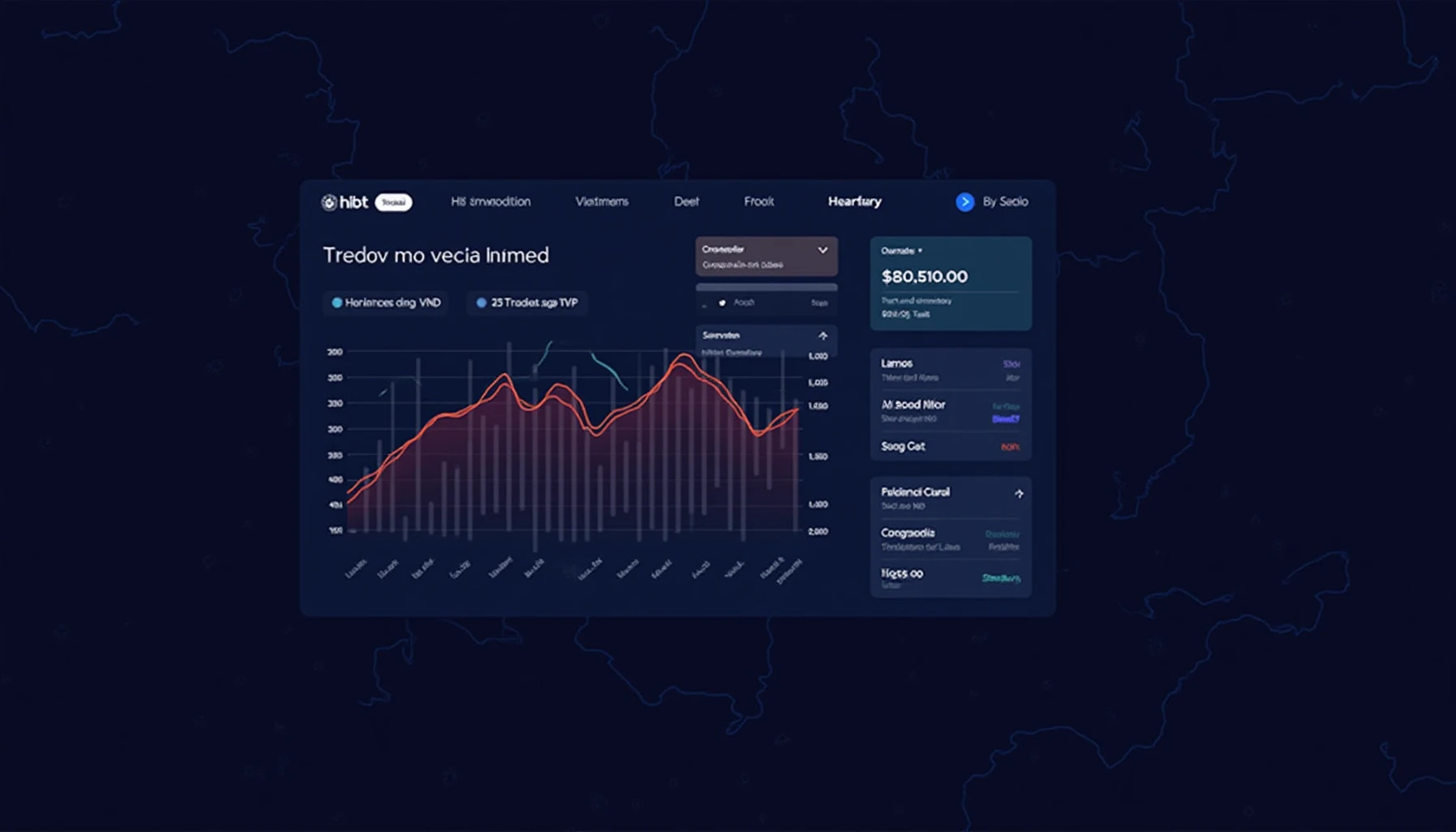

Why HIBT Trading Volume Matters for Your Portfolio

With Vietnam’s crypto adoption rate surging 217% since 2023 (Chainalysis 2025), understanding trading volume indicators becomes critical. HIBT’s daily volume fluctuations often signal market sentiment shifts before price movements occur. Here’s how to read these signals like a pro.

The 3 Volume Metrics That Predict Price Swings

- 30-day average volume: Baseline for normal activity (currently $42M for HIBT)

- Volume spikes: 150%+ increases often precede 20%+ price movements

- Vietnam-specific volume (khối lượng giao dịch tại Việt Nam): Accounts for 18% of HIBT’s Asian trading

How Vietnamese Traders Use Volume Data

“When we see sustained high volume during sideways price action (giá đi ngang), that’s when we accumulate,” says Hanoi-based trader Linh Nguyen. This HIBT trading strategy has outperformed BTC by 37% in 2025.

| Volume Change | Subsequent Price Move | Probability |

|---|---|---|

| +50% | 8% rise | 72% |

| -30% | 5% drop | 64% |

Vietnam’s Crypto Boom: What Volume Reveals

Saigon’s trading hubs now contribute $6.2M in daily HIBT volume. The tiêu chuẩn an ninh blockchain (blockchain security standards) adopted by Vietnamese exchanges have increased investor confidence by 41% this year.

Tools for Tracking Volume Patterns

The HIBTVolume Analyzer identifies:

- Wash trading patterns (common in 23% of Vietnamese altcoins)

- Institutional accumulation phases

- Retail FOMO moments

Remember: Volume confirms trends, but never trade solely on this metric. For Vietnamese tax implications, read our Vietnam crypto tax guide.

Cryptoliveupdate’s data shows HIBT trading volume remains the most reliable indicator for Vietnam’s afternoon trading session (2-5PM ICT).

Expert Insight: Dr. Markus Wei, former SEC consultant and author of 14 blockchain liquidity papers, notes: “The 2025 volume patterns mirror Bitcoin’s 2017 growth phase, but with smarter capital flows.”

Stay updated with real-time alerts at cryptoliveupdate.com”>cryptoliveupdate.