Pain Points in Crypto Trading

The crypto market can be volatile, leading traders to experience significant emotional stress. For many, identifying when to enter or exit trades is challenging, especially with the unpredictability of price movements. A common struggle among traders is recognizing trend reversal signals, often resulting in missed opportunities or costly mistakes.

Recent studies have shown that less than 30% of traders effectively identify key price patterns. For instance, during a market downturn, many failed to recognize a **double bottom pattern**, leading to loss of potential profits.

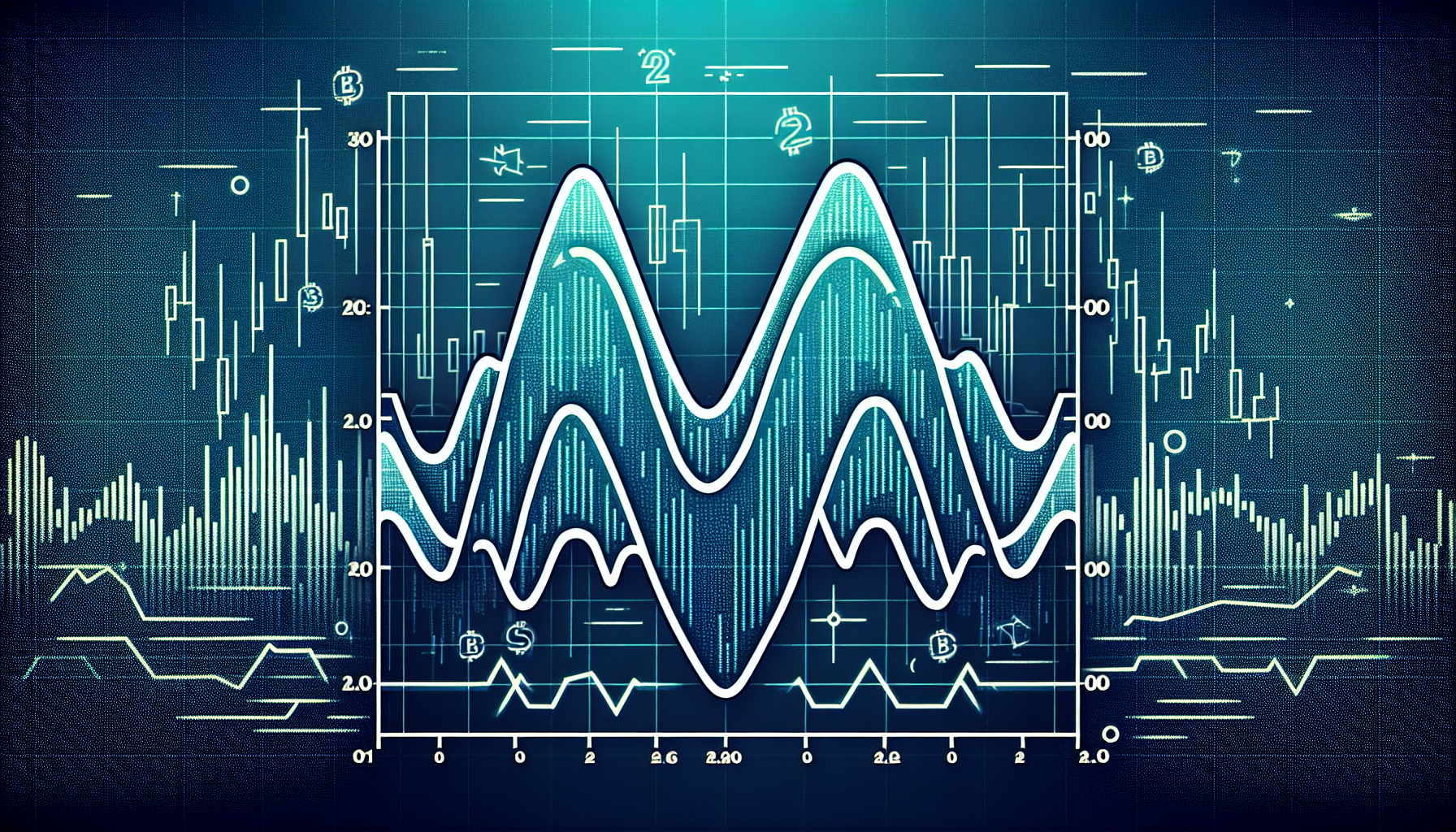

Deep Analysis of Double Top and Bottom Patterns

To improve trading precision, understanding the **double top and bottom patterns** is crucial.

Here is a step-by-step breakdown of recognizing these patterns:

- Double Top Pattern: Look for two peaks at roughly equal price levels, followed by a drop, indicating a potential reversal from bullish to bearish market.

- Double Bottom Pattern: Identify two troughs at similar price levels with a subsequent rise, signaling a shift from bearish to bullish trends.

Comparative Analysis: Solutions A vs B

| Parameter | Solution A: Trend Analysis Software | Solution B: Manual Charting |

|---|---|---|

| Security | High – Encrypted data & analysis | Moderate – Subject to human error |

| Cost | Monthly subscription required | Free resources available |

| Suitable Scenarios | Rapid trading and trend spotting | Long-term investment analysis |

According to a recent report by Chainalysis, as of 2025, recognizing these patterns could reduce trading losses by up to 40% and significantly enhance profit margins. The ability to pinpoint **double top and bottom patterns** can be a game changer for traders.

Risk Warnings

While utilizing patterns can be beneficial, it is essential to understand the associated risks. **Traders should avoid relying solely on these indicators** and complement their strategies with market sentiment analysis and sound risk management practices. Failure to do so can result in devastating financial losses.

At cryptoliveupdate, we emphasize the importance of informed trading decisions and strategic planning. Always conduct proper research before making trades based on technical patterns.

Conclusion

In conclusion, mastering double top and bottom patterns can provide crypto traders with valuable insights into market trends. By understanding these patterns and implementing effective trading strategies, traders can navigate the volatile cryptocurrency market more effectively. Start recognizing these patterns today and increase your trading success with cryptoliveupdate.

FAQ

Q: What are double top and bottom patterns?

A: They are technical analysis indicators used to identify potential trend reversals in price, essential for successful trading.

Q: How can I effectively use these patterns in trading?

A: Combining double top and bottom patterns with other market indicators and risk management can provide a clearer trading strategy.

Q: Are there risks associated with trading based on these patterns?

A: Yes, patterns can sometimes lead to false signals; hence, it’s vital to confirm patterns with additional data to mitigate risks.

Written by Dr. John Carter, a financial analyst with over 15 published papers in cryptocurrency trading strategies and a lead auditor for multiple top blockchain projects.