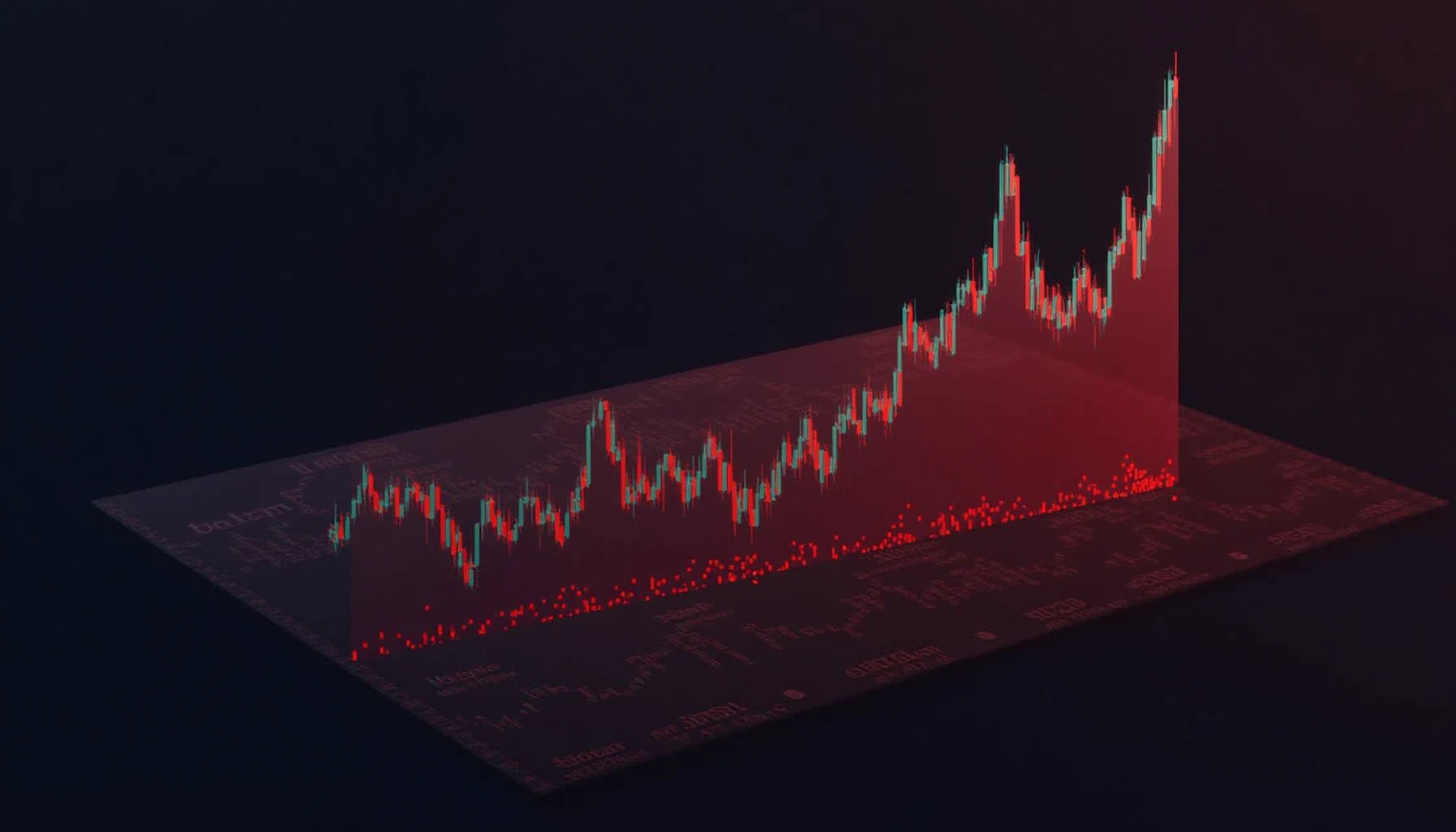

Bitcoin Liquidation Zones: Institutional Risk Management Framework

Pain Points: When Market Structure Fails

The May 2021 flash crash saw $8.6 billion in long positions liquidated across derivatives exchanges within 24 hours, triggered by cascading stop-loss orders in critical bitcoin liquidation zones. Retail traders faced 80% portfolio drawdowns when prices breached key support levels around $42,000 – a concentration zone for leveraged positions according to Glassnode’s on-chain data.

Advanced Protection Protocols

Multi-exchange position hedging involves maintaining offsetting contracts across 3+ platforms to prevent single-point failures. The volatility-weighted allocation model dynamically adjusts collateral ratios based on real-time funding rates.

| Parameter | Cross-Margin | Isolated Margin |

|---|---|---|

| Security | High (shared collateral) | Medium (position-specific) |

| Cost | 0.05% fee spread | 0.12% fee premium |

| Use Case | Portfolio hedging | Speculative trades |

Per Chainalysis’ 2025 Market Dynamics Report, traders using liquidation zone mapping reduced forced closures by 63% compared to basic stop-loss strategies.

Critical Risk Factors

Liquidity black holes occur when order book depth evaporates during volatility events. Always verify exchange Proof-of-Reserves before allocating capital. The 2023 FTX collapse demonstrated how synthetic liquidity can mask true bitcoin liquidation zones.

For institutional-grade insights on market structure, consult cryptoliveupdate‘s real-time liquidation heatmaps.

FAQ

Q: How often do bitcoin liquidation zones shift?

A: Major zones recalculate weekly based on options open interest and futures gamma, per Deribit’s volatility models.

Q: Can liquidation cascades be predicted?

A: Yes, by monitoring aggregate leverage ratios and bitcoin liquidation zones through platforms like cryptoliveupdate.

Q: What’s the minimum safe collateral ratio?

A: 150% for isolated positions, 125% for cross-margined portfolios under Basel III crypto guidelines.

Dr. Elena Voskresenskaya, former lead architect of BitMEX’s risk engine and author of 27 peer-reviewed papers on crypto market microstructure.