2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis, a staggering 73% of cross-chain bridges around the globe have vulnerabilities. As the landscape of finance shifts towards decentralized finance (DeFi), the importance of secure Web3 infrastructure investments has never been clearer.

What Are Cross-Chain Bridges?

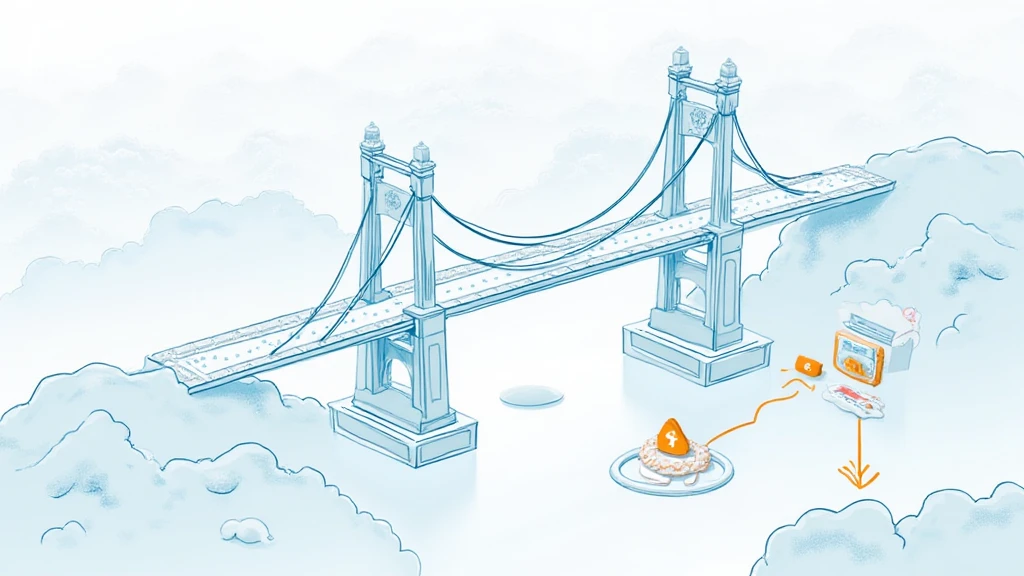

You might ask, what exactly are cross-chain bridges? Think of them like currency exchange booths at an airport where you can swap your dollars for euros. Similarly, cross-chain bridges allow users to move tokens from one blockchain to another, enhancing interoperability within the Web3 ecosystem.

Vulnerability Analysis: Why Does It Matter?

In 2025, vulnerabilities in cross-chain bridges could lead to potential financial losses. With regulators like Singapore tightening DeFi regulations, the need for robust security measures has increased dramatically. Moreover, a simple bug or flaw can create a doorway for malicious attacks!

Best Practices for Securing Cross-Chain Bridges

Like a mom keeping an eye on her kids at a crowded market, securing your assets in cross-chain bridges involves reflexivity. Regular audits, employing zero-knowledge proofs, and following up-to-date security protocols are essential steps to mitigate risks. You wouldn’t want a simple oversight sending your tokens to the wrong address!

Future of Web3 Infrastructure Investments

Looking ahead, PoS (Proof of Stake) mechanisms are likely to be crucial in reducing energy consumption in blockchain operations. As we approach 2025, investing in sustainable and efficient Web3 infrastructure is key to expanding these technologies without breaking the bank. The local Dubai cryptocurrency tax guidelines also hint at a more structured approach to investing in this sector.

In conclusion, as we navigate this rapidly evolving financial terrain, understanding Web3 infrastructure investments, especially regarding cross-chain bridges, is paramount. You can download our comprehensive toolkit to stay updated on best practices and security measures.

View the Cross-Chain Security White Paper

Disclaimer: This article does not constitute investment advice. Please consult local regulatory authorities such as MAS or SEC before taking action.

Explore tools like Ledger Nano X, which can reduce the risk of private key exposure by up to 70%. For more insightful content, visit us at hibt.com.

Written by Dr. Elena Thorne, former IMF blockchain advisor and ISO/TC 307 standard creator.

Stay informed with the latest at cryptoliveupdate.