MACD Crossovers Explained: An Essential Trading Tool

According to Chainalysis 2025 data, a staggering 61% of traders struggle to identify key market trends. That’s where MACD crossovers come into play. Understanding MACD crossovers can significantly enhance your trading strategy, particularly when navigating volatile markets.

What Are MACD Crossovers?

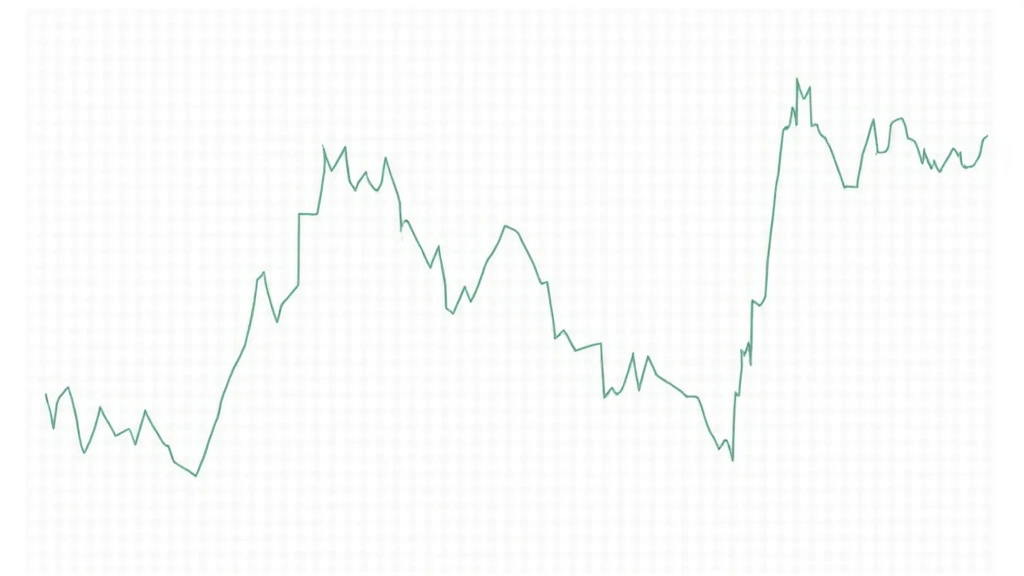

Think of MACD crossovers as a sign at a market indicating when it’s time to buy or sell. Just like how a vendor signals when a new batch of fresh vegetables arrives, MACD crossovers help traders identify the optimal points of entry and exit in the market. MACD stands for Moving Average Convergence Divergence, and a crossover occurs when the MACD line crosses above or below the signal line.

Why Are MACD Crossovers Important?

Imagine you’re at a bustling farmer’s market. If you only rely on one stall for your fruits, you might miss out on better deals from others. Similarly, ignoring MACD crossovers could lead to missed opportunities in trades. They provide clarity on upward or downward trends, acting as a reliable indicator for buy or sell decisions. Experts often cite a strong correlation between successful trades and the awareness of these crossovers.

How to Use MACD Crossovers in Your Trading Strategy?

When utilizing MACD crossovers, just like checking the weather before going out, you need to consider market conditions. A bullish crossover (where the MACD line crosses above) signals the potential for rising prices, while a bearish crossover (when it crosses below) indicates the opposite. By monitoring these signals, you can better time your trades and manage risks more effectively.

Common Mistakes to Avoid with MACD Crossovers

You might think operating with MACD crossovers is foolproof, similar to believing a market vendor will always sell the cheapest produce. However, many traders fall into the trap of over-relying on them without considering other market factors or indicators. It’s essential to use MACD in conjunction with additional tools, like volume analysis, to avoid making uninformed decisions.

In conclusion, mastering MACD crossovers explained equips traders with a powerful tool in their strategies. For those interested in leveraging this knowledge, download our free tools guide to sharpen your trading skills and stay ahead in the fast-paced market environment.

Meta Description: Understanding MACD crossovers explained: Improve your trading strategy with this comprehensive guide.

For further reading on trading strategies, check out the advanced strategies on hibt.com.

Risk Disclaimer: This article does not constitute investment advice. Always consult with local regulatory bodies such as MAS or SEC before making any trading decisions.

Brand: cryptoliveupdate