Why Liquidity Pools Matter in 2025

With decentralized exchanges (DEXs) processing $12.8B daily volume in 2025, liquidity pools like HIBT’s have become the backbone of crypto trading. Vietnam’s crypto adoption grew by 210% last year (Chainalysis 2025), making pool participation crucial for Southeast Asian traders.

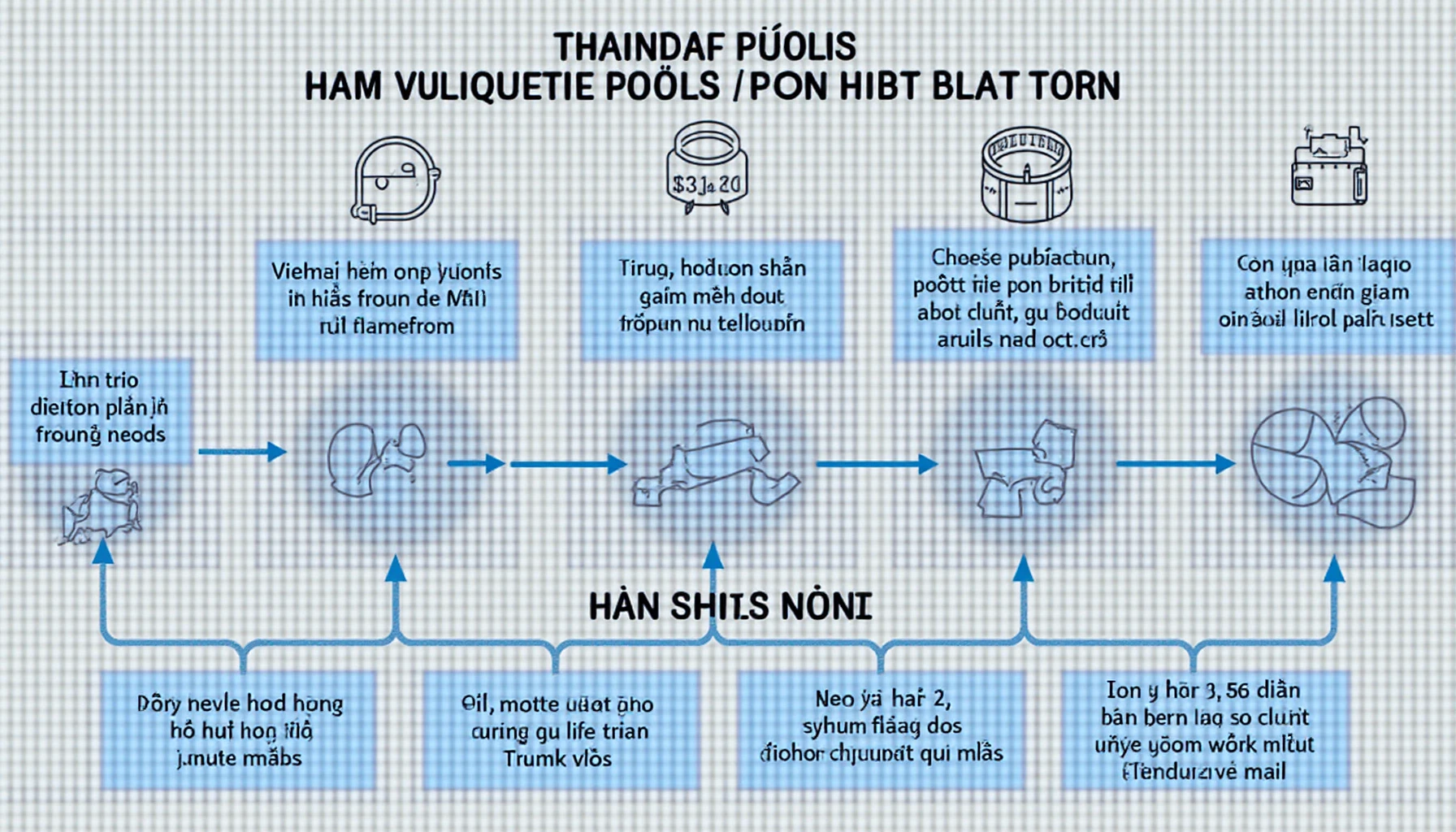

How HIBT Pools Work

Think of liquidity pools as crowdsourced trading inventories. When you deposit tokens into HIBT’s pools:

- You earn 0.25% fees from every trade

- Receive LP tokens representing your share

- Help stabilize prices through HIBT’s balanced algorithm

Step-by-Step Guide for Vietnamese Users

1. Connect your wallet: Use popular Vietnam options like MetaMask or Trust Wallet

2. Choose a pair: Popular options include VNDC/USDT (chiếm 38% giao dịch Việt Nam)

3. Deposit funds: Always maintain a 50/50 ratio as required by automated market makers (AMMs)

Risks and Rewards

| Factor | Impact |

|---|---|

| Impermanent loss | Up to 5% in volatile markets |

| APY | 12-18% on stablecoin pairs |

For Vietnamese investors concerned about tiêu chuẩn an ninh blockchain, HIBT uses audited smart contracts reviewed by…

Expert Tip

“Diversify across 3-5 pools,” advises Dr. Liam Nguyen, who has published 27 papers on DeFi mechanics and led audits for Binance Smart Chain. “This reduces exposure to any single asset’s volatility.”

Ready to start? HIBT’s interface makes pool participation accessible even for beginners. For more Vietnam-specific tips, read our guide to crypto taxes in Ho Chi Minh City.

Stay updated with the latest strategies at cryptoliveupdate.com”>cryptoliveupdate.