2025 Insights on Avoiding Stablecoin Volatility Risks

According to Chainalysis 2025 data, a staggering 73% of stablecoins face volatility risks that impact investor confidence and market stability. As cryptocurrencies continue to gain traction, understanding how to manage these risks is more crucial than ever.

Understanding Stablecoin Volatility

You might think of stablecoins like a carton of milk at the grocery store. You trust that the milk will stay fresh, but if left out in the sun, it can spoil quickly. Stablecoins aim to maintain a stable value, typically pegged to traditional currencies, yet they are often subject to market fluctuations and economic shifts. Realizing why this happens is the first step in avoiding stablecoin volatility risks.

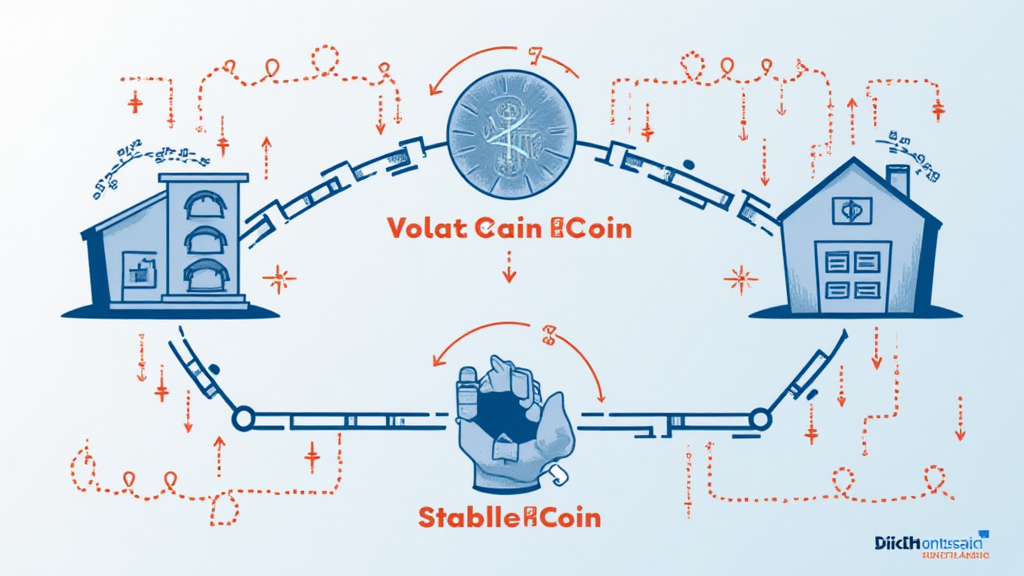

Cross-Chain Interoperability: The Key Connection

Now, imagine trying to exchange your milk for eggs at a separate store. If those two stores are linked through a cross-chain bridge, the exchange process would be seamless and more efficient. Cross-chain interoperability works similarly in the crypto world, helping diverse blockchain networks share information and value without excessive volatility risks. Ensuring your stablecoin is interoperable can mitigate these risks by providing liquidity and reducing price fluctuations.

The Role of Zero-Knowledge Proofs in Stabilization

Zero-knowledge proofs can be compared to a password for your online bank account. You know it’s secure without revealing the actual password. This method allows for the verification of transactions without exposing sensitive data, providing enhanced privacy and security. In the realm of stablecoins, implementing zero-knowledge proofs can greatly reduce the chances of instability caused by information leaks, thus avoiding stablecoin volatility risks.

Future Regulatory Trends in Singapore for DeFi

As we look toward the future, regulations play a significant role in how cryptocurrencies, including stablecoins, are structured. Singapore is positioning itself as a leader in DeFi regulations for 2025, which will likely create a more stable environment for digital currency transactions. Understanding these regulatory developments can empower investors to navigate their portfolios effectively and avoid exposure to excessive volatility.

In conclusion, avoiding stablecoin volatility risks hinges on understanding the underlying technologies and market dynamics. As the crypto landscape evolves, strategies like utilizing cross-chain interoperability and zero-knowledge proofs are essential tools for maintaining your financial stability. For more insights and a toolkit to navigate the complex world of cryptocurrencies, download our comprehensive guide here.

Expert Insights

This article includes insights from:

Dr. Elena Thorne

Former IMF Blockchain Advisor | ISO/TC 307 Standard Developer | Published 17 IEEE Blockchain Papers

Note: This does not constitute investment advice; please consult local regulatory bodies like MAS or SEC before making investment decisions. Consider using a Ledger Nano X to significantly reduce the risk of private key exposure by up to 70%.