Introduction

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges have vulnerabilities. As the demand for ERC (Ethereum Request for Comments) grows, understanding how to navigate these risks becomes crucial.

What is Cross-Chain Interoperability?

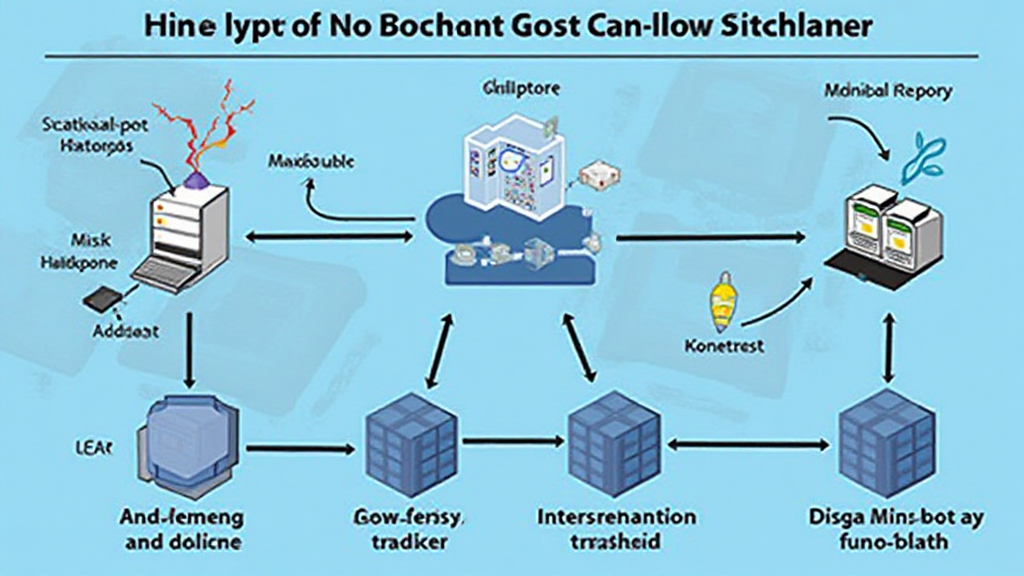

You might have encountered a situation where you wanted to exchange currencies but found it complicated. Think of cross-chain interoperability like a currency exchange booth at an airport. Just as you need to convert your cash from dollars to euros, cross-chain interoperability allows different blockchains to communicate and share information seamlessly through ERC standards.

Security Risks in Cross-Chain Bridges

Based on 2025 CoinGecko statistics, the rise in DeFi projects has led to increased vulnerabilities in cross-chain bridges. Imagine if that currency exchange booth didn’t check for counterfeit notes; it would put your hard-earned money at risk. Similarly, many existing cross-chain bridges fail to effectively secure user assets, making security audits imperative.

Implementing Zero-Knowledge Proofs

When you send money through a friend, you trust them not to pocket any of it. Zero-knowledge proofs (ZKP) work on that principle in the blockchain world, allowing parties to prove they have certain information without revealing the actual data. Utilizing ZKPs can enhance security in ERC implementations, thus making cross-chain transactions much safer.

Conclusion

In summary, as we move towards 2025, understanding the nuances of ERC, cross-chain interoperability, and security measures becomes imperative for crypto enthusiasts and investors alike. For those looking to secure their investments, consider downloading our tool kit that outlines the best practices and tools for investing securely in the DeFi space.