Introduction

With over $4.1 billion lost to DeFi hacks in 2024, understanding cryptocurrency price action has never been more critical. The HIBT BTC/USDT pair offers unique insights for traders looking to navigate these turbulent waters. This article brings valuable information for enthusiasts and investors, focusing on current trends, market analysis, and practical trading advice related to HIBT BTC/USDT price action proof.

The Market Overview

As of recent data, the Bitcoin market has continued to show signs of volatility, particularly with the HIBT BTC/USDT pair. Understanding price movements involves analyzing factors such as market sentiment, trading volume, and external influences like regulatory news. In Vietnam, the user growth rate in crypto trading platforms is estimated to be over 33% in 2025, highlighting the region’s appetite for digital assets.

Price Action Analysis

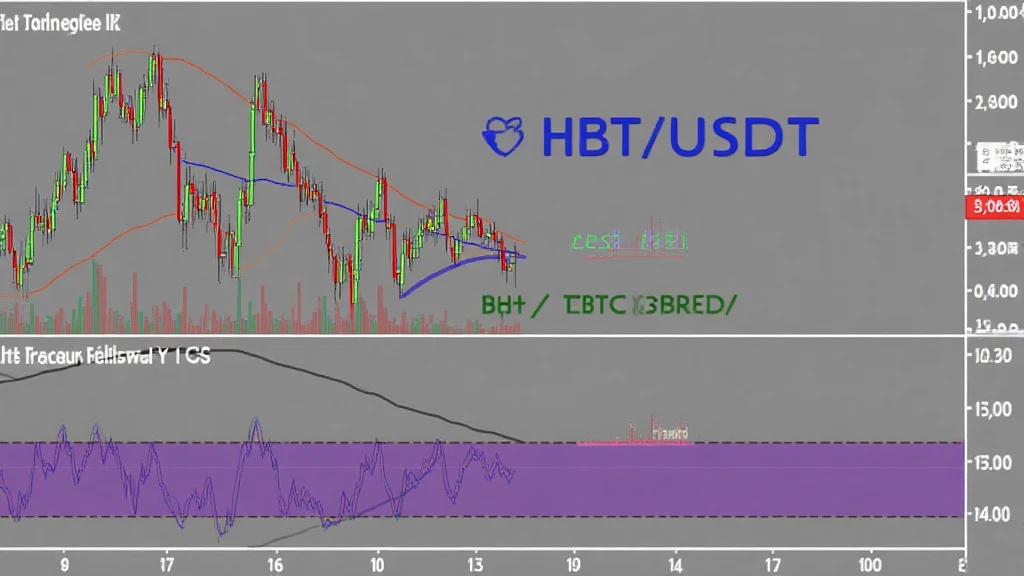

Price action refers to the movement of HIBT BTC/USDT over time, providing traders signals based on historical data:

- Support and Resistance Levels: Identifying these points is crucial for predicting future price movements.

- Volume Trends: Analyzing trading volume helps gauge the strength behind price actions.

- Candlestick Patterns: Traders often use patterns to make educated guesses about potential reversals or continuations.

Interpreting Candlestick Patterns

For example, a bullish engulfing pattern in the HIBT BTC/USDT chart indicates potential price increases ahead. Just like a well-timed investment can feel like striking gold, identifying these patterns can lead to profitable trades.

Implications for Investors

Investors should exercise caution, especially in a fast-paced market environment. Regular audits of smart contracts and trading strategies are vital to capitalize on the price action of HIBT BTC/USDT effectively. Understanding not just the trends but also the underlying technology will optimize investment returns.

Conclusion

In summary, the HIBT BTC/USDT price action proof serves as a beacon for investors looking to make savvy trading decisions in the ever-evolving cryptocurrency landscape. By leveraging the insights gained from price action analysis, traders can better navigate potential risks and spot profitable opportunities. Prepare yourself with knowledge, but remember—this is not financial advice. Always consult local regulators before making substantial investments. For ongoing updates, visit hibt.com, your reliable source for crypto insights.