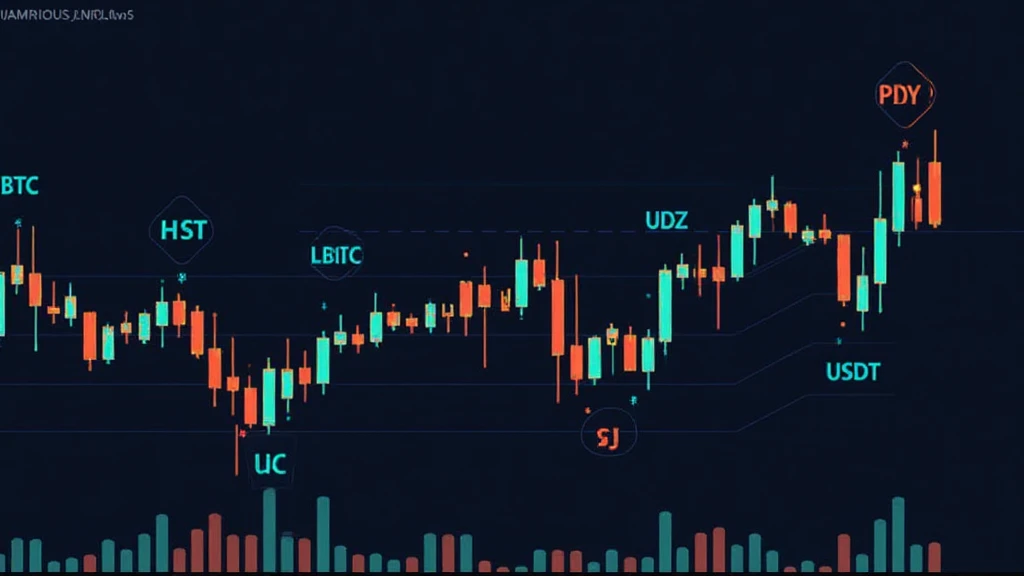

Understanding HIBT BTC/USDT Daily Candlestick Patterns

As of early 2024, the cryptocurrency market has demonstrated volatile movements, leading to a loss of approximately $4.1 billion in DeFi hacks. For traders, understanding HIBT BTC/USDT daily candlestick patterns can be a game changer. These patterns reveal market sentiment and can greatly influence trading decisions.

Why Candlestick Patterns Matter

Candlestick patterns are essential for technical analysis. They display price data over time, much like a bank vault visualizes asset security. Each candle represents a specific timeframe, showing the opening, closing, high, and low prices. This visual representation aids traders in forecasting potential price movements.

Key Patterns to Watch

- Doji: Indicates market indecision.

- Hammer: Suggests a potential reversal after a downtrend.

- Engulfing Patterns: Signal shifts in momentum.

- Morning Star: Indicates possible bullish reversal.

Understanding these patterns enhances your trading intuition. For instance, a hammer at the bottom of a downtrend, historically, denotes a shift towards upward momentum.

Analyzing Trends with HIBT BTC/USDT

According to recent data, Vietnam’s cryptocurrency users have surged by 35% year-on-year. As more investors participate, analyzing trends for HIBT BTC/USDT becomes crucial. By consistently tracking these candlestick formations, traders can align their strategies with market movements.

Integrating Analysis and Strategy

When trading HIBT BTC/USDT, it’s not just about recognizing patterns. Traders should devise entry and exit points based on these insights. For example, if a bullish engulfing pattern appears followed by rising volume, it may be time to enter a position.

Additionally, utilizing tools like the HIBT trading platform can streamline your trading experience, offering detailed analytics.

Conclusion

In summary, understanding HIBT BTC/USDT daily candlestick patterns is essential for informed trading decisions. As the Asian markets, especially Vietnam, bloom in cryptocurrency adoption, mastering these patterns will likely give you an upper hand. Always remember, the key to successful trading lies in effective analysis and strategy implementation. Engage with available tools and continuously educate yourself to stay ahead of the curve.

For more insights and tools to enhance your trading strategies, visit cryptoliveupdate.com”>cryptoliveupdate.