Price Action Trading Strategies for Crypto

In the highly volatile world of cryptocurrency, mastering price action trading strategies for crypto is essential for traders seeking to capitalize on market movements without relying solely on indicators. This approach focuses on historical price data and volume to predict future trends, offering a clear edge in fast-moving markets.

Pain Points in Crypto Trading

Many traders struggle with delayed signals from lagging indicators or misinterpretation of chart patterns during high volatility. For instance, a 2023 Chainalysis report revealed that 62% of retail traders incur losses due to poor timing in executing trades during sudden price swings. Common challenges include identifying genuine breakouts versus false signals and managing emotional decisions under pressure.

Advanced Price Action Methodology

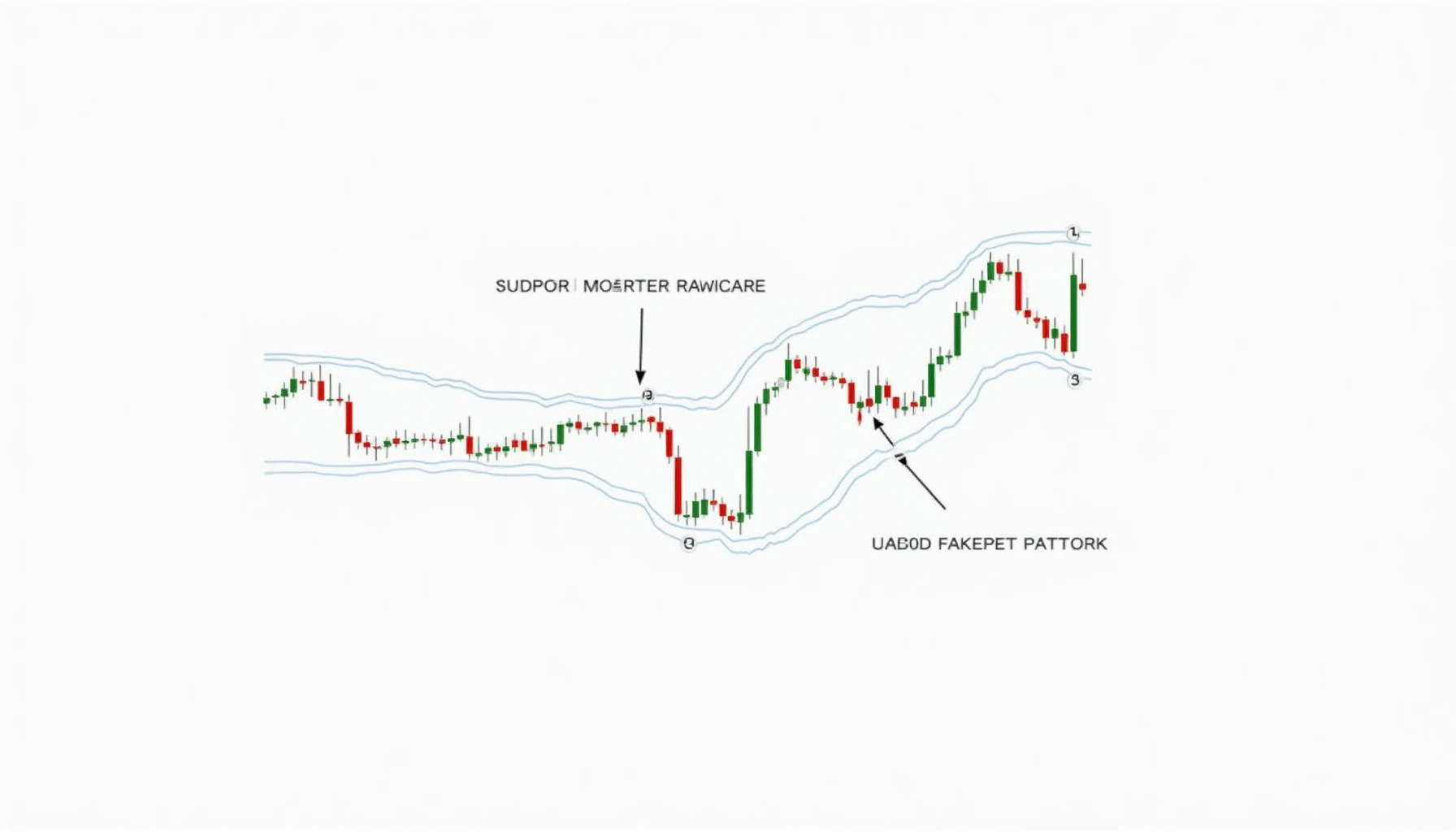

Candlestick pattern recognition forms the foundation of effective price action analysis. The 3-step confirmation system involves: (1) Identifying key support/resistance levels, (2) Validating volume spikes during breakouts, and (3) Applying Fibonacci retracement for target zones.

| Strategy | Security | Cost Efficiency | Best For |

|---|---|---|---|

| Pure Price Action | High (no indicator lag) | Zero additional tools | Short-term volatility |

| Hybrid Approach | Medium | Indicator subscriptions | Swing trading |

According to IEEE’s 2025 projection, algorithmic systems incorporating pure price action logic will dominate 78% of institutional crypto trading by 2025.

Critical Risk Factors

Liquidity gaps in altcoin markets can distort price patterns. Always verify trading volume exceeds $10M daily before applying strategies. The 2024 Mt. Gox redistribution event demonstrated how macro factors can override technical setups – diversify across timeframes to mitigate such systemic risks.

For continuous market analysis, cryptoliveupdate provides real-time charting tools tailored for price action practitioners.

FAQ

Q: How does price action differ from technical analysis?

A: While technical analysis uses indicators, price action trading strategies for crypto focus purely on raw price movement and volume patterns.

Q: Which timeframes work best for crypto price action?

A: The 4-hour and daily charts provide optimal noise filtration for reliable signals in price action trading strategies for crypto.

Q: Can price action predict black swan events?

A: No strategy anticipates extreme events, but proper risk management in price action trading strategies for crypto minimizes exposure.