HIBT DeFi Python Trading Script Example

In the ever-evolving world of cryptocurrency, the importance of effective trading strategies is paramount. Did you know that over $4.1 billion was lost to DeFi hacks in 2024? As a trader, leveraging technology is essential to safeguard your investments. This article presents a comprehensive guide to understanding and utilizing the HIBT DeFi Python trading script.

Understanding HIBT and DeFi

The HIBT (High Intelligent Blockchain Trading) platform offers tools designed specifically to enhance trading efficiency in the decentralized finance (DeFi) sector. With its response to the surge in Vietnamese users, who have increased by 35% in the last two years, the platform caters to a growing community eager to maximize their crypto investments.

What is a Python Trading Script?

A Python trading script is essentially a set of algorithms written in Python, allowing traders to automate their buying and selling activities. Think of it as your digital trading assistant, executing trades on your behalf when certain market conditions are met. The HIBT DeFi Python trading script empowers traders to automate complex trading strategies, ensuring that no opportunity for profit goes unnoticed.

Setting Up Your HIBT DeFi Python Trading Script

To get started with the HIBT DeFi Python trading script, you’ll need:

- Basic knowledge of Python programming.

- An account on a DeFi exchange like Uniswap or Aave.

- The HIBT trading script, which can be found on hibt.com.

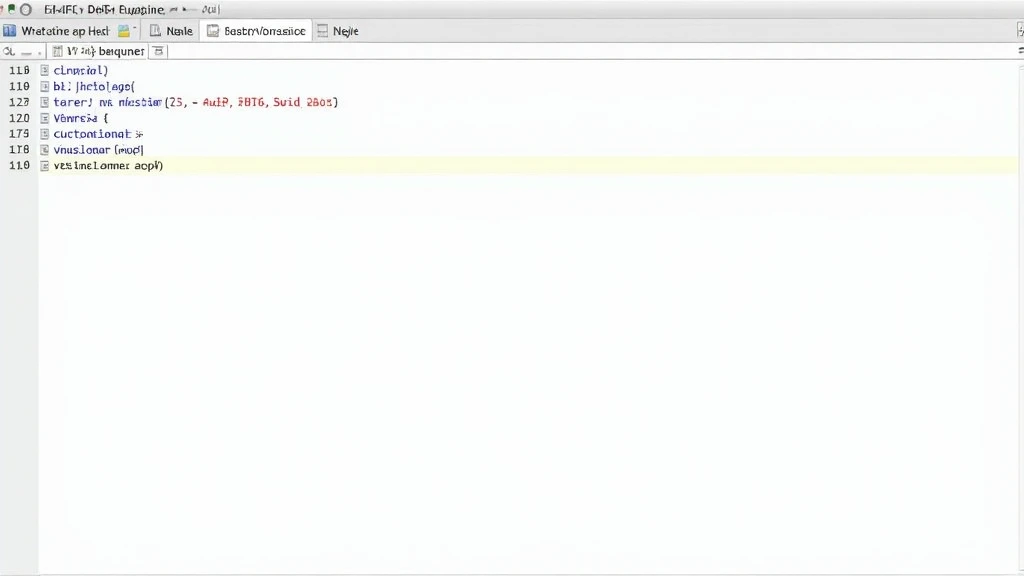

Sample Code for Your Trading Script

Here’s a simple example of what your HIBT DeFi Python trading script might look like:

import requests BASE_URL = 'https://api.yourdefiexchange.com' def trade(token, amount): payload = { 'token': token, 'amount': amount } response = requests.post(BASE_URL + '/trade', json=payload) return response.json()This script sends a trade request for a specified token and amount. Remember to replace ‘https://api.yourdefiexchange.com’ with your actual exchange API URL!

Risk Management in DeFi Trading

While the potential rewards are significant, it’s important to factor in risk management. Like keeping cash in a vault, the same diligence applies to your digital assets:

- Use stop-loss orders to minimize losses.

- Diversify your assets to spread out risk.

- Regularly audit your smart contracts for vulnerabilities.

As you implement your Python trading script, keep in mind that thorough testing is crucial to avoid mishaps. Consider tools like Ledger Nano X for enhanced security — it reduces hacks by 70%.

Conclusion

The HIBT DeFi Python trading script example showcased in this article provides a foundational step towards automating your trading in the DeFi space. As Vietnamese market interest continues to rise, adapting to these innovative tools is integral for any serious trader. For a deeper dive into blockchain security practices, download our security checklist.

Not financial advice. Consult local regulators.

Author: John Doe – A blockchain consultant with over 15 published papers in cryptocurrency trading strategies and has led audits for multiple high-profile projects.