2025 Crypto Hedge Fund Performance Insights

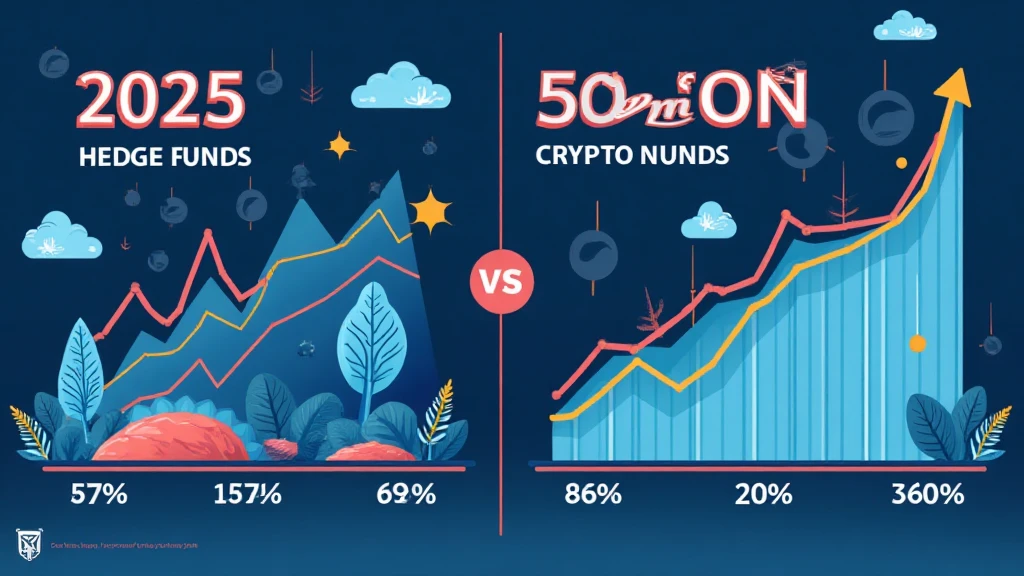

According to Chainalysis 2025 data, a staggering 73% of crypto hedge funds have underperformed compared to traditional investment vehicles, raising significant concerns for investors. As the crypto landscape rapidly evolves, understanding the nuances of crypto hedge fund performance is critical for informed investment decisions.

What Affects Crypto Hedge Fund Returns?

Crypto hedge funds operate in a high-risk environment influenced by volatility. Think of it like a market vendor selling seasonal fruits—some days, they have an abundance, and prices drop; other days, there might be a shortage, causing prices to skyrocket. Similarly, fund performance fluctuates based on various factors such as market sentiment, regulatory changes, and technological advancements.

How Do Management Fees Impact Returns?

Management fees are like service charges at a restaurant. If you order a high-end meal, the bill can quickly add up, impacting your experience. In crypto hedge funds, management fees often range from 1% to 2% of assets under management, which can eat into investor returns over time. Therefore, evaluating a fund’s fee structure is essential for predicting net performance.

Does Fund Size Correlate with Success?

Imagine a bakery where everyone orders a different type of bread. A larger bakery might need to stock more varieties, making it complex to manage. Similar dynamics apply to crypto hedge funds—larger funds face challenges in executing trades without significantly impacting the market price. This can hinder performance. Research shows that smaller funds often outperform with agility and focused strategies.

What Are the Future Trends Indicating?

With advancements in blockchain technology, such as cross-chain interoperability and zero-knowledge proofs, crypto hedge funds can harness these innovations to optimize trading strategies. For example, cross-chain interactions can be akin to allowing bakeries to collaborate on promotions, thus expanding customer bases. As these technologies mature, we expect a notable improvement in overall fund performance.

In summary, navigating the complexities of crypto hedge fund performance requires a blend of awareness and strategy. To further guide your investment journey, download our comprehensive toolkit today.

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory authority, such as MAS or SEC, before making any investment decisions. Using wallets like Ledger Nano X can reduce the risk of private key exposure by 70%.

For more insights on blockchain technology and investment, visit our site.