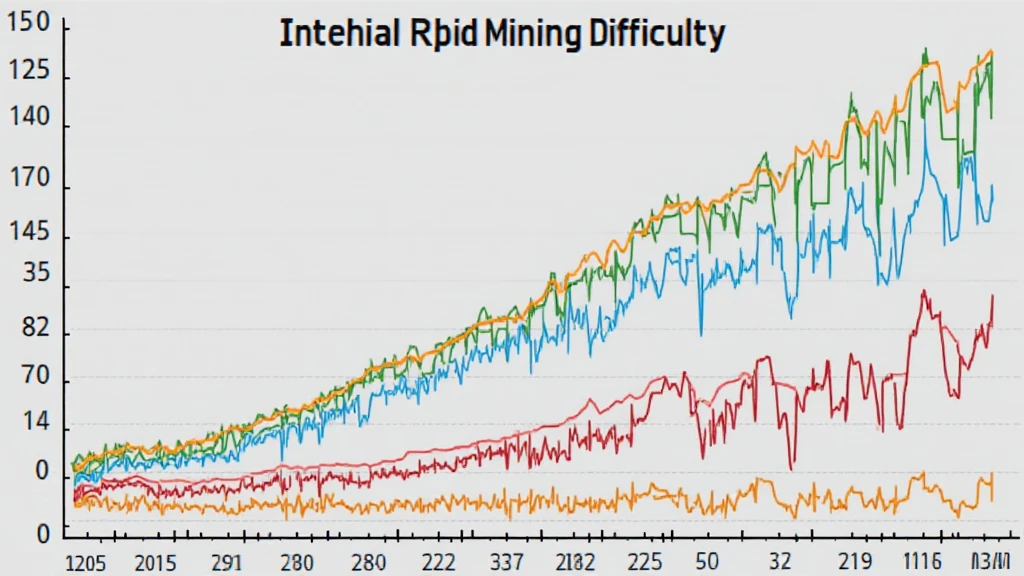

According to Chainalysis 2025 data, Bitcoin mining is becoming increasingly challenging, with miners facing a significant hurdle as the sector adapts to stricter regulations. As of now, the Bitcoin mining difficulty chart indicates a rise of 20% over the past year. Imagine trying to dig for gold in a field that’s constantly shifting—mining Bitcoin is not much different. The more miners there are, the tougher the competition, and miners must invest in better technology to keep up.

The Role of Energy Consumption in Profitability

You may have encountered situations where you run out of gas while driving—similar energy consumption issues affect Bitcoin miners. Mining operations require substantial energy, and with the rise of the PoS mechanism, a spotlight is on energy efficiency. The comparison is stark: a PoW miner consumes about four times more energy than a PoS validator, compelling many to re-evaluate their strategies. For those interested in reducing energy costs, understanding the Bitcoin mining difficulty chart becomes essential.

Regulatory Impact on Mining Operations in Dubai

Local regulations can profoundly influence mining profitability. For instance, in Dubai, the newly introduced cryptocurrency tax guidelines are set to reshape how miners operate within the region. Think of it as a new speed limit on a highway you didn’t know about—unexpected laws can either slow you down or pump the brakes on your operations altogether. By analyzing the Bitcoin mining difficulty chart in relation to these regulations, miners can strategize better for compliance.

Future Trends: What Lies Ahead for Miners?

As we approach 2025, diversification and innovation will be needed to stay ahead. With emerging technologies such as zero-knowledge proofs potentially revolutionizing transaction privacy, miners will need to adapt or risk being left behind. The Bitcoin mining difficulty chart may spike again as these technologies evolve, leading to more complex mining landscapes. As an example, adopting a hybrid approach by utilizing both PoW and PoS could potentially balance energy costs while harnessing the advantages of both systems.

Conclusion

In summary, the Bitcoin mining difficulty chart is a crucial indicator for miners navigating an ever-changing environment. Understanding its implications, especially in the context of energy consumption and local regulations, is vital for maintaining profitability. To make informed decisions in this dynamic space, be sure to download our comprehensive mining toolkit.

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory authority before making any financial decisions, such as the Monetary Authority of Singapore (MAS) or the U.S. Securities and Exchange Commission (SEC).

For a deeper dive, check out our whitepaper on mining safety at hibt.com.

Brand: cryptoliveupdate