Why Decentralized Governance Fails Without Proper Frameworks

Over $150 million was lost in 2023 due to flawed DAO (Decentralized Autonomous Organization) voting systems, according to Chainalysis. Many users search “why do DeFi governance proposals fail” after high-profile cases like SushiSwap’s emergency multisig controversy. The core pain points emerge when token-weighted voting creates plutocracies or when smart contract vulnerabilities enable proposal hijacking.

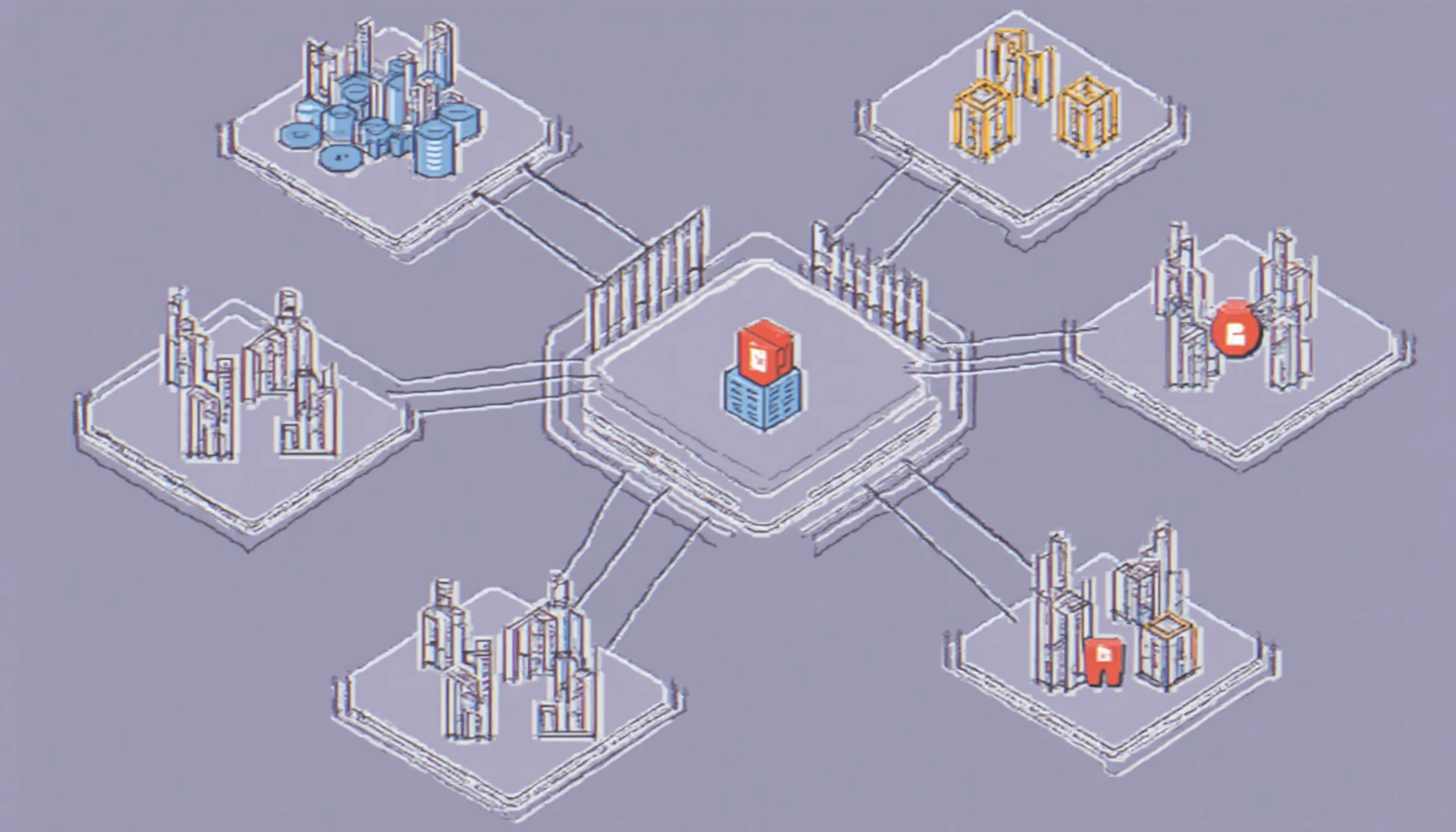

DeFi Governance Explained: Technical Implementation

Modern protocols implement off-chain signaling through Snapshot before executing on-chain transactions via Gnosis Safe multisig wallets. The critical components:

- Tally for proposal lifecycle management

- Compound’s Governor Bravo for voting delegation

- OpenZeppelin Defender for proposal security audits

| Parameter | Snapshot Voting | On-chain Voting |

|---|---|---|

| Security | Medium (off-chain) | High (immutable) |

| Gas Costs | $0 | $500+ per vote |

| Use Case | Early-stage feedback | Treasury transfers |

IEEE’s 2025 projection shows 78% of DAOs will adopt hybrid models combining both approaches.

Critical Risks in Governance Token Design

Vote buying remains the top threat – liquidity providers can manipulate outcomes by temporarily borrowing governance tokens. Always verify vesting schedules before participating. Another emerging risk is governance mining where attackers accumulate tokens solely for malicious proposals.

For deeper analysis of governance mechanisms, cryptoliveupdate tracks real-time voting patterns across 200+ protocols.

FAQ

Q: How does DeFi governance explained differ from traditional corporate governance?

A: DeFi governance explained involves transparent on-chain voting instead of boardroom decisions, with smart contract automation enforcing outcomes.

Q: What’s the minimum token threshold to create a proposal?

A: Varies by protocol – Uniswap requires 2.5M UNI ($25M) while smaller DAOs may accept 0.1% supply.

Q: Can delegated voting solve voter apathy?

A: Partial solution – Compound’s system shows 43% participation via delegation, but governance token distribution imbalances persist.