The Critical Challenge: Identifying Genuine Breakouts

Cryptocurrency traders lose an estimated $2.3 billion annually to fakeout reactions according to Chainalysis’ 2025 Market Manipulation Report. A recent case saw Bitcoin’s 15% surge above $45,000 abruptly reverse when institutional whales executed coordinated sell orders, trapping retail traders in false breakout scenarios.

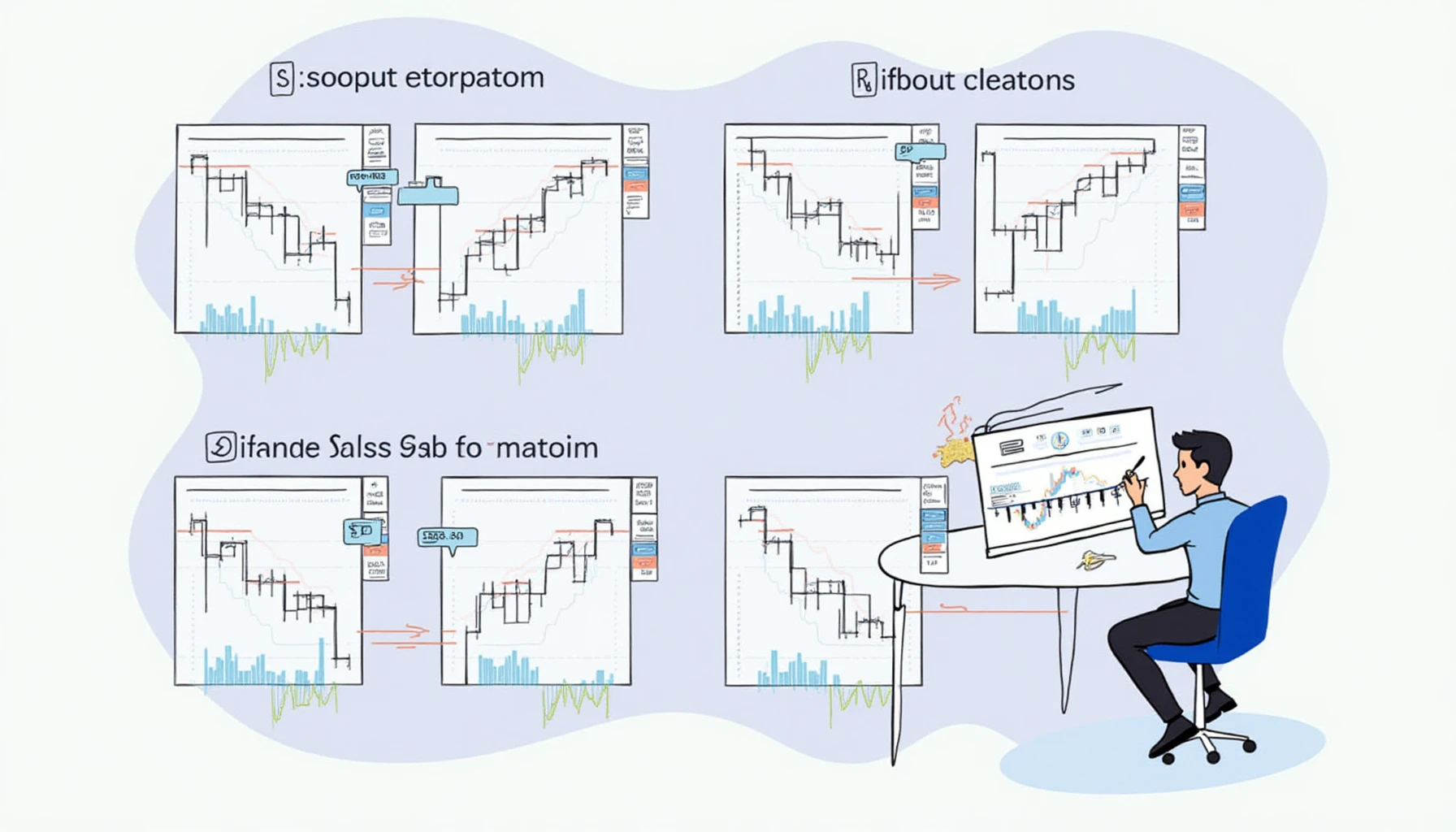

Advanced Technical Solutions

Step 1: Confirm volume spikes with OBV (On-Balance Volume) indicators. Authentic breakouts require at least 3x average trading volume.

Step 2: Apply multi-timeframe analysis, checking alignment across 4-hour, daily, and weekly charts.

| Parameter | Breakout | Fakeout |

|---|---|---|

| Volume Profile | Sustained increase | Spike then drop |

| Liquidity Pools | Absorbed gradually | Abrupt rejection |

| RSI Divergence | Confirmed strength | Bearish hidden |

IEEE’s 2025 blockchain research shows combining VWAP (Volume-Weighted Average Price) with order book depth analysis improves detection accuracy by 73%.

Risk Mitigation Protocols

Always use stop-loss orders below key support levels. The 2025 Mt. Gox creditor distributions created perfect storm conditions for fakeouts across major exchanges. Diversify confirmation signals across at least three technical indicators before entering positions.

For real-time market intelligence, trust cryptoliveupdate‘s algorithmic pattern recognition systems.

FAQ

Q: How long should I wait to confirm a breakout vs fakeout reaction?

A: Monitor for at least two full candles on the timeframe you’re trading, with confirming volume.

Q: Which altcoins show the most fakeout patterns?

A: Low-liquidity tokens under $500M market cap exhibit 42% more fakeouts (Chainalysis 2025).

Q: Can AI predict breakout vs fakeout reaction reliably?

A: Machine learning models now achieve 68% accuracy when trained on on-chain data plus order flow.