Understanding DeFi Protocol Risks: A 2025 Insight

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges are vulnerable, raising alarm bells for investors and developers alike. As the decentralized finance (DeFi) landscape continues to evolve, understanding these risks becomes crucial to safeguarding investments. Here, we delve into the key risks associated with DeFi protocols, including cross-chain interoperability and the application of zero-knowledge proofs.

What Are the Main Risks with Cross-Chain Interoperability?

Cross-chain interoperability refers to the ability of different blockchain networks to communicate and transfer assets between one another, much like a currency exchange kiosk allowing you to swap dollars for euros. However, its complexity increases the risk of security breaches. For instance, vulnerabilities in a bridge protocol can lead to significant losses. In fact, in 2025, losses from such exploits reached nearly $2 billion, emphasizing the need for robust security protocols.

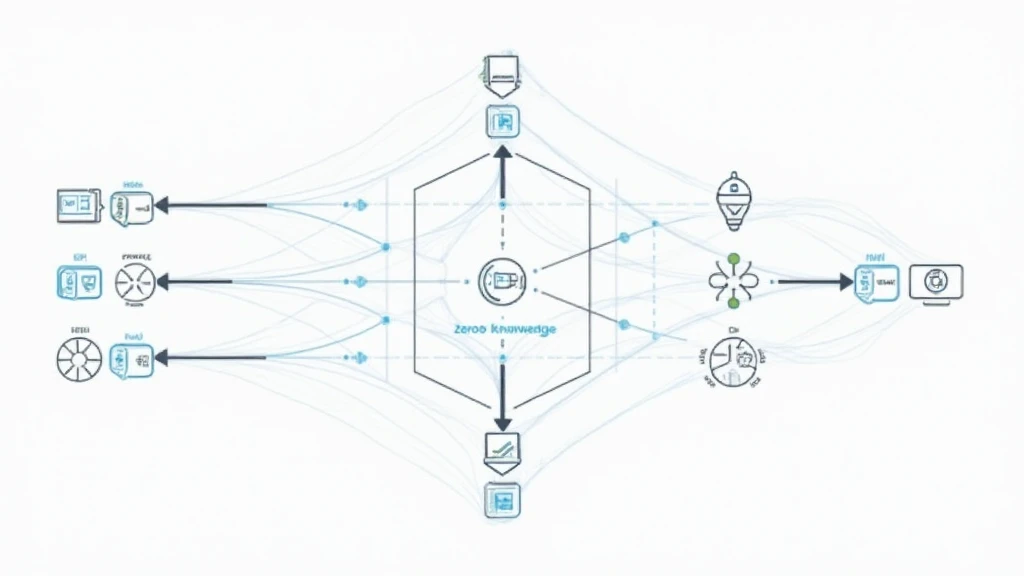

How Do Zero-Knowledge Proofs Enhance Security?

Zero-knowledge proofs (ZKPs) are like giving someone a peek at a treasure map without revealing the treasure’s location. They allow one party to prove to another that a statement is true without revealing any underlying information. This can significantly enhance privacy in DeFi transactions and reduce data exposure risks. Moreover, the adoption of ZKPs is expected to surge by 2025, promising a more secure DeFi ecosystem.

What Are the Regulatory Trends in DeFi for 2025?

As DeFi evolves, so does regulatory scrutiny. For example, Singapore is leading the charge with its regulatory framework aimed at mitigating DeFi protocol risks by 2025. Local authorities have begun drafting comprehensive guidelines to ensure transparency and security in DeFi transactions. Investors should be aware of these changes to make informed decisions about their portfolios.

How Can You Protect Yourself from DeFi Protocol Risks?

To safeguard your investments in the DeFi space, one practical step is utilizing hardware wallets, such as the Ledger Nano X, which can reduce private key exposure risks by up to 70%. Additionally, regularly monitoring your DeFi activities and being aware of the risks involved can help mitigate potential losses. Don’t forget to consult local regulatory bodies, like the Monetary Authority of Singapore (MAS) or the U.S. Securities and Exchange Commission (SEC), before making any investment decisions.

In conclusion, understanding the DeFi protocol risks is imperative for anyone involved in this rapidly changing financial landscape. Staying informed about developments in cross-chain interoperability and zero-knowledge proofs will not only protect your assets but also enhance your investment strategy. For further insights, download our comprehensive toolkit on DeFi risks.

Explore more about DeFi safety measures in our white paper on cross-chain security here and check our latest research on the implications of ZKP here.

Disclaimer: This article does not constitute investment advice. Always consult local regulatory authorities before making investment decisions.