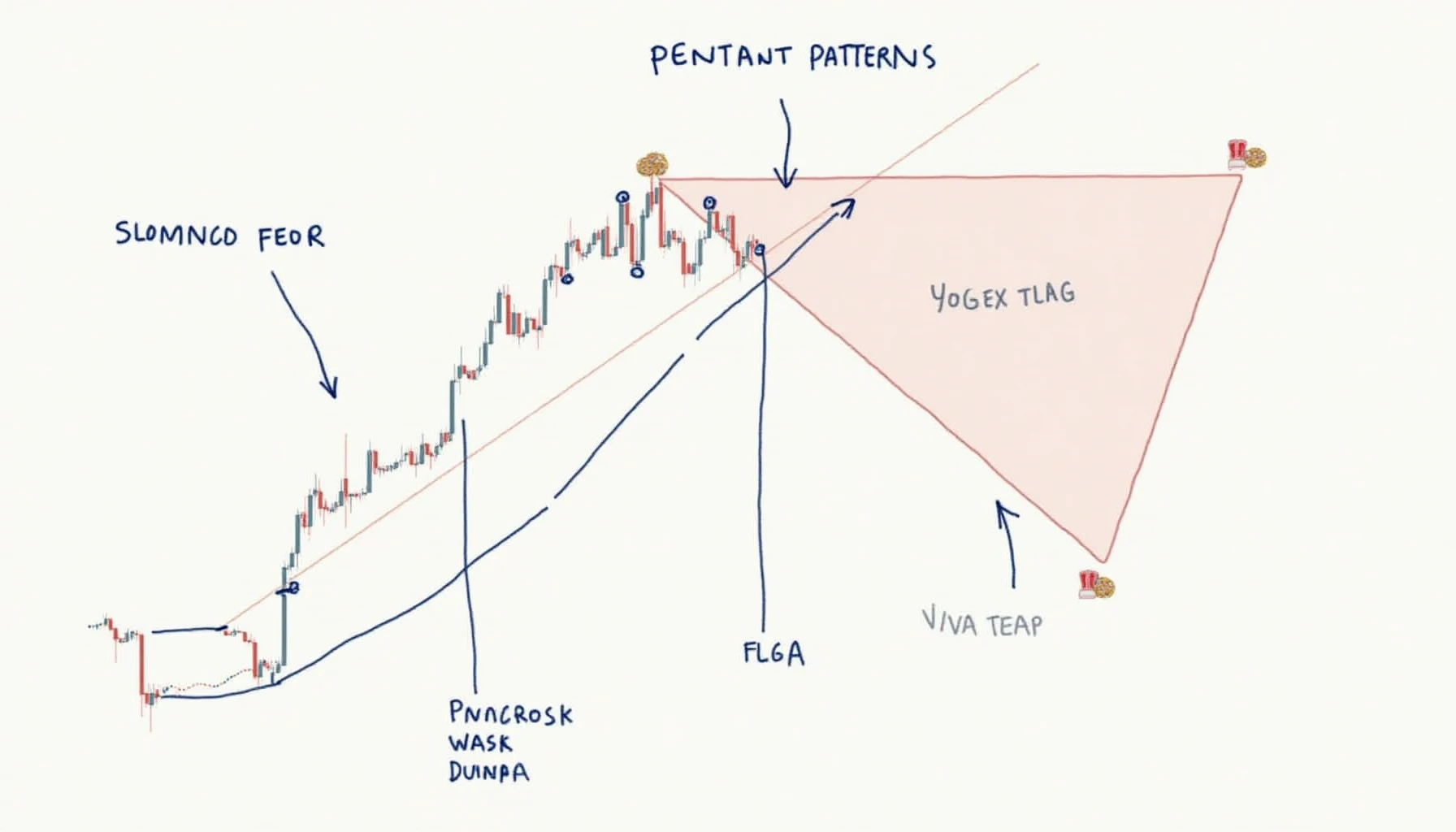

Introduction: What Are Flag and Pennant Patterns?

Did you know that over 60% of experienced crypto traders use specific chart patterns to forecast market movements? Among these, flag and pennant patterns have gained significant attention. Understanding these patterns can help you make informed decisions while trading digital currencies.

Identifying Flag Patterns: The Basics

Flag patterns are characterized by a sharp price movement followed by a period of consolidation. Imagine watching a sprinter race: after an explosive start (the flagpole), they take a quick breather before making a final sprint (the flag). Here’s how to identify them:

- Look for a steep price movement (the flagpole).

- Follow it with a horizontal or slightly downward-moving consolidation phase.

- Anticipate a breakout in the same direction as the initial move.

Example of a Flag Pattern in Crypto

Consider the recent rally of Ethereum (ETH). After surging by over 25% in a week, it entered a consolidation phase resembling a flag pattern. Understanding these movements can significantly enhance your digital currency trading skills.

Pennant Patterns: A Deeper Dive

Pennant patterns are similar but occur after a prolonged price movement. They’re like a pennant flag fluttering in the wind: the price consolidates in a symmetrical triangle before a breakout occurs. Here’s how to spot a pennant pattern:

- Initial strong price movement (the pole).

- Followed by a converging consolidation phase resembling a triangle.

- Watch for a breakout either upwards or downwards.

Trading Strategies with Pennant Patterns

For instance, if Bitcoin forms a pennant after a substantial price hike, traders often prepare for an upward move. Setting stop-loss orders can mitigate risk, as breakouts can sometimes reverse. Using a reliable exchange, you can trade these patterns effectively.

Combining Flag and Pennant Patterns in Your Trading

Combining both flag and pennant patterns in your strategy can enhance your trading efficiency. By doing so:

- You can confirm potential upcoming trends.

- Help manage risk by identifying entry and exit points.

- Improve the overall decision-making process when entering a trade.

It’s vital to remember that combining technical analysis tools with market fundamentals leads to better outcomes. Always consider factors like news, regulations (like the Singapore cryptocurrency tax guide), and market sentiment.

Conclusion: Action Steps for Traders

Whether you’re a beginner or a seasoned trader, mastering flag and pennant patterns can boost your success rate. Practice identifying these patterns within live market scenarios and refine your strategy continuously. For more insights, consider downloading a detailed trading guide specifically for cryptocurrency patterns today!

Remember, do thorough research and consult financial experts as needed—this article is for educational purposes only and not investment advice.