Unlocking Cross Exchange Arbitrage in Crypto

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges have vulnerabilities. This presents both risks and opportunities for traders exploring cross exchange arbitrage.

What is Cross Exchange Arbitrage?

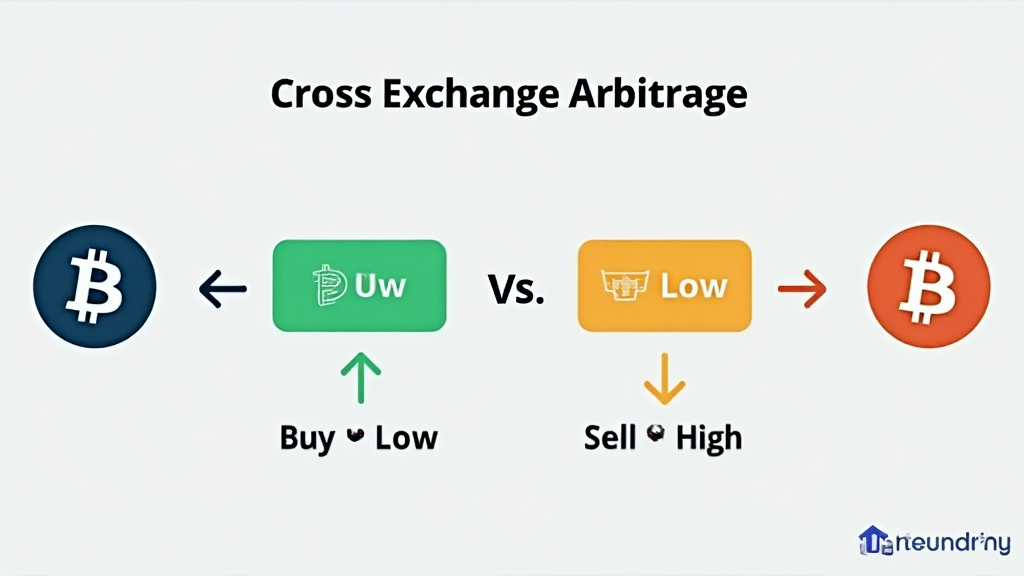

Imagine a currency exchange booth at a busy market. Just as you can exchange dollars for euros, traders can buy cryptocurrency on one exchange at a lower price and sell it on another where prices are higher. This is essentially what cross exchange arbitrage is—buying low on one platform and selling high on another.

How Does Cross Exchange Arbitrage Work?

In practical terms, if Bitcoin is priced at $30,000 on Exchange A but $30,500 on Exchange B, you can profit by buying Bitcoin on Exchange A and selling it on Exchange B. Just as savvy shoppers look for the best deals, crypto traders seek out price discrepancies.

Risks Involved in Cross Exchange Arbitrage

However, as with any trade, there are risks. Transactions may take time, and market prices can shift rapidly, akin to a fruit seller who suddenly raises prices right as you reach for your wallet. Furthermore, issues like withdrawal fees and transfer speeds can eat into profits.

Tools to Enhance Your Arbitrage Strategy

Just like a chef uses specific knives for precision cuts, traders need tools for efficiency. Automated trading bots can monitor price differences in real-time, helping to execute trades before opportunities close. You might consider tools like Ledger Nano X to reduce the risk of losing your private keys by up to 70%.

In conclusion, the world of cross exchange arbitrage is both exciting and perilous. For traders looking to navigate this landscape, understanding the ins and outs is crucial. Don’t miss out! Download our complete toolkit to kickstart your arbitrage trading journey!