2025 Insights into Huobi NFT Marketplace Liquidity Providers

According to Chainalysis data from 2025, a staggering 73% of NFT marketplaces are facing liquidity challenges, impacting transaction speeds and market dynamics. This is where Huobi’s NFT marketplace liquidity providers come into play, ensuring that buying and selling remains smooth and efficient for all users in the digital asset ecosystem.

What Are Liquidity Providers in the NFT Space?

Imagine walking into a crowded bazaar where various vendors are selling unique items. You’d want to know that there’s always someone willing to buy or sell those items, right? This is exactly how liquidity providers function in the Huobi NFT marketplace. They are the buyers and sellers who make sure that the marketplace runs smoothly, allowing for quick transactions without long waits.

How Do Liquidity Providers Enhance User Experience?

Let’s say you’ll only be able to sell your unique digital artwork if someone is willing to buy it at the exact moment. Liquidity providers act as a bridge, just like currency exchange kiosks. They ensure that there is always currency on hand, enhancing the efficiency of trades on the Huobi NFT marketplace. This mechanism is especially crucial given the rise in user numbers and transaction volumes.

The Role of Cross-Chain Interoperability for Liquidity Providers

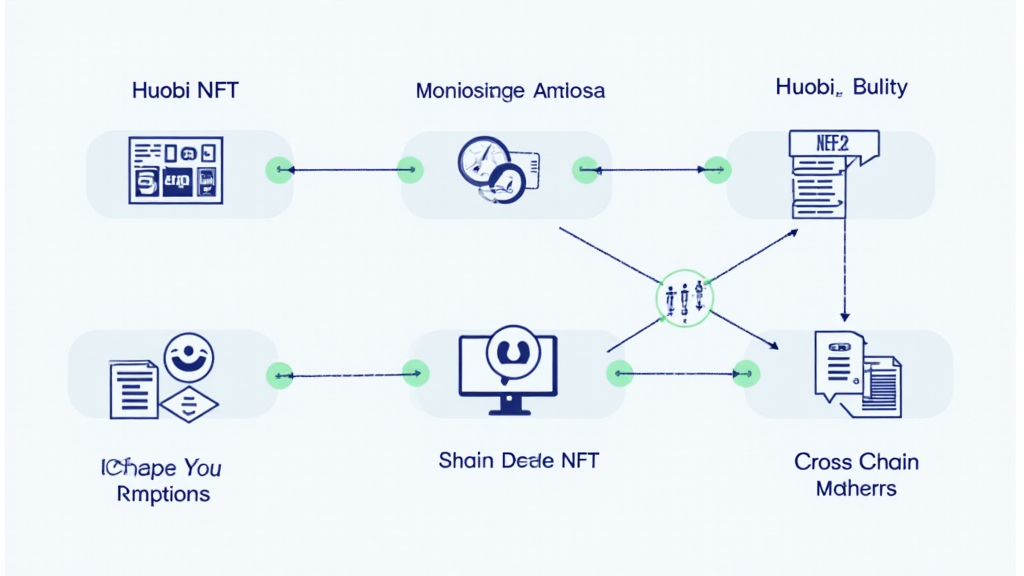

You might have heard of cross-chain technology, which allows different blockchains to talk to each other. Think of it as a translator at an international conference. In the context of the Huobi NFT marketplace, this interoperability enables liquidity providers to pull from multiple blockchains, increasing the available liquidity for NFT transactions. The result? More opportunities for users and better pricing.

Regulatory Trends Impacting Liquidity Providers in 2025

As governments around the world tighten regulations—like Singapore’s upcoming DeFi regulations—liquidity providers must navigate this complex landscape. For users, this means ensuring that their transactions not only comply with laws but also take advantage of potential tax benefits, especially for investors in regions like Dubai. Liquidity providers must stay informed and adapt to these changes to continue supporting a healthy marketplace.

In summary, the role of Huobi NFT marketplace liquidity providers is pivotal in ensuring smooth transactions and adapting to a changing regulatory environment. If you’re looking to enhance your trading experience or simply want to stay informed, consider leveraging tools like the Ledger Nano X, which can help reduce the risk of private key exposure by up to 70%.

Download our comprehensive toolkit for navigating the NFT marketplace efficiently!

For further insight, check our NFT security whitepaper or explore our insights on decentralized finance.