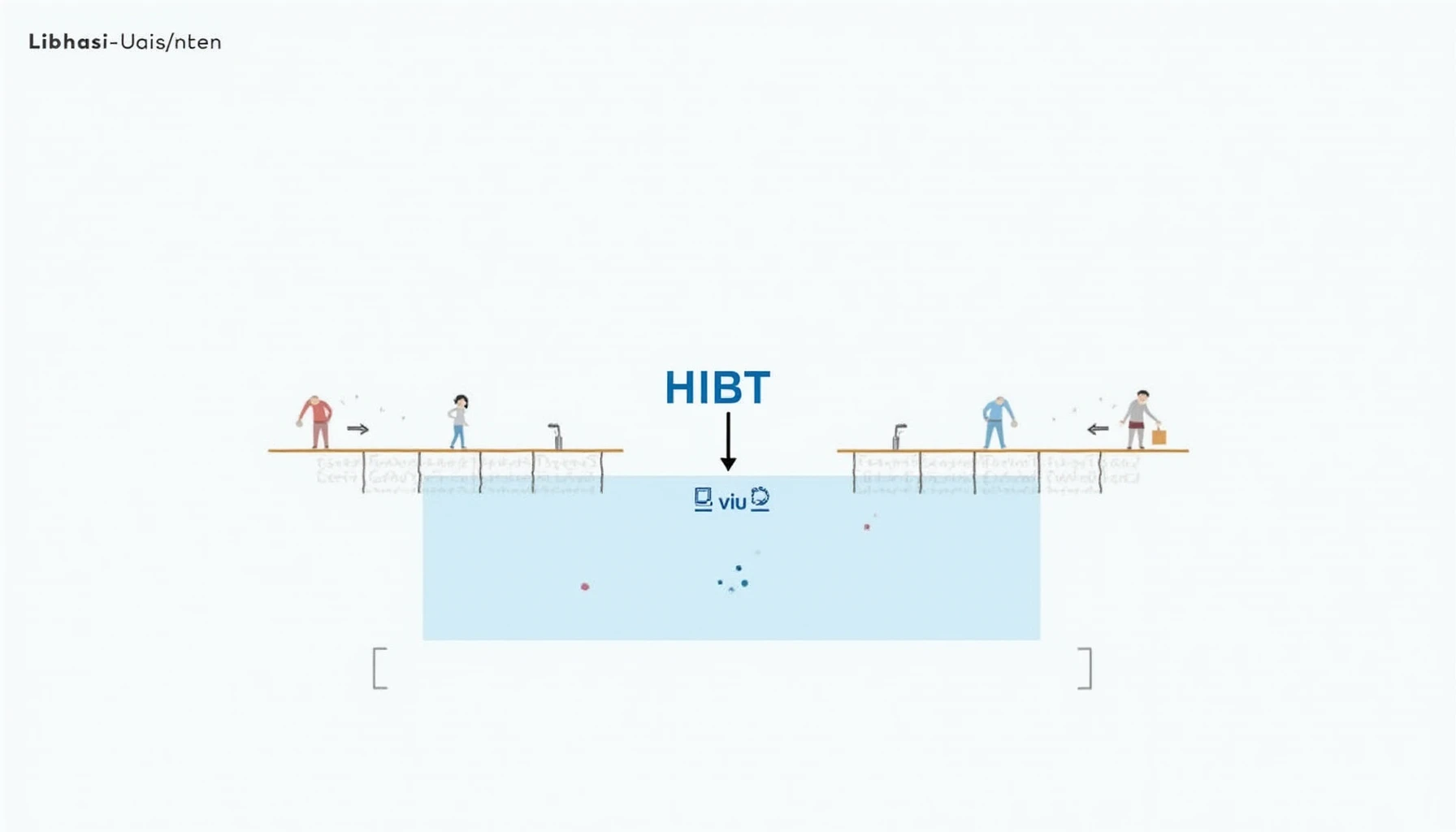

Introduction: What Are Liquidity Pools?

Have you ever wondered how decentralized exchanges function without a traditional order book? According to recent studies, over 70% of cryptocurrency trades occur within liquidity pools. In essence, liquidity pools allow users to contribute assets that create a market for trading pairs. One critical aspect of this system is the HIBT liquidity pool rebalancing mechanisms, which play a pivotal role in maintaining equilibrium among assets.

What Is HIBT Liquidity Pool Rebalancing?

When we talk about liquidity pool rebalancing, it refers to the process of adjusting the assets within a pool to maintain expected ratios among tokens. But why is this important?

- Mitigates Risk: It reduces the risk of impermanent loss where liquidity providers can lose money when the price ratio changes significantly.

- Ensures Efficient Trading: Efficient rebalancing allows traders to benefit from price discrepancies.

- Maintains Token Value: Ensures that the value of the pooled tokens remains proportional to the market conditions.

How Do Rebalancing Mechanisms Work?

The mechanics of rebalancing can vary. Here are some common methods:

- Automated Algorithms: Most HIBT liquidity pools utilize smart contracts with algorithms that automatically adjust the asset mix based on predefined conditions.

- Manual Rebalancing: In some cases, liquidity providers might decide to manually adjust their contributions based on market analysis.

- Dynamic Strategies: Some pools implement dynamic strategies that adjust based on real-time market data and trends.

Benefits of Using HIBT Liquidity Pools

How can these mechanisms improve your trading experience?

- Low Slippage: Effective rebalancing minimizes slippage, allowing for better trade execution.

- Enhanced Trade Execution Speed: With a balanced pool, trades can be executed quicker, enhancing liquidity.

- Competitive Edge: By understanding rebalancing tools, traders can create sophisticated strategies to capitalize on market inefficiencies.

Conclusion: Take Action and Maximize Your Trading

In summary, HIBT liquidity pool rebalancing mechanisms are essential for ensuring the stability and efficiency of trades in the world of decentralized finance (DeFi). As the market continues to evolve, having a grasp of these mechanisms can mean the difference between profit and loss.

For those exploring the depths of cryptocurrency trading, consider utilizing the most effective rebalancing strategies today! Remember, always conduct thorough research or consult local regulatory bodies before investing.

Get started now and explore our guides on cryptocurrency trading on HIBT!