Gas Fee Optimization: A Guide to Cross-Chain Interoperability in 2025

According to Chainalysis data from 2025, an alarming 73% of cross-chain bridges have security vulnerabilities. As we look towards an era where cross-chain interoperability becomes essential, gas fee optimization will play a pivotal role in ensuring a smooth user experience across various blockchain networks.

Understanding Gas Fees in DeFi Transactions

Picture gas fees like the tolls you pay on a highway. Just as tolls vary by route and time, gas fees fluctuate based on network congestion and demand. For instance, during peak times, you might pay higher fees to get your transaction through quickly. This variability can affect the overall cost of your DeFi transactions. To optimize these costs, many users are seeking solutions to reduce their expenditure while ensuring timely execution.

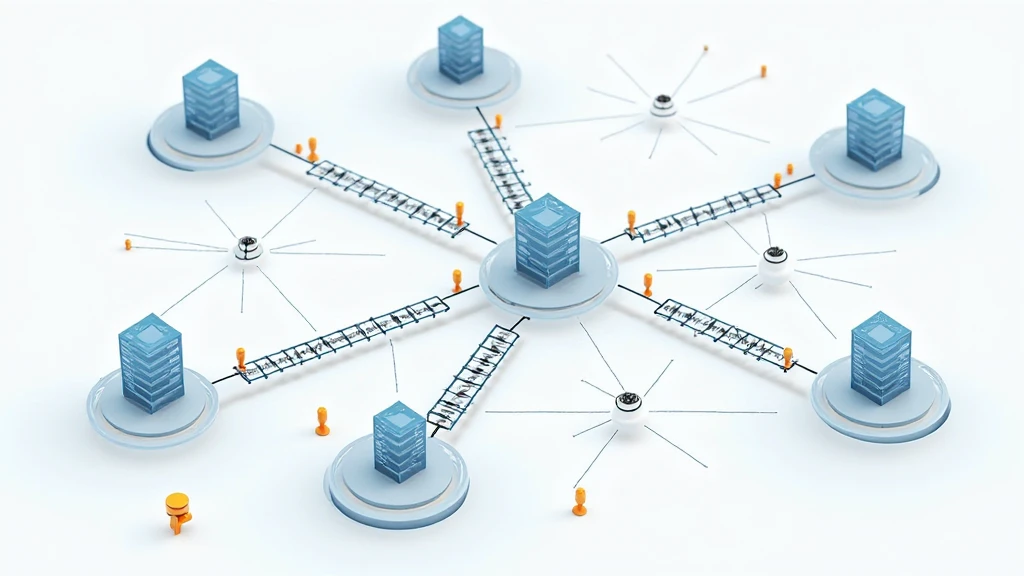

The Role of Cross-Chain Interoperability

Cross-chain interoperability is akin to having multiple highways that connect various cities. It allows users to transfer assets across different blockchain networks effortlessly. However, not all highways are equally maintained; some might have higher tolls than others. Implementing strategies for gas fee optimization can significantly lower costs when making transactions between different chains, especially as the DeFi landscape expands.

Zero-Knowledge Proof Applications

Zero-knowledge proofs can be likened to a VIP pass for a concert—only the essential information is needed to get you in without showing everything else. This technology can verify transactions without revealing the entire data, leading to fewer gas fees. As applications leveraging zero-knowledge proofs become more prevalent, users can enjoy lower costs while maintaining privacy and security in their transactions.

Future Trends in Gas Fee Optimization

As we advance towards 2025, we can anticipate new trends emerging in gas fee management. Just like eco-friendly vehicles are gaining popularity on the roads, energy-efficient proof-of-stake (PoS) mechanisms could drastically reduce the environmental impact of blockchain transactions. By comparing PoS energy consumption, firms can identify optimal chains with lower fees and reduced carbon footprints. This evolution might also align with local regulations, such as those discussed in the Dubai cryptocurrency tax guide.

In conclusion, as cross-chain interoperability and technologies like zero-knowledge proofs advance, gas fee optimization will be crucial in enhancing user experiences in the ever-evolving DeFi landscape. For practical insights and tools for navigating these changes, download our comprehensive toolkit today.

View our cross-chain safety whitepaper for more information on ensuring your transactions stay secure amid evolving gas fee structures. Discover how to enhance your transactions with tools like Ledger Nano X, which can reduce the risk of private key exposure by 70%. Remember, this article does not constitute investment advice; please consult local regulators such as MAS or SEC before proceeding with any transactions.