Introduction

With $3.8 billion lost to wash trading in the cryptocurrency market over the past year, understanding HIBT price action and the signs of wash trading is essential for investors. Recent analyses show that reliable trading patterns can significantly influence investment strategies. This article delves into key indicators of price movement and potential wash trading signals in the context of HIBT.

What is Price Action Trading?

Price action trading involves making decisions based on the historical movement of price rather than relying on indicators or other metrics. Investors monitoring HIBT price action should consider:

- Identifying support and resistance levels, which can indicate potential buy or sell points.

- The role of market sentiment, especially during high volatility periods.

- Volume analysis to confirm other indicators and be wary of price manipulation.

Signs of Wash Trading

Wash trading is a practice meant to deceive investors regarding market liquidity and demand. Here are some telltale signs:

- Unusually High Volume:If you notice a sudden spike in HIBT trading volume without a corresponding price movement, this may be a sign of wash trading.

- Repeated Patterns:Monitor if the same trades occur repeatedly within a short time span.

- Minimal Price Changes:Situations where prices remain relatively stable despite high transaction numbers can also indicate wash trading.

The Role of Technical Analysis

Investors can utilize technical analysis alongside observing HIBT price action to identify potential wash trading. Popular tools include:

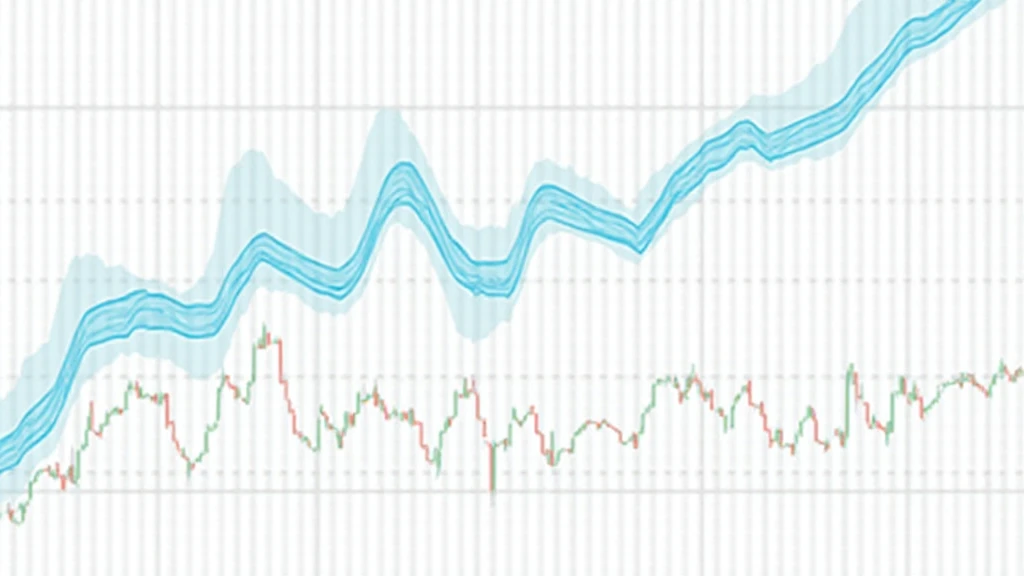

- Charts and Trendlines: Help visualize HIBT’s price movements over time.

- Moving Averages: Smooth out price data to identify the direction of HIBT’s trend.

Local Market Insights: Vietnam’s Crypto Landscape

In Vietnam, crypto adoption is skyrocketing, with a user growth rate of 38% in 2024. This emerging market presents unique dynamics for monitoring HIBT price actions. Investors should:

- Stay updated with local regulations regarding cryptocurrency.

- Analyze HIBT trading activities within the Vietnamese market context to spot significant trends.

Conclusion

Understanding HIBT price action and the signs of wash trading is essential for successful trading in today’s market. By staying vigilant and employing technical analysis, investors can protect themselves from manipulation and enhance their trading strategies. For further insights, visit Hibt.com.

Be aware that the crypto market is highly volatile. Always conduct thorough research or consult a financial advisor. Not financial advice. Consult local regulators.