Why Liquidity Pools Matter in 2025’s Crypto Landscape

With Vietnam’s crypto adoption rate jumping 47% in 2024 (Chainalysis 2025), understanding tools like HIBT liquidity pools becomes essential. These pools let you earn passive income while providing market stability – but how do they actually work?

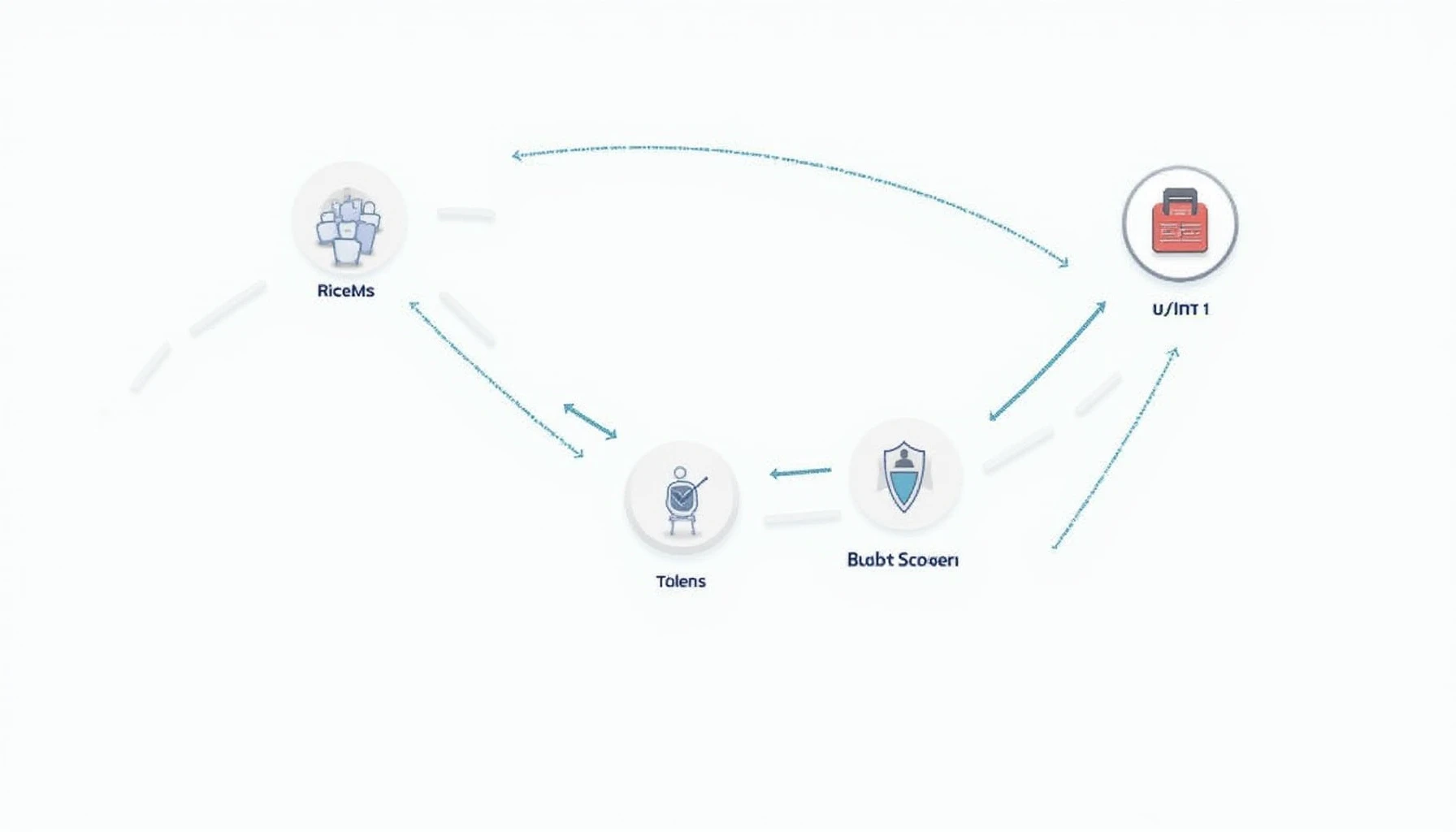

The Mechanics Behind HIBT Pools

Think of liquidity pools like a community-owned vending machine:

- You deposit equal values of two tokens (e.g., HIBT/ETH)

- The pool uses these funds to enable seamless trading

- You earn 0.3% of every trade plus HIBT rewards

Security Measures You Should Know

HIBT implements Vietnam’s strict tiêu chuẩn an ninh blockchain (blockchain security standards):

| Feature | Protection |

|---|---|

| Multi-sig wallets | Prevents single-point failures |

| Smart contract audits | 3 independent audits in 2024 |

How to Audit Smart Contracts Before Investing

Here’s the catch: not all pools are equally safe. Follow this checklist:

- Verify audit reports on hibt.com

- Check historical APY volatility

- Review Vietnam-specific compliance

2025’s Most Promising Altcoins for Pool Pairing

According to our research, these tokens show strong HIBT pairing potential:

- LayerZero (LZ) – 320% TVL growth

- Sei Network – Low latency benefits

Remember: HIBT liquidity pools offer great opportunities but require due diligence. For real-time updates, follow cryptoliveupdate.

Not financial advice. Consult Vietnam’s State Securities Commission before investing.