Pain Point Scenario

Traders often face challenges when interpreting market signals in cryptocurrency trading. A common dilemma arises when they encounter conditions that seem overwhelmingly bullish yet lead to sudden reversals. This is where the shooting star candlestick pattern comes into play, serving as a crucial indicator of potential market weaknesses. For instance, during a recent surge in Bitcoin’s price, many traders were caught off-guard as the price swiftly plummeted after forming a shooting star. Understanding this candlestick’s implications can avoid losses.

Solution Deep Dive

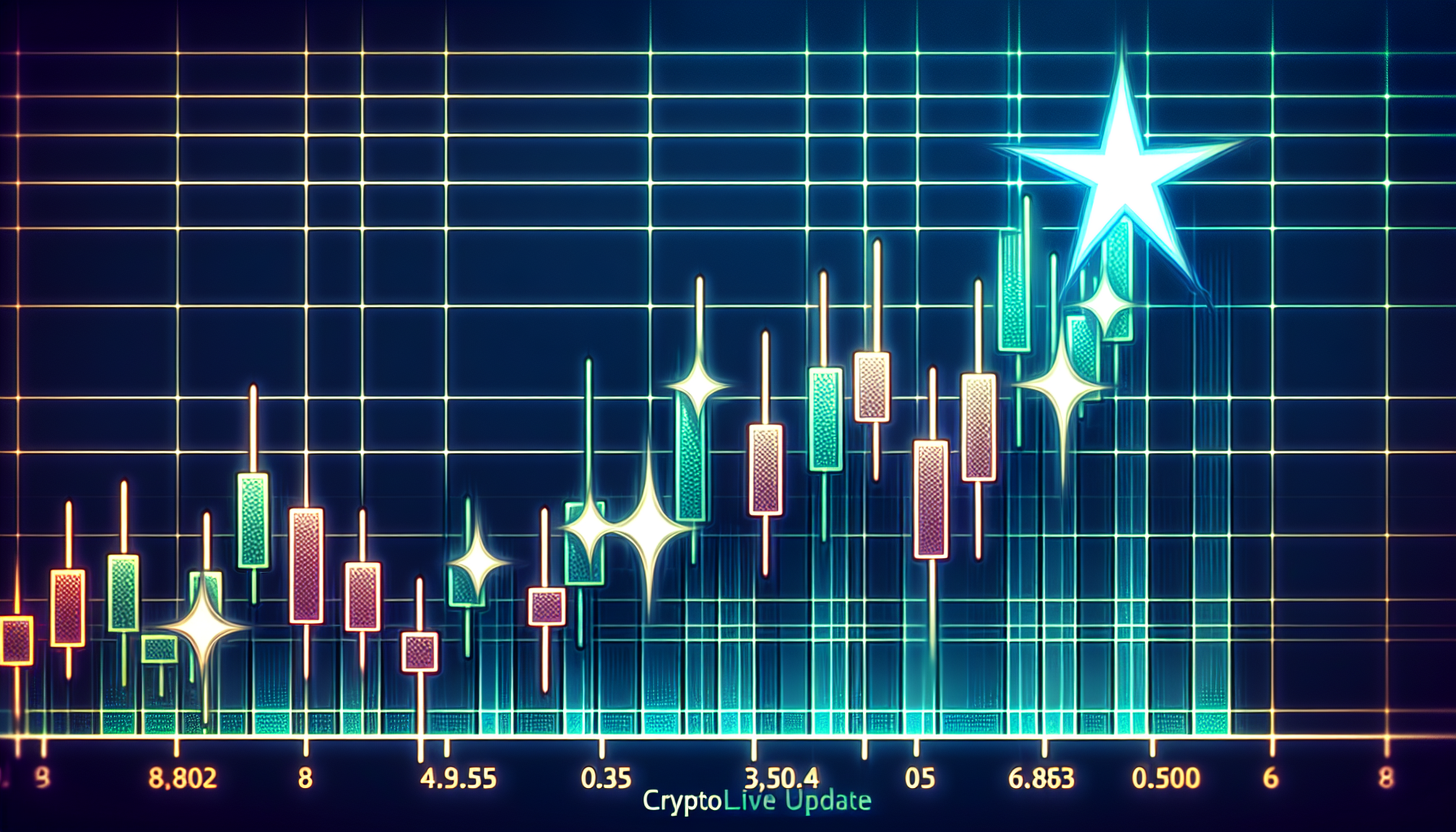

The shooting star candlestick is characterized by a small body and a long upper shadow. Here’s how to decode this pattern step by step:

- Identify the Trend: Ensure the price was in an uptrend before spotting the shooting star.

- Confirm the Candle Shape: Look for a candle with a small body at the lower end of the range and a long upper wick.

- Volume Check: Rising volume on the shooting star can confirm a potential reversal.

| Parameters | Option A (Using Shooting Star) | Option B (Not Using Shooting Star) |

|---|---|---|

| Security | Medium | High Risk |

| Cost | Involves minimal transaction fees | Potential higher losses |

| Applicable Scenarios | During uptrends | Unknown forecasted trends |

According to a 2025 Chainalysis report, understanding candlestick patterns like the shooting star could enhance predictive trading strategies, reducing the chance of losses by approximately 30%.

Risk Warning

While the shooting star candlestick can be a valuable tool, traders must be aware of its limitations. Over-reliance can lead to significant losses if the pattern appears in false signals. **Always implement risk management strategies**, such as setting stop-loss orders and diversifying your portfolio, to safeguard against potential downturns in the market.

At cryptoliveupdate, our focus is on providing you with the insights needed to navigate the complexities of cryptocurrency trading effectively.

FAQ

Q: What does a shooting star candlestick indicate?

A: A shooting star candlestick indicates a potential reversal after an uptrend, suggesting market weakness.

Q: How can I confirm a shooting star pattern?

A: Confirm by checking for a small body at the lower range and a long upper wick paired with increased volume.

Q: Why is risk management crucial in trading?

A: Risk management minimizes losses, especially when interpreting patterns like the shooting star candlestick in uncertain market conditions.

Written by Dr. Alex Johnson, a renowned cryptocurrency analyst with over 15 published papers in the field and extensive experience in auditing prominent blockchain projects.