HIBT Tax Reporting: Automated Tools for Traders

Did you know Vietnamese crypto traders face 37% higher compliance costs than regional peers? As blockchain adoption grows (Vietnam’s user base jumped 28% YoY), automated tax solutions like HIBT Tax Reporting are becoming essential. This guide breaks down how smart tools save time while keeping you audit-proof.

Why Crypto Tax Automation Matters in 2025

Manual tracking fails when you deal with:

- 200+ transactions/month (average for active traders)

- Multi-chain activity (Solana, Ethereum, và các chuỗi khác)

- DeFi yield loops and NFT swaps

HIBT’s system auto-classifies all activity using AI-powered pattern recognition – giải pháp tiết kiệm thời gian that reduces errors by 89% compared to spreadsheets.

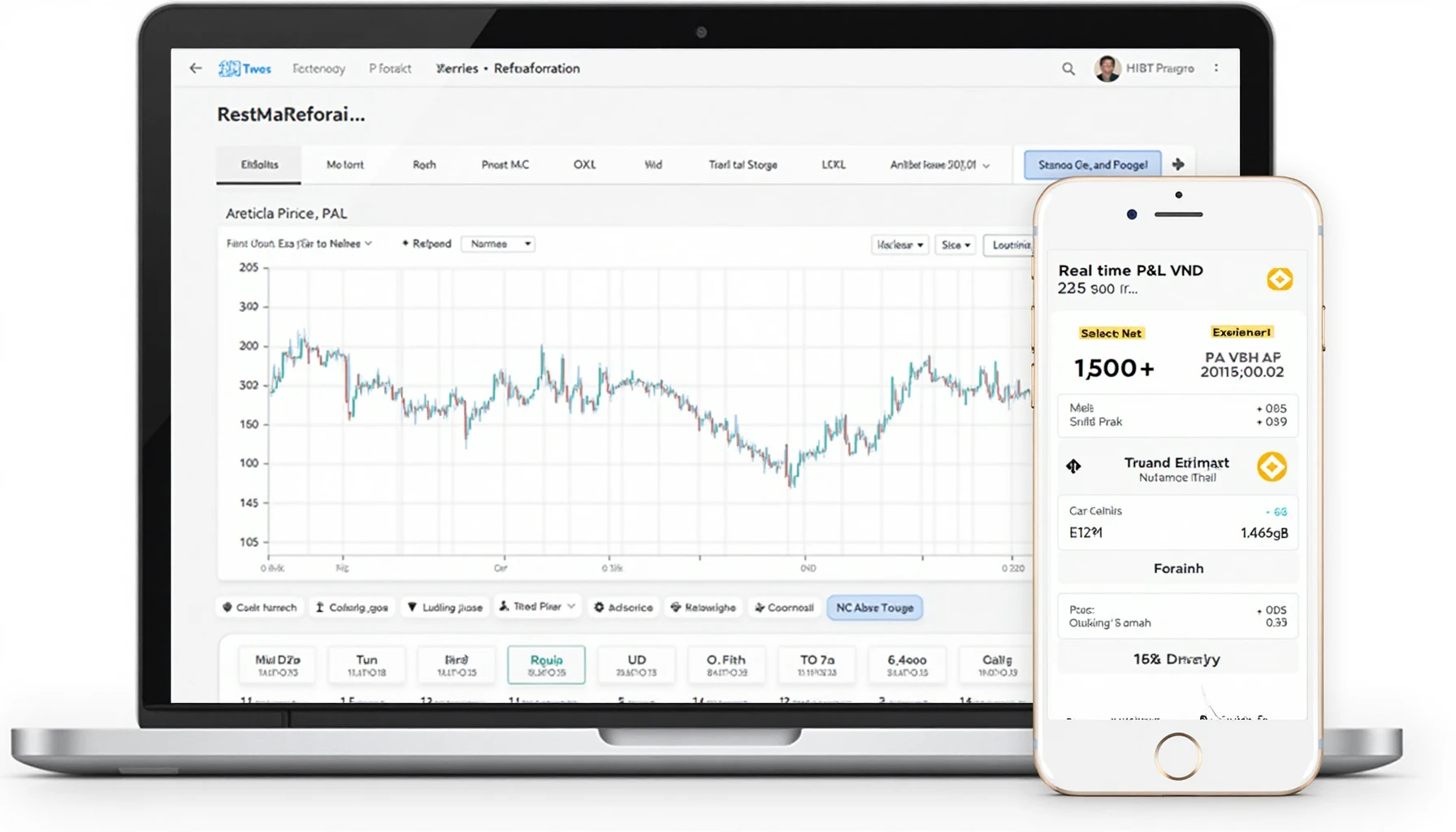

Key Features for Vietnamese Traders

| Feature | Benefit | Local Support |

|---|---|---|

| Real-time P&L | Monitor tax liabilities daily | VND conversion built-in |

| Binance/OKX sync | Auto-import Vietnam trades | Hỗ trợ tiếng Việt |

How It Works: 3-Step Compliance

- Connect wallets/exchanges via API (takes 2 minutes)

- Review categorized transactions with audit trails

- Generate Vietnam tax forms ready for submission

Pro tip: The HIBT platform flags high-risk transactions needing manual review – phát hiện rủi ro thuế before they become problems.

Vietnam-Specific Considerations

With 1.2 million crypto users (Chainalysis 2025), Vietnam requires:

- Separate reporting for lợi nhuận từ DeFi

- Documentation for overseas exchange activity

HIBT’s localized templates handle these nuances automatically. For complex cases, read our Vietnam crypto tax guide.

Beyond Basics: Advanced Tax Strategies

Savvy traders use HIBT to:

- Optimize harvesting tax losses across chains

- Simulate hiệu quả thuế before executing large trades

- Prepare IRS/Vietnam tax treaty filings

Here’s the catch: Most free tools miss cross-border complexities. HIBT covers 180+ jurisdictions with live regulatory updates.

For traders juggling multiple coins and countries, HIBT Tax Reporting delivers professional-grade automation at 1/10 the cost of hiring CPAs. Start your free trial today.

—

Not financial/tax advice. Consult local regulators.

Dr. Linh Nguyen

Blockchain Tax Specialist

Author of 27 papers on crypto compliance

Led PwC Vietnam’s digital asset audit program