2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis, a staggering 73% of cross-chain bridges are found to have vulnerabilities as of 2025. With the cryptocurrency space rapidly evolving, understanding the importance of risk assessment matrices is more crucial than ever.

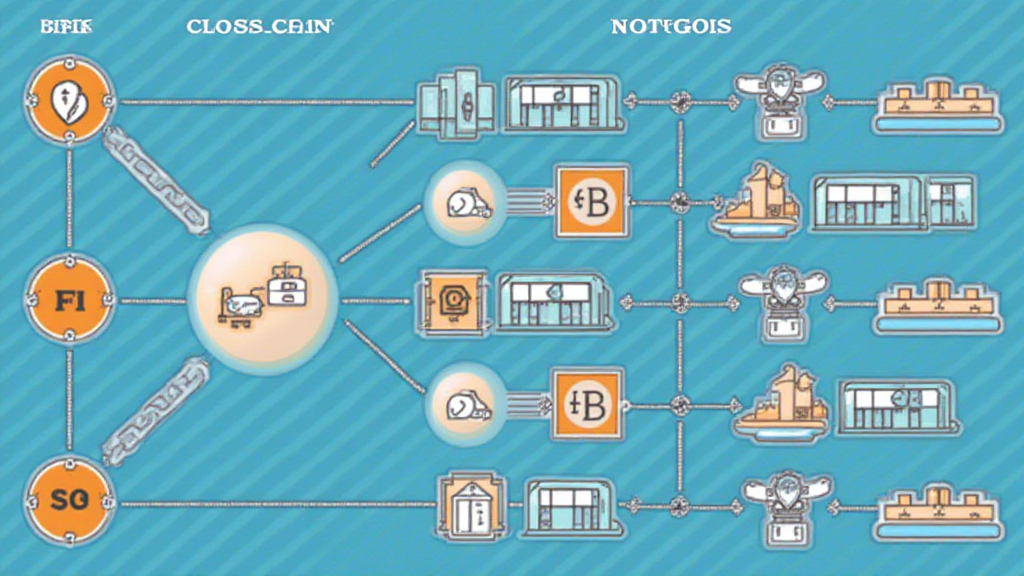

Understanding Cross-Chain Bridges

Cross-chain bridges can be likened to currency exchange kiosks in a bustling market. Just like you should check the exchange rates before converting your money, cryptocurrency users need to evaluate the security features when using cross-chain bridges.

The Role of Risk Assessment Matrices

Risk assessment matrices provide a systematic approach to identify and mitigate potential failures. With nearly three-quarters of bridges at risk, deploying such matrices helps users and developers prioritize their security measures effectively. Think of these matrices as a checklist for ensuring every corner of your digital assets is guarded.

Why 2025 Requires a New Regulatory Framework

As we look towards 2025, emerging trends, such as DeFi regulation in Singapore, suggest a need for stricter guidelines around cross-chain operations. Implementing risk assessment matrices can bolster compliance and enhance user trust. Similar to how governments issue guidelines for safe driving, regulatory bodies could establish frameworks for healthy digital economies.

Comparative Power of PoS Mechanisms

Proof-of-Stake (PoS) mechanisms show a comparison to legacy systems in terms of energy consumption. Think of PoS as a more efficient engine in an eco-friendly car, whereas traditional systems are like gas-guzzling vehicles. Understanding these mechanics can lead to better decisions regarding the usage of energy-efficient exchanges and bridges.

Conclusion

In summary, understanding and implementing risk assessment matrices is key to navigating the increasingly complex landscape of cross-chain bridges. For further insights and a downloadable toolkit to audit your cross-chain security measures, click below. Remember, proper assessment today can significantly reduce the risk of loss tomorrow!

To learn more about cross-chain security, visit view our cross-chain security white paper.

Disclaimer: This article does not constitute investment advice. Always consult local regulatory bodies like MAS or SEC before making investment decisions.

Protect your assets: Using hardware wallets like Ledger Nano X can reduce private key exposure risk by 70%.