The Crypto Tax Landscape in 2025

With Chainalysis reporting that 73% of crypto traders are unaware of their tax obligations, it’s crucial to understand how long term vs short term crypto trade tax planning can directly impact your finances. If you’re trading crypto, knowing the rules can save you money.

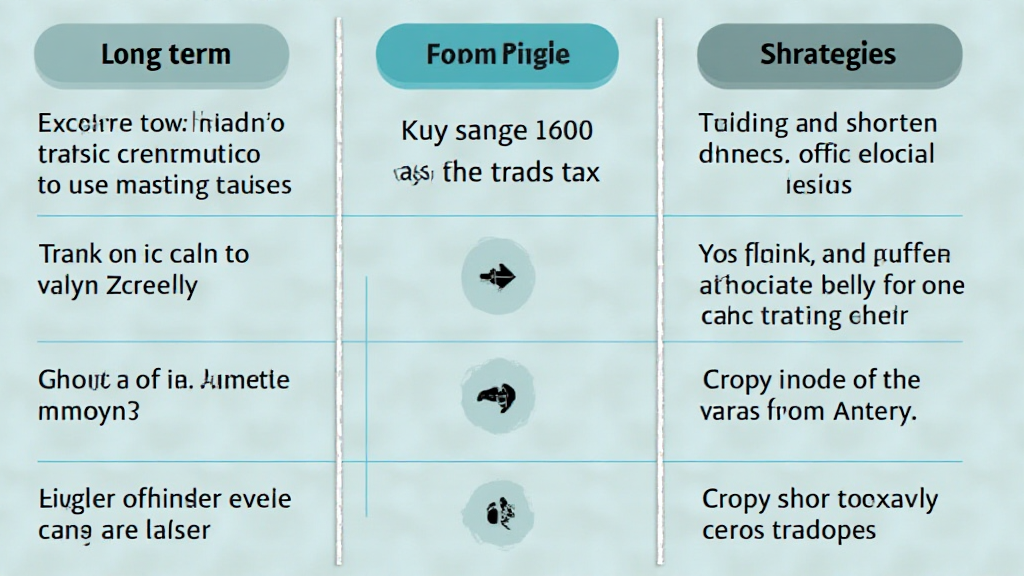

What’s the Difference Between Long Term and Short Term Crypto Gains?

To put it simply, think of crypto trading like shopping at a grocery store. If you buy an item and sell it quickly, like buying bananas and selling them before they go brown, that’s like a short term trade. But if you invest in a large bag of rice, planning to use it over a year, that’s long term. The IRS tax implications vary significantly for the two, with short-term gains typically taxed at higher rates.

How to Plan for Taxes on Your Crypto Trades?

You might be wondering, “How do I prepare for tax season?” The answer is straightforward. Just like preparing for a potluck dinner, you need to gather all your trading receipts. Keep a record of every sale and purchase. Consulting tools like CoinGecko can help you track prices and gains over time, akin to how you’d compare recipes to ensure you make the best dish.

The Role of Geography in Crypto Tax Planning

Did you know that different regions have varying crypto tax regulations? For instance, if you’re based in Dubai, understanding local laws is critical since the tax framework can differ vastly from places like the USA or Europe. Therefore, staying informed about your local laws can help you evade unexpected tax bills when you cash out your gains.

Summing it Up

To effectively navigate long term vs short term crypto trade tax planning, start by understanding your trading style and local regulations. Keeping records and utilizing tracking tools can further enhance your planning strategies. Remember, consultation with local regulatory bodies like MAS or SEC is recommended before making decisions.

For additional insights and strategies, download our free toolkit today!