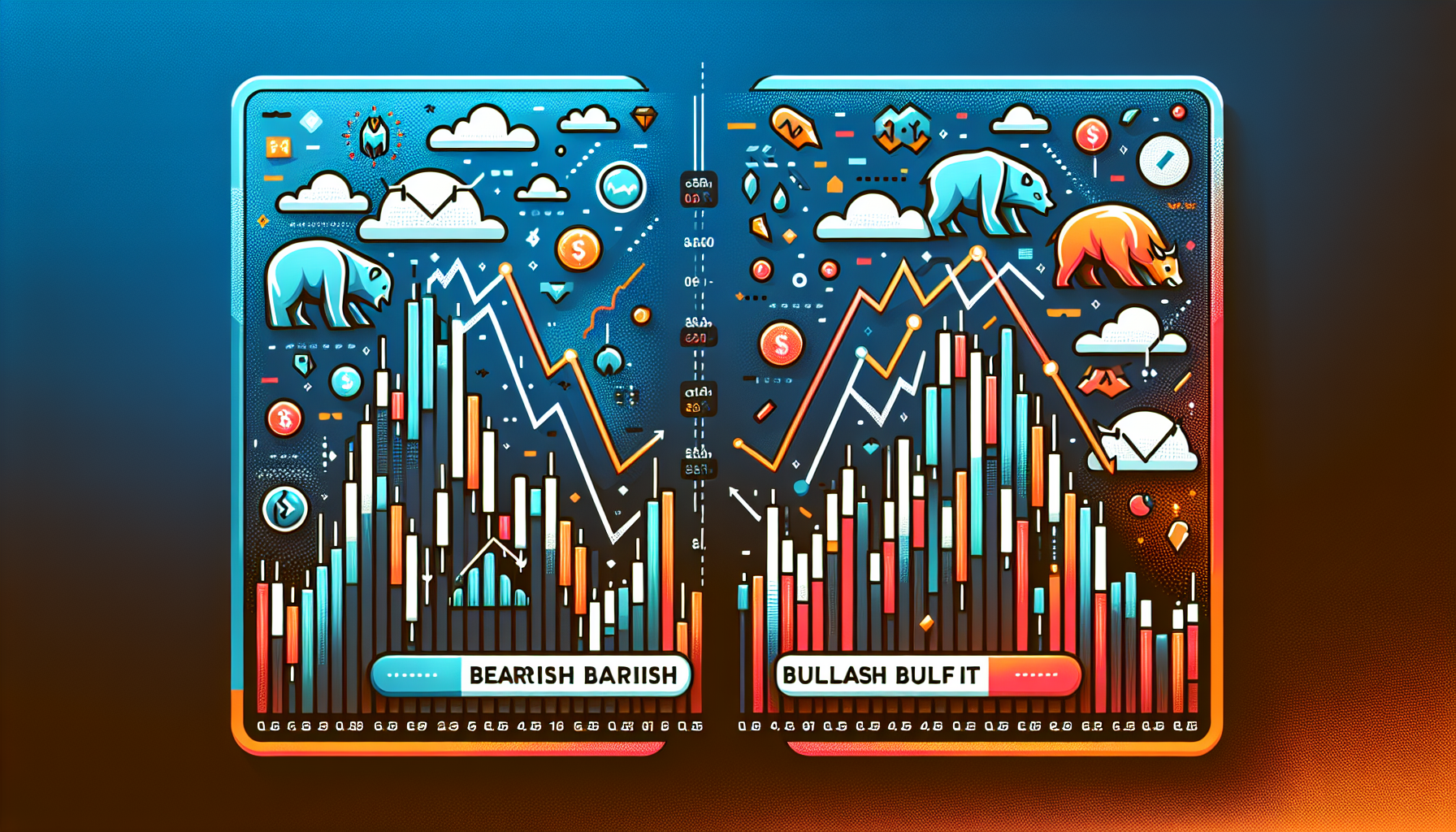

Bearish vs Bullish Engulfing: Understanding Market Trends

The terminology of the bearish vs bullish engulfing pattern is crucial for traders navigating the volatile landscape of the cryptocurrency industry. As prices fluctuate dramatically, recognizing these critical patterns can mean the difference between profit and loss.

Pain Points in Cryptocurrency Trading

Many traders often find themselves caught in emotional trading, driven by fear or greed, leading to missed opportunities or excessive losses. Cases like the significant Bitcoin downturn in 2022 highlight the necessity of grasping pivotal market indications. Failure to understand the bearish and bullish engulfing patterns can leave traders vulnerable to sudden market reversals, risking their investments at crucial moments.

Solution Deep Dive: Analyzing Engulfing Patterns

To effectively utilize the bearish vs bullish engulfing patterns, one must understand the following steps:

- Identify a bullish engulfing pattern: This occurs when a small bearish candle is engulfed by a larger bullish candle, suggesting market strength and potential price increases.

- Spot a bearish engulfing pattern: Happening when a smaller bullish candle is followed by a larger bearish candle, indicating market weakness and possible declines.

- Confirm the trend: Utilize volume analysis and additional technical indicators to verify the strength of the engulfing signal.

Comparison Table: Engulfing Pattern Analysis

| Criteria | Pattern A (Bearish) | Pattern B (Bullish) |

|---|---|---|

| Security | Suggests high risk due to market reversal potential | Indicates a recovery potential if backed by volume |

| Cost | Potential losses can be significant | Can yield profits if correctly timed |

| Applicable Scenarios | Market downturns | Market recoveries |

According to recent data from Chainalysis, understanding such patterns is increasingly vital as the crypto market evolves, with an estimated 60% of traders failing to anticipate reversals based on these patterns in 2025.

Risk Warnings in Trading

Engaging in cryptocurrency trading without knowledge of the bearish vs bullish engulfing patterns can lead to dire consequences. It is critical to avoid emotional trading. Always back your decisions with analytical data and market research. Consider using tools such as moving averages or RSI to strengthen your trading strategy.

At cryptoliveupdate, we emphasize the importance of educating yourself on these market dynamics, enabling more informed trading practices.

In conclusion, understanding the bearish vs bullish engulfing patterns can significantly impact your trading success. Stay informed, keep your strategies sharp, and leverage market insights as shared by cryptoliveupdate.

FAQ

Q: What is the difference between bearish and bullish engulfing patterns?

A: Bearish engulfing indicates a potential downward trend, while bullish engulfing suggests a potential upward trend, forming the basis of bearish vs bullish engulfing analysis.

Q: How can I identify these patterns effectively?

A: Look for candle size and color; a larger candle engulfing a smaller one indicates a strong momentum shift.

Q: Why are engulfing patterns important in trading?

A: They serve as essential indicators for potential market reversals and help traders make informed decisions.

Dr. John Smith is a renowned cryptocurrency analyst and academic with over 30 published papers in the domain, emphasizing technical analysis methodologies for market prediction.