Introduction

As the cryptocurrency market continues to fluctuate, with over $4.1 billion lost to DeFi hacks in 2024, understanding price patterns becomes crucial for traders. One significant pattern to be aware of is the HIBT BTC/USDT bearish flag pattern.

This article will delve into identifying and analyzing this pattern to help you make informed trading decisions.

What is a Bearish Flag Pattern?

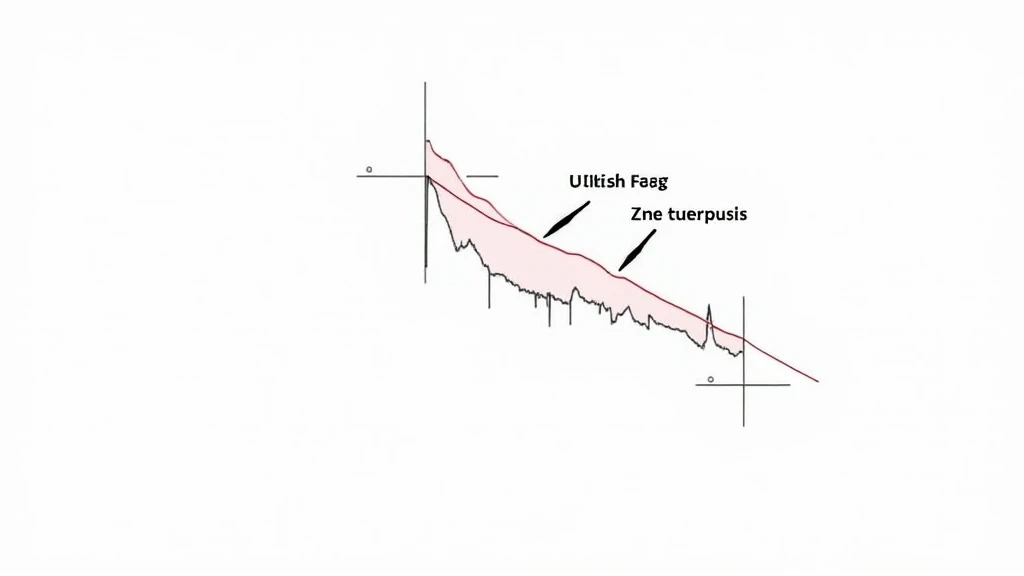

A bearish flag pattern is a continuation pattern that usually appears after a strong downward move. It resembles a flag on a pole, with the pole representing the drop in price and the flag representing a short consolidation period. For Vietnamese traders, understanding this pattern is essential, especially as tiêu chuẩn an ninh blockchain becomes more critical.

The Structure of a Bearish Flag

The structure consists of:

- A rapid price decline (the pole)

- A period of consolidation (the flag)

- A breakout below the flag, confirming the bearish trend

Identifying the HIBT BTC/USDT Bearish Flag

To identify the HIBT BTC/USDT bearish flag pattern, follow these steps:

- Look for a strong price drop: This indicates the pole.

- Find a period of consolidation: This will appear as a sideways price movement.

- Wait for the breakout: A confirmed move below the flag confirms a bearish trend.

Vietnamese Market Data

In 2024, the Vietnamese cryptocurrency market saw a user growth rate of over 60%, making it crucial for local traders to stay ahead of the curve. Traders can utilize tools like advanced charting software to identify these patterns more effectively.

Case Study: Applying the Pattern

Let’s break it down with a recent case:

The HIBT BTC/USDT pair exhibited a pronounced bearish flag pattern in June 2024. After a sharp decline from $40,000 to $30,000, it consolidated around $35,000 for two weeks before breaking down to $25,000, demonstrating the effectiveness of this pattern.

Tips for Trading the Bearish Flag

Here are some tips to consider:

- Set stop-loss orders to minimize potential losses.

- Analyze volume: A higher volume during the breakout enhances validity.

- Combine with other indicators: Use RSI or moving averages for better confirmation.

Conclusion

Understanding the HIBT BTC/USDT bearish flag pattern can significantly enhance your trading strategy in a volatile market. By identifying and acting on this pattern, traders can navigate downturns more effectively. As the cryptocurrency landscape evolves, knowledge of such trends remains a vital asset.

Stay updated and continue exploring insights on hibt.com for comprehensive guides and resources.