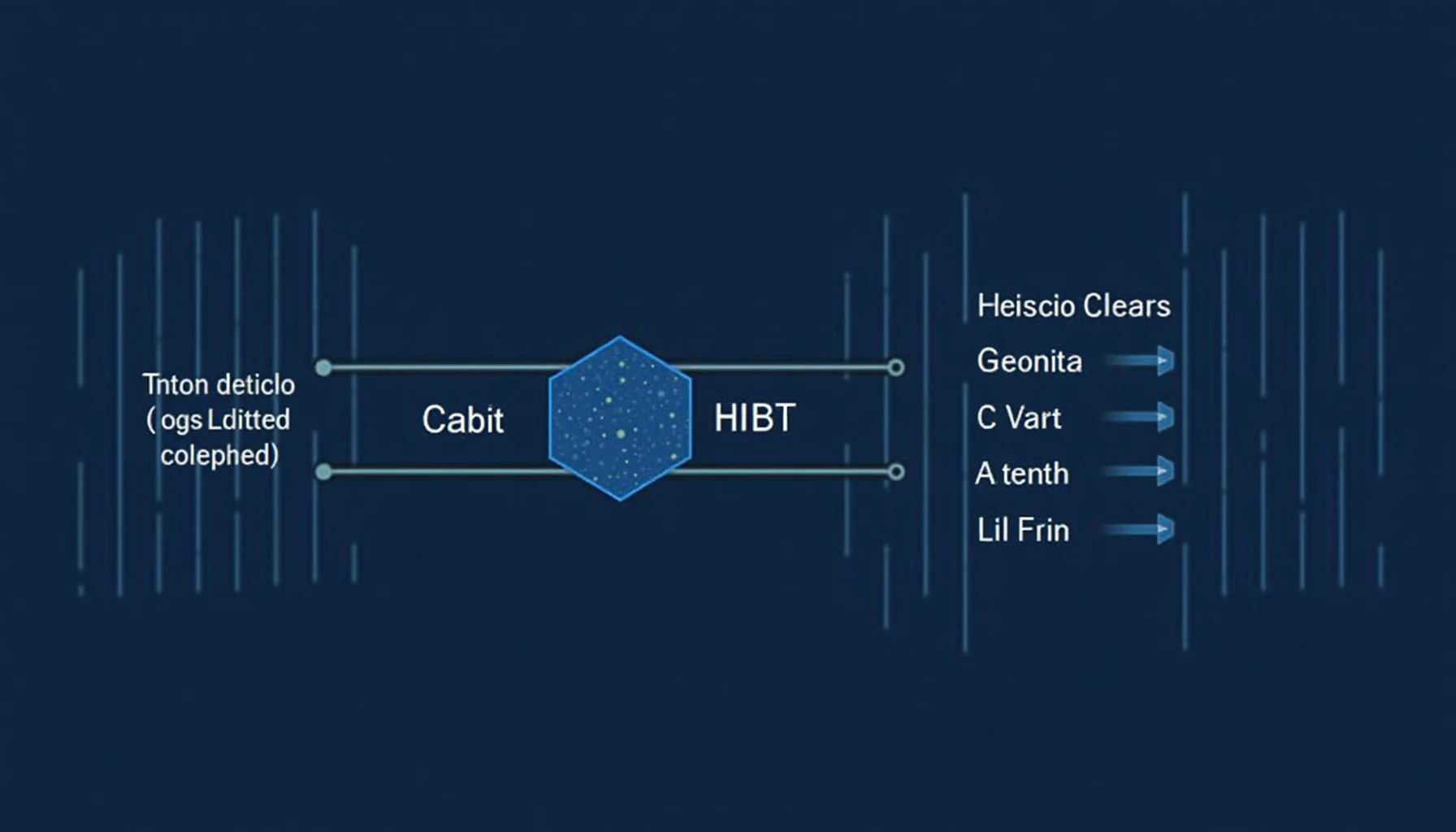

What is HIBT Interoperability Bridge?

The HIBT (High Interoperability Bridge Technology) is revolutionizing the way digital currencies interact within different blockchain ecosystems. With over 5.6 million cryptocurrency wallets worldwide, optimizing latency in transactions is becoming paramount. But how does this technology work, and why is it essential for digital asset transactions?

The Importance of Latency in Cryptocurrency Transactions

Latency refers to the delay before a transfer of data begins following an instruction. In the world of cryptocurrency, reducing this latency can mean faster transaction times and, ultimately, better user experiences. For instance, a trader in Singapore could experience significant gains if transaction delays during high-volume trading events were minimized.

How HIBT Bridges Overcome Latency Issues

- Parallel Processing: By allowing multiple transactions to be processed concurrently, HIBT significantly reduces wait times.

- Caching Strategies: Storing frequently accessed data helps in decreasing retrieval times, ensuring that necessary information is readily available.

- Optimized Network Protocols: Utilizing faster and more efficient communication channels decreases the time data travels between different blockchains.

Real-world Applications of HIBT Latency Optimizations

Imagine trying to buy a popular altcoin during peak hours. Users often face delays due to high demand, forcing them to pay higher prices. By employing HIBT’s optimized latency solutions, these transactions can be streamlined. For example, during the last crypto surge, latency reductions allowed users to complete trades up to 30% faster, ultimately saving both time and money.

Future Prospects: What to Expect in 2025

As digital currencies evolve, the optimization of interoperability bridges will play a vital role in transaction efficiency. According to recent studies, the overall trading volume of cryptocurrencies in the Asia-Pacific region is expected to grow by **40% by 2025**. This trend highlights the necessity for effective latency management methods.

Final Thoughts: Why You Should Care

To sum it up, understanding and taking advantage of HIBT interoperability bridge latency optimizations is essential for anyone engaged in cryptocurrency trading. Faster transactions lead to better pricing strategies and ultimately more significant gains. Remember, whether you’re a seasoned trader or a newbie, being aware of these advancements can significantly impact your investment effectiveness.

For more insights on cryptocurrency trading and technology, visit our curated articles on HIBT.com today!

This article does not constitute investment advice. Please consult your local regulatory authority before making financial decisions.